-

The U.S. Treasury expanded its plans for the issuance of longer-term debt in coming months, after depending mainly on shorter-dated bills to fund the federal government’s record spending surge to address the COVID-19 crisis.

August 5 -

The rating agency affirmed the U.S. at AAA but said the outlook cut reflects ongoing deterioration in U.S. public finances.

July 31 -

The Financial Stability Board issued a statement April 2 affirming that it is sticking with plans to transition away from Libor by the end of 2021.

May 29 -

The Federal Reserve has been proactive and the secondary market could be next up for assistance.

May 6 -

The primary market remained mostly on the sidelines with issuers slow to jump back into coronavirus-driven volatility while also awaiting Fed engagement.

March 31 -

Rep. Peter DeFazio said gas tax revenue could finance $500 billion in Treasury bonds.

February 26 -

Tradeweb ICE U.S. Treasury Closing Prices is designed to represent the daily market mid-price for Treasury securities.

September 13 -

MarketAxess Holdings will buy LiquidityEdge for $150 million.

August 13 -

The U.S. Treasury Department announced plans to maintain record debt sales.

July 31 -

Treasury Secretary Steven Mnuchin warned that the U.S. government will face a default in “late summer” unless Congress increases the debt ceiling.

May 22 -

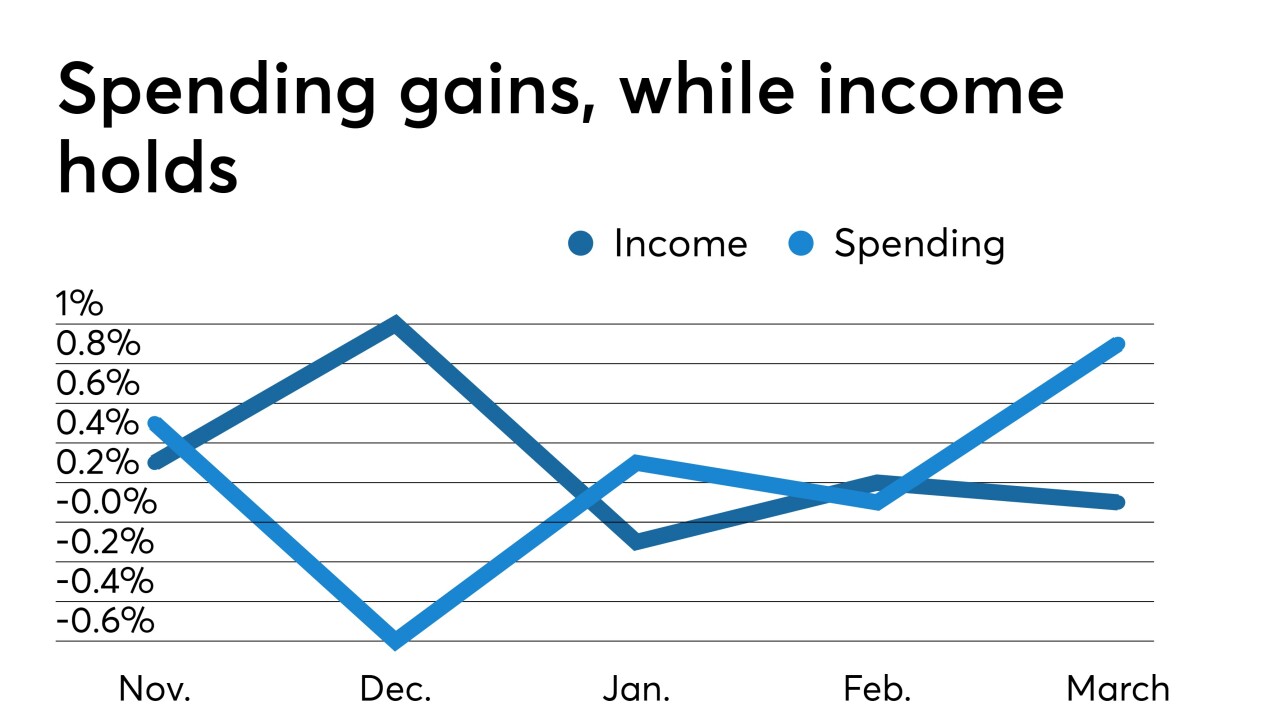

Inflation took a step back, according to the Federal Reserve’s favorite indicator, while income edged up in March, ahead of this week’s Federal Open Market Committee meeting, suggesting the Fed will be able to remain patient on rates.

April 29 -

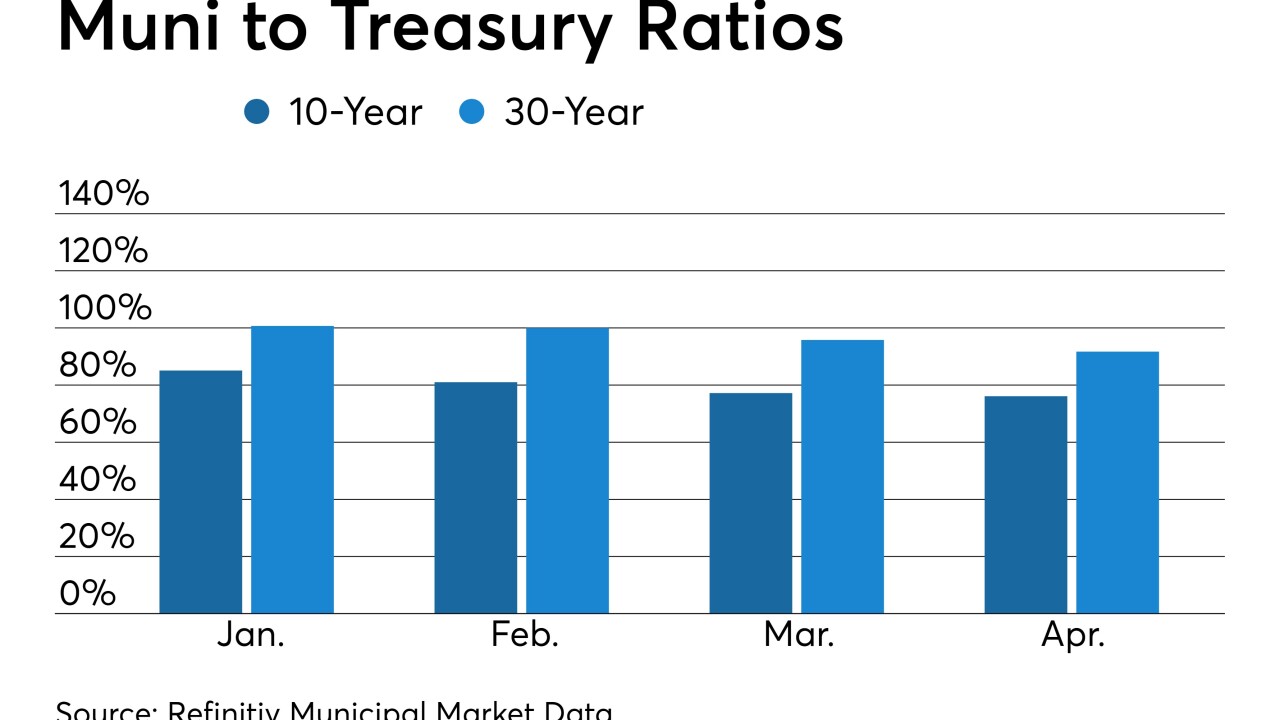

Undersupply and demand for the muni exemption in high tax states are expected to help municipal bonds outperform in the second quarter.

April 5 -

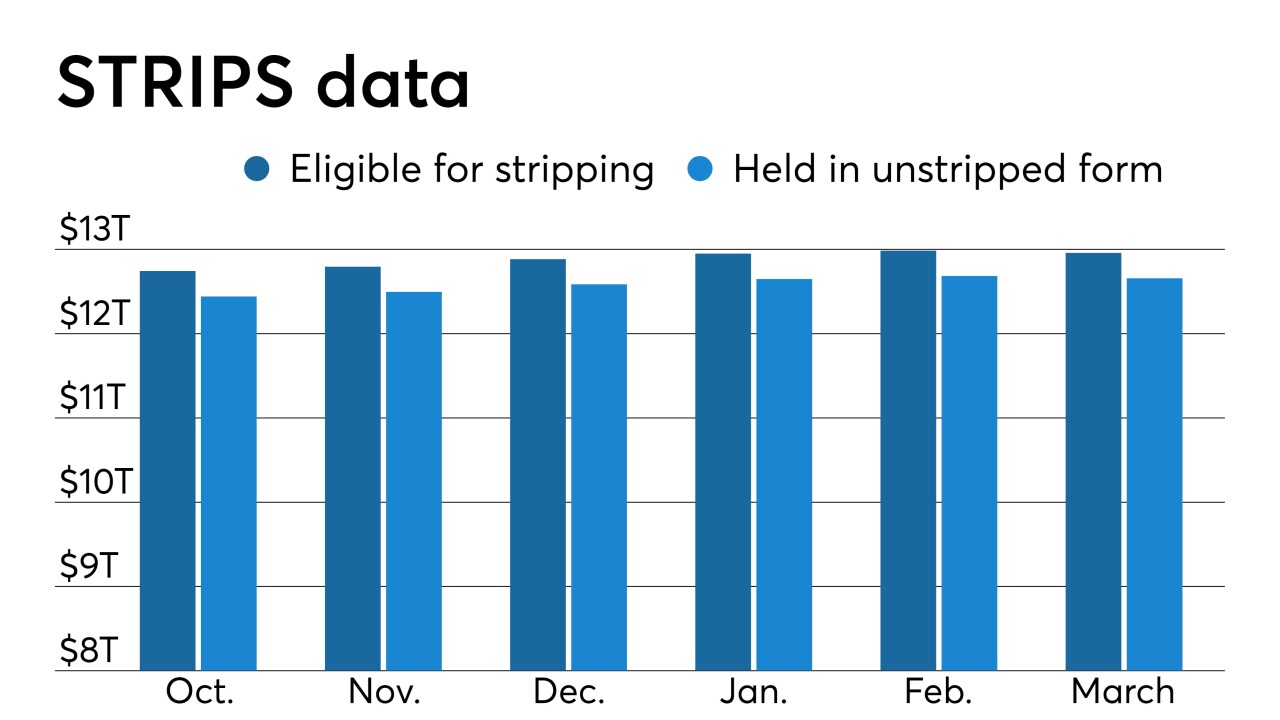

Newly issued Treasury securities held in stripped form increased about $1.155 billion in March to a total of $301.140 billion.

April 4 -

A gauge of U.S. economic health closely watched by the Federal Reserve is flashing warning signs for the second time this year.

March 8 -

Newly issued Treasury securities held in stripped form decreased about $1.197 billion in February.

March 6 -

The federal government ran an $8.7 billion surplus in January, the Treasury Department reported Tuesday.

March 5 -

The Treasury Department said it will auction $23 billion 41-day cash management bills on Feb. 28.

February 28 -

The federal government ran a $13.5 billion deficit in December, the Treasury Department reported Wednesday.

February 13 -

Newly issued Treasury securities held in stripped form increased about $2.97 billion in January to a total of $301.182 billion.

February 6 -

The Treasury Department's February quarterly refunding of $84.0 billion will raise $29.9 billion new cash.

January 30