Want unlimited access to top ideas and insights?

The municipal market weakened Tuesday with AAA benchmark yields rising by as much as 15 basis points on the long end of the curve, signaling that the massive rally that began a week prior was overdone. Treasuries were also on the rise as stocks sold off near the close.

The primary market remained mostly on the sidelines as issuers still are tepid on bringing new deals into coronavirus-driven volatile conditions.

There was not a clear sign yet from the Fed when municipal purchases would begin and market participants

“Month/quarter-end positioning is undoubtedly having an effect on the market today after several weeks of extreme volatility, but we have also heard from several participants that the recent muni rally might have gone too far, too fast,” said Greg Saulnier, managing analyst at Refinitiv. “As a result, yields are rising today as sellers attempt to square positions before the close of business and the depth of the bid side is being tested.”

Saulnier said that munis also have to consider what will happen when the backlog of day-to-day new issuance comes off the sidelines and perhaps what rates will do when the Fed’s purchasing of Treasuries diminishes and issuance increases to pay for the stimulus package.

“After big gains in a multi-day rally, munis are giving some back today as the month draws to a close,” ICE Data Services said in a Tuesday market comment noting that trade volumes were modestly lower from Monday.

Municipals represent value over Treasuries with a backdrop of uncertainty in the primary market where this week up to $18 billion remains on day-to-day status, according to Peter Block, managing director of credit and market strategy at Ramirez & Co.

Net municipal supply over the next 30 days is nearing positive territory at only negative $2.54 billion, Block wrote in his weekly municipal report released late Monday.

That consists of a total of $16.77 billion of new-issue volume, which includes a loss of $10.69 billion from maturing bonds, and the decrease of $8.61 billion due to announced calls. He said that California stands to experience the largest change in outstanding debt with the loss of $2.1 billion.

Kim Olsan, senior vice president at FHN Financial noted that tax-exempt indices likely will post losses for March between 0.50% and 4.75%, with short maturities, general obligation bonds and high grades poised to close the quarter just above a flat return.

She also noted that high-yield has struggled the most, losing 10% this month and reaching a 6% loss for the year. Taxable munis have widened out from the end of February but are situated to end the first quarter with a nominal gain.

“Secondary trading is still seeing inconsistent bidding in active sectors (<1 year, active state names) which is likely being driven by late-month cash needs and more anxious sellers,” Olsan said.

Municipal credit is beginning to be priced into trading and several participants anticipate it to increase as an investment consideration as the crisis unfolds with better rated, secured credits faring better.

“Despite the immediate challenges and unknown breadth and depth of the economic pullback, credit spreads for high-tax states aren't showing stress,” said Eric Kazatsky, Bloomberg Intelligence Strategist. “While demand for tax-exempt income is high, credit fundamentals should be more fully priced in.”

Overall virus-related credit concerns lead Block to expect negative outlooks to occur on selected credits within the not-for-profit hospital and private education sectors, primarily systems and institutions with lower available resources relative to operations, he said.

“We do not expect widespread defaults in most sectors, except for the most speculative credits,” Block wrote.

There have been over 200 COVID-19 related disclosures, according to Diver by Lumesis, and most of those disclosures have been voluntary so far, but late filings and rating changes are scattered throughout.

Primary Market

The primary was quiet for most of the day as issuers and financial advisors still are set for several big competitive sales coming to market Thursday.

Some of the big negotiated deals that had been slated for Tuesday such as the San Bernardino Community College District, California, (Aa1/AA/NR/NR) the Aledo Independent School District, Texas, (NR/NR/AAA/AAA) and the Birmingham Airport Authority, Alabama, (A3/NR/NR/NR) have been moved to the day-to-day calendar.

On Tuesday, BofA Securities did a quarterly remarketing of Republic Services’ $142.34 million of bonds.

The deal consists of the California Municipal Finance Authority’s (NR/BBB+;A-2/NR/NR) $127.045 million of Series 2010 solid waste refunding revenue bonds and the Pennsylvania Economic Development Financing Authority’s $15.385 million of Series 2010B solid waste refunding revenue bonds not subject to the AMT.

“It really hit home for me on Friday the 13th when we gaped out by 50 basis points. We have been careening back and forth at warp speed from cheaper to richer and then back again a few times,” said John Hallacy, Bond Buyer contributing editor. “We are now at levels where issuers may care more or just enough to come to market. I do not cherish the thought that munis are only doing better when equities are pressured. Now that the CARES Act has been signed, we can begin the long mending process for the economy. I expect the volatility to be ever present and just a salient feature of the trading day.”

On Thursday, the Portland School District No. 1J, Multnomah County, Oregon, (Aa1/ AA+/NR/NR) is coming with the biggest sale of the week.

The district will competitively sell $441.32 million of Series 2020 general obligation bonds under the Oregon School Bond Guaranty Act.

Proceeds will finance capital costs of the district.

Also Thursday, Milwaukee, Wisconsin, (NR/ AA-/ AA-/NR) will competitively sell $295.745 of bonds and notes in three deals.

The deals are composed of $160.825 million of General Obligation Promissory Notes, Series 2020 N4 GO promissory notes and Series 2020 B5 GO corporate purpose bonds; $14.92 million of taxable Series 2020 T6 GO promissory notes and Series 2020 T7 taxable GO corporate purpose bonds; and $120 million of Series 2020 R3 revenue anticipation notes.

Secondary market

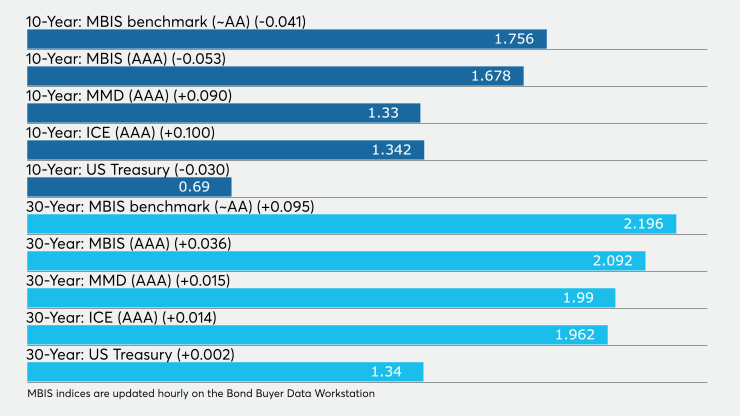

Munis were mixed on the MBIS benchmark scale Tuesday, with yields falling four basis points in the 10-year maturity and rising 10 basis points in the 30-year maturities. High-grades were also mixed, with yields on MBIS' AAA scale falling five basis points in the 10-year and increasing three basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year muni GO rose nine basis points to 1.33% while 30-year increased 15 basis points to 1.99%.

On the ICE muni yield curve late in the day, the 10-year yield was up nine basis points to 1.30% while the 30-year was up 14 basis points to 1.96%.

BVAL saw the 10-year rose 6 basis points to 1.44% and the 30-year rose 14 basis points to 2.08%.

Stocks fell as Treasuries strengthened.

The Dow Jones Industrial Average fell about 1.4%, the S&P 500 index dropped around 1.4% and the Nasdaq lost roughly 0.9%.

The three-month Treasury was yielding 0.05%, the Treasury two-year was yielding 0.23%, the five-year was yielding 0.37%, the 10-year was yielding 0.68% and the 30-year was yielding 1.34%.

Christine Albano contributed to this report.