-

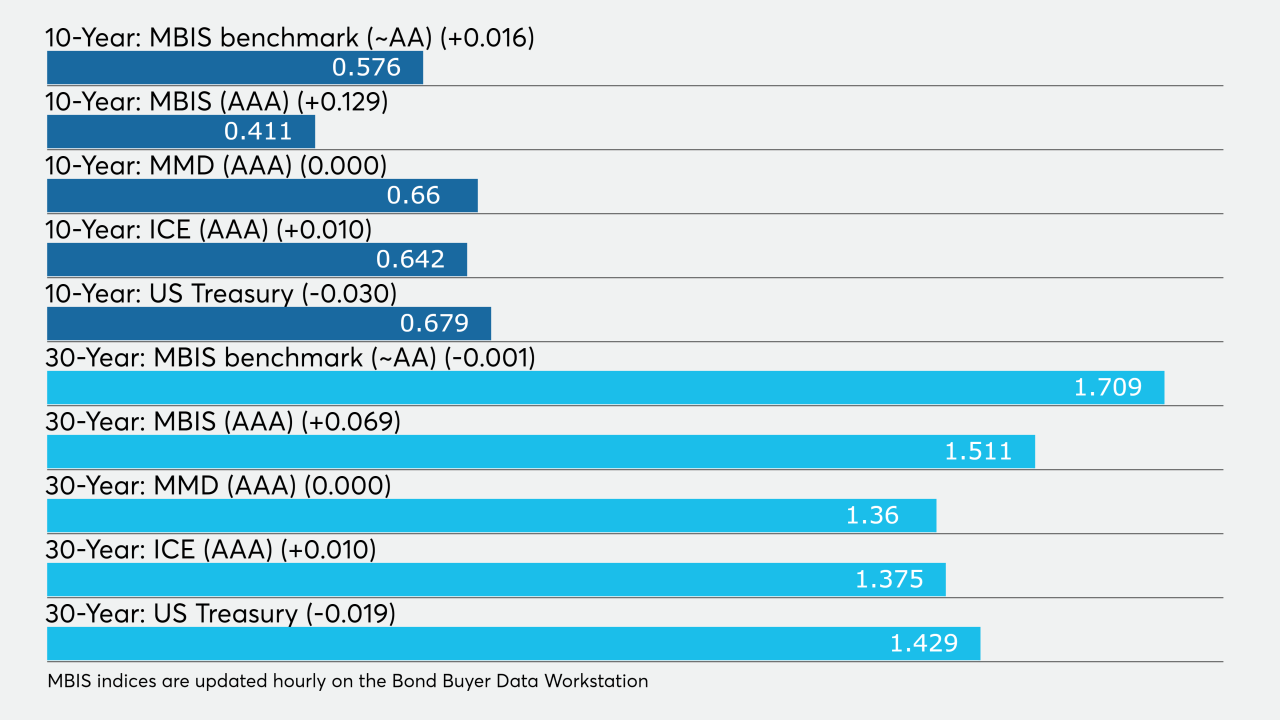

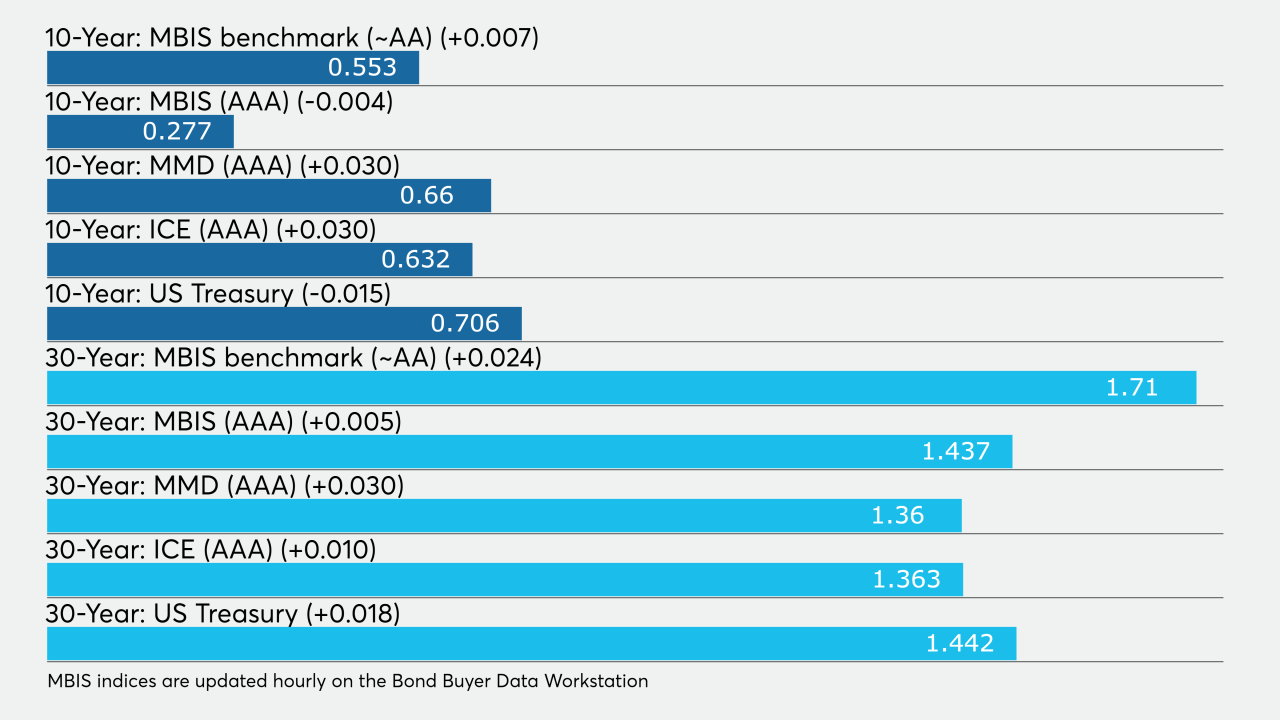

Municipal investors are somewhat tepid on current low rates Monday ahead of the week's $`11.5 billion of new supply.

August 17 -

Municipals continued to correct, with yields on the AAA scales rising by as much as three basis points as signs point to investor pullback from current low yields.

August 14 -

Municipals were steady on Thursday a day after turning weaker for the first time in almost two months. Refinitiv Lipper reported $2.3 billion of inflows.

August 13 -

Municipal yields rose as much as four basis points on Wednesday, while new issues played the field.

August 12 -

Municipal bonds were steady to weaker as billions of dollars in new deals hit the screens Tuesday.

August 11 -

The total number of COVID-19 disclosures reported to EMMA for the week ending Aug. 9 was about 700, down from nearly 1,000 the previous week.

August 11 -

Now investors have hit the reset button on municipal credit expectations and the corresponding return in demand has been quite strong.

August 10 -

Moody's Investors Service says the appellate court decision could impede the state government's flexibility in dealing with coronavirus-driven budget woes.

August 10 -

Municipals rallied Friday, with yields dropping by as much as one basis point on the long end.

August 7 -

Munis rallied all along the curve Thursday, with long end yields down by as much as four basis points.

August 6