Municipals were steady on Thursday a day after turning weaker for the first time in almost two months. Yields on long-dated maturities rose by as much as two basis points on the AAA GO scales.

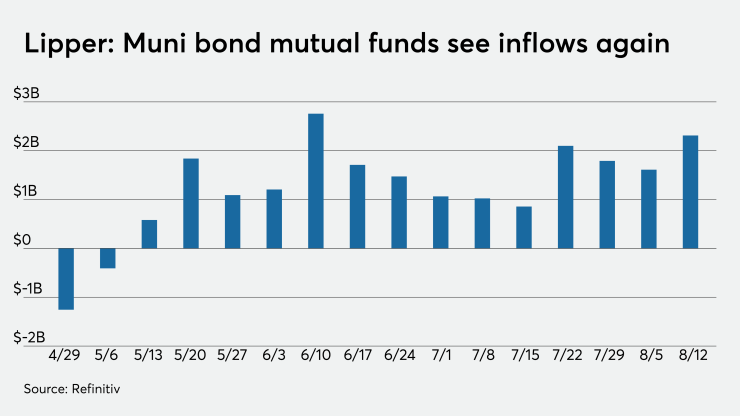

Refinitiv Lipper reported $2.3 billion of inflows into muni mutual funds in the week ended Aug. 12, marking the 14th week in a row of positive results.

"The juxtaposition of inflows and a bit of tepid investment from market players in the secondary, along with a heftier primary has left this a market in flux," a New York trader said. "You've got BlackRock saying they think volatility will be exacerbated from the elections and the seemingly unending virus effects and they're going short duration even though the long end rallied until Wednesday — this is just murky, all of it."

From BlackRock: “Additionally, seasonal trends typically turn less favorable in the fall, and we believe volatility is likely to be exacerbated alongside the upcoming U.S. election and ebbs and flows in the virus and vaccine progression,” BlackRock municipal leaders wrote in a report.

Supply-demand dynamics remained favorable and interest rates fell as COVID-19 cases surged in many areas and Congress has failed to pass additional fiscal support, according to the report, which was written by Peter Hayes, head of the BlackRock’s municipal bonds group, James Schwartz, head of municipal credit research and Sean Carney, head of municipal strategy.

"Considering the extreme volatility we experienced earlier in the year, we need to take stock that a two- to four-basis point move higher in the secondary is not something to be afraid of. These markets move," the New York trader said. "We're not doing the massive 10-plus basis point moves back and forth that we had in the spring. You look at the trades that are occurring, and you have to keep your head on. These are relatively simple movements in the market. In fact, I'd argue that we're still on pretty stable ground, given the times."

Meanwhile, action was brisk in the primary as deals from Florida and California issuers came to market.

Primary market

Miami-Dade County, Fla., competitively sold two offerings of transit system sales surtax revenue bonds totaling $750.71 million.

Morgan Stanley won the $511.16 million of Series 2020B taxable revenue refunding bonds with a true interest cost of 2.4888%.

The bonds were priced to yield from 0.41% with a 0.45% coupon in 2021 to 1.75% at par in 2021 and 2.661% with a 2.6% coupon in 2042

BofA Securities won the $239.55 million of Series 2020A tax-exempt revenue bonds with a TIC of 2.9997%.

The bonds were priced to yield from 1.41% with a 5% coupon in 2043 to 1.86% with a 4% coupon in 2050.

PFM was the financial advisor; Hogan Lovells and Steve E. Bullock were the bond counsel.

Citigroup priced the San Diego Unified School District, Calif.’s (Aa2/NR/AAA/AAA) $756.915 million of Series 2020 dedicated unlimited ad valorem property tax general obligation bonds.

The Election of 2012 Series M-2 GOs were priced to yield 0.16% with a 5% coupon in 2022, 2.01% with a 3% coupon and 1.66% with a 4% coupon in a split 2050 maturity.

The Election of 2018 Series D-2 GOs were priced to yield 0.16% with a 5% coupon in 2022 and from 0.26% with a 3% coupon in 2026 to 1.75% with a 3% coupon in 2041; a 2044 maturity was priced to yield 2.19% with a 2% coupon and a 2050 maturity was priced to yield 1.66% with a 4% coupon.

The Massachusetts Water Resources Authority (Aa1/AA+/AA+/NR) competitively sold $160 million of Series 2020B general revenue bonds. BofA won the deal with a TIC of 2.3171%. The bonds were priced to yield from 0.11% with a 5% coupon in 2021 to 1.31% with a 5% coupon in 2045.

PFM was the financial advisor; Greenberg Traurig was the bond counsel.

Goldman Sachs priced the New York City’s Trust for Cultural Resources (A3/A/NR/NR) $127.425 million of Series 2020A refunding revenue bonds for Lincoln Center for the Performing Arts Inc.

The bonds were priced to yield from 1.76% with a 5% coupon in 2021 to 2.17% with a 4% coupon in 2035.

BofA priced the Municipal Improvement Corporation of Los Angeles, Calif.’s (NR/AA-/NR/AA) $167.04 million of Series 2020A lease revenue bonds for capital equipment and Series 2020B lease revenue refunding bonds for real property.

The Series 2020A bonds were priced with 5% coupons to yield from 0.20% in 2021 to 0.89% in 2030. The Series 2020B bonds were priced with 5% coupons to yield from 0.18% and 0.20% in a split 2021 maturity to 1.42% in 2040.

Siebert Williams Shank priced Newark, N.J.’s $105.855 million of GO refunding bonds in three tranches. The issue was partially insured by Assured Guaranty Municipal Corp.

Lipper reports $2.3B inflow

Investors continued to pour cash into bond funds in the latest reporting week.

In the week ended Aug. 12, weekly reporting tax-exempt mutual funds saw $2.313 billion of inflows, after inflows of $1.612 billion in the previous week, according to data released by Refinitiv Lipper Thursday.

It was the 14th week in a row that investors put cash into the bond funds.

Exchange-traded muni funds reported inflows of $385.762 million, after inflows of $229.1140 million in the previous week. Ex-ETFs, muni funds saw inflows of $1.926 billion after inflows of $1.383 billion in the prior week.

The four-week moving average remained positive at $1.954 billion, after being in the green at $1.590 billion in the previous week.

Long-term muni bond funds had inflows of $1.224 billion in the latest week after inflows of $610.154 million in the previous week. Intermediate-term funds had inflows of $215.339 million after inflows of $13.977 million in the prior week.

National funds had inflows of $2.127 billion after inflows of $1.588 billion while high-yield muni funds reported inflows of $343.887 million in the latest week, after inflows of $102.616 million the previous week.

BlackRock: Muni demand outpaces supply

BlackRock’s near-term outlook for municipal bonds has turned more cautious and its team has shifted to a shorter duration stance in their muni bond exposure, the muni team said Thursday.

“We hold a more cautious outlook for municipals in the near term given their recent strong performance, muni yields near all-time lows and muni-to-Treasury ratios having compressed materially across the curve, particularly in the long end,” they said.

Municipal bonds posted another month of strong performance in July, BlackRock said.

The S&P Municipal Bond Index returned 1.41% for the month, bringing the year-to-date return to 3.41%. Supply hit a record high for the month of July at $45.9 billion.

“The net negative supply scenario that typically occurs at this time of year did not materialize as issuance continued to outpace the reinvestment of income from coupons, calls and maturities,” they wrote. “It’s important to note that a significant 35% of supply was comprised of taxable issues, which are typically marketed to a different buyer base, allowing issuance to be more easily absorbed.”

Demand remained firm throughout the month.

Mutual funds, led by long-term funds, garnered substantial inflows, avoiding typical seasonal outflows around tax day, which was extended to July 15 this year.

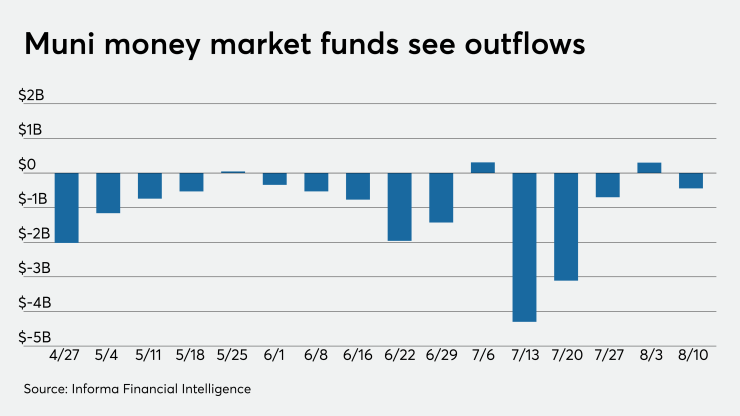

Money market muni funds fall $444M

Tax-exempt municipal money market fund assets fell $443.8 million, bringing total net assets to $121.84 billion in the week ended Aug. 10, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 187 tax-free and municipal money-market funds slipped to 0.2% from 0.3% in the previous week.

Taxable money-fund assets decreased $8.97 billion in the week ended Aug. 11, bringing total net assets to $4.379 trillion.

The average, seven-day simple yield for the 788 taxable reporting funds dropped to 0.03% from 0.04% in the prior week.

Overall, the combined total net assets of the 975 reporting money funds fell $9.41 billion in the week ended Aug. 11.

Secondary market

Some notable trades Thursday:

We can point to Mecklenburg County, North Carolina 5s of 2022 at 0.12%. Montgomery County, Maryland 4s of 2022 at 0.13%-0.12%. New York City TFAs 5s of 2022 at 0.17%. Baltimore County schools, 5s of 2025 at 0.21%-0.19%.

In the 10-year range, blocks of Maryland GOs, 5s of 2030, were at 0.70%-0.69%. On Monday they were at 0.61%.

Washingon GOs, 5s of 2037 at 1.17% while Wednesday they were at 1.14%.

Out further, Washington GOs 5s in 2041 were at 1.37%-1.35% while last Wednesday they traded at 1.35%. Out long, Prospect Texas ISD 4s of 2050 were at 1.50%, but still well below the original 1.63% selling price.

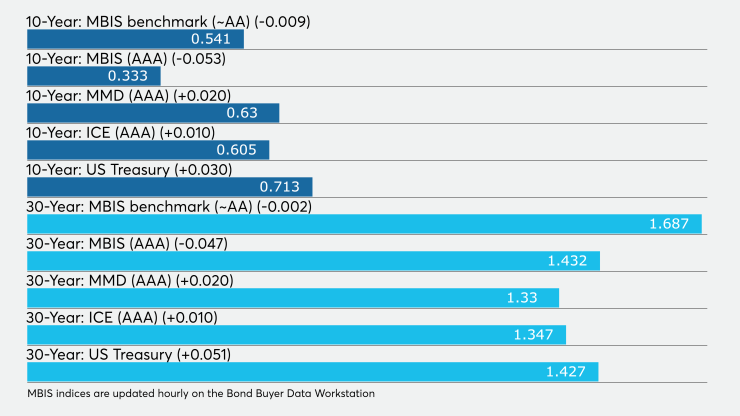

On Thursday, municipals were weaker on the long end of the curve, according to the final readings on Refinitiv MMD’s AAA benchmark scale.

Yields were flat in 2021 and 2022 at 0.10% in 2021 and 0.11%, respectively. The yield on the 10-year muni gained two basis points to 0.63% while the 30-year yield increased two basis points to 1.33%.

The 10-year muni-to-Treasury ratio was calculated at 87.6% while the 30-year muni-to-Treasury ratio stood at 93.0%, according to MMD.

“After a small uptick yesterday, trade volumes have backed off so far today,” ICE Data Services said. “The muni percentage of Treasury yields have generally fallen below 100% as the ratios continue to approach more historical norms.”

The ICE AAA municipal yield curve showed the 2021 maturity rising steady at 0.080% and the 2022 maturity flat at 0.096%. The 10-year maturity was up one basis point to 0.605% and the 30-year gained one basis point to 1.347%.

ICE reported the 10-year muni-to-Treasury ratio stood at 89% while the 30-year ratio was at 93%.

The IHS Markit municipal analytics AAA curve showed the 2021 maturity yielding 0.11% and the 2022 maturity at 0.12% while the 10-year muni was at 0.61% and the 30-year stood at 1.33%.

The BVAL AAA curve showed the 2021 maturity yielding 0.08% and the 2022 maturity at 0.09%, both up two basis points, while the 10-year muni was at 0.56% plus two, and the 30-year was up four at at 1.33%.

Munis were little changed on the MBIS benchmark and AAA scales.

Treasuries were weaker as stock prices traded mixed.

The three-month Treasury note was yielding 0.105%, the 10-year Treasury was yielding 0.713% and the 30-year Treasury was yielding 1.427%.

The Dow lost 0.62%, the S&P 500 decreased 0.42% and the Nasdaq gained 0.10%.

Lynne Funk contributed to this report.