Municipals continued to show strength on Monday ahead of this week’s larger calendar.

Yields on the AAA GO scales were steady to down as much as one basis point, continuing to entice issuers with record low rates.

Back in March, the coronavirus pandemic led to the fastest sell-off in municipals on record — only to have investors see a rebound at month-end and then a derailment again in April, said Catherine Stienstra, head of municipal bond investments at Columbia Threadneedle Investments.

Now investors have hit the reset button on municipal credit expectations and the corresponding return in demand has been quite strong, she said.

“The current rally in municipals may extend further as technical factors (supply/demand imbalance), policy support and interest rate stability all bode well for a gradual improvement within the sector,” Stienstra said.

She said even if another shutdown were to occur, the sell-off would likely not be as swift or sharp as last time around.

Stienstra said that certain sectors of the market may be more volatile given COVID-19 headlines, but that it was important to remember that even within those sectors, skilled portfolio management can uncover gems.

As such, Stienstra believes opportunities exist in sectors that were impacted more by fears of COVID and will be able to bounce back.

“Transportation, specifically airports and tolls, should weather the downturn, as most airport operators have solid debt, service coverage, plus an average of 600 days of cash on hand,” she said.

The drop in yields to record low levels has been noted by all market participants.

“Since the first week of July, 10-year yields are down 30 basis points and gains in long-dated bonds are nearing 40 basis points,” FHN Financial Senior Vice President Kim Olsan said. “Trading flows suggest a steady pace, but recent moves can be seen in a longer context as well.”

She took a specific look at last week when The Bond Buyer's 20-bond GO Index of 20-year general obligation yields, which dropped seven basis points to 2.02%.

She said that from the Bond Buyer 20 GO Index’s inception and the onset of World War II, the average annual yield was 3.82%.

“Between 1943 and 1947 the index average was 1.70%, hitting a low of 1.29% in 1946. That pattern reemerged in 1950 and 1951 when the index yield fell below 2% again,” she said. “A long-run period from the 1960s to the Great Recession of 2008 saw the index yield trade to a 5.95% average. The 1980s obviously inflates that figure but the decades on either side of that were consistently traded in the low-6% range.”

She said that since 2009, the index yield has moved from an average 4.61% to the current 2.02%.

“At the end of 2019 the closing yield was 2.74%, marking the largest intra-year move since 2011,” Olsan said. “Such extreme lows will influence coupon and credit allocations for the foreseeable future as a way to find additional concession.”

Last week, the most traded muni sector was industrial development followed by education and utilities.

Secondary trading on Monday showed Boston 5s of 2022 at 0.09%-0.11%, Columbus, Ohio GOs 5s 0f 2023 at 0.10%-0.11%. Washington Suburban Sanitation District 5s of 2024 at 0.11%-0.12%.

Johnson County, Kansas 3s of 2030 at 0.76%-0.73%. Anchorage, Alaska schools, 5s of 2033, at 1.15%-1.09%. The Port of Houston 4s of 2037at 1.16%-1.30%. Alvin, Texas ISD 4s of 2048, at 1.47%.

"These yields show how much the world economy is in disarray and how far the municipal market will reach for anything relatively stable," a New York trader said. "When you have municipal and UST yields as low as the 1940s and 50s, you cannot have to wonder where this market is headed. Are we in store for negative yields on the short end? What does that mean for investors? For the economy at large? When does the correction happen? Coronavirus has clearly upended the financial markets to a degree we still haven't wrapped our arms around."

Primary market

This week’s volume is estimated at $8.7 billion in a calendar composed of $5.9 billion of negotiated deals and $2.9 billion of competitive sales.

On Tuesday, Wells Fargo Securities is set to price the Los Angeles Transportation Authority’s (NR/AA/AA/NR) $1.371 billion of Series 2020A Measure R junior subordinate sales tax revenue refunding green bonds on Tuesday.

The issue has been “climate bond certified” by First Environment. Proceeds will be used to refund all four outstanding TIFIA loan agreements.

Co-managers are BofA Securities, Barclays, Citigroup, Loop Capital Markets and Ramirez & Co The financial advisor is Montague DeRose and the bond counsel is Norton Rose Fulbright.

Also on Tuesday, Minnesota is competitively selling $1.204 billion of GOs in five offerings.

The deals consist of $462 million of Series 2020A various purpose and Series 2020D various purpose refunding GOs; $245.465 million of Series 2020C taxable various purpose and Series 2020F taxable refunding bonds; $180.975 million of Series 2020G taxable highway refunding bonds; $163 million of Series 2020E highway refunding bonds; and $152.02 million of highway bonds.

Public Resources Advisory Group is the financial advisor; Kutak Rock is the bond counsel.

On Wednesday, Goldman Sachs is set to price the New York and Presbyterian Hospital’s (Aa2/NR/AA/NR) $750 million of Series 2020 taxable bonds.

Also on Wednesday, RBC Capital Markets is expected to price Pomona, Calif.’s (/AA-/A+/) $219.26 million of Series 2020BJ taxable pension obligations bonds.

On Thursday, Miami-Dade County, Fla., will competitively sell two offerings of transit system sales surtax revenue bonds totaling $750.71 million. The sales consist of $239.55 million of Series 2020A tax-exempt revenue bonds and $511.16 million of Series 2020B taxable revenue refunding bonds.

PFM Financial Advisors is the financial advisor; Hogan Lovells and Steve E. Bullock are the bond counsel.

Citigroup is expected to price the San Diego Unified School District’s (Aa2/NR/AAA/AAA) $739.815 million of Series 2020 dedicated unlimited ad valorem property tax general obligation bonds on Thursday.

The deal consists of $267.645 million of Election of 2012 Series M-2 GOs and $472.17 million of Election of 2018 Series D-2 GOs.

Secondary market

“Tax-exempt munis outperformed taxable munis by 40 basis points and Treasuries by 62 basis points week over week, as risk-on sentiment and stimulus bill hopes drove markets last week,” Wells Fargo Securities said in a market report.

“Riding the positive momentum, high-yield munis outperformed all asset classes, besting the MBI benchmark by 28 basis points week over week; BBBs outperformed AAAs by 13 basis points week over week,” Wells Fargo said.

On Monday, municipals were steady, according to the final readings on Refinitiv MMD’s AAA benchmark scale. All of MMD's 5% GO yield levels remain at record low levels since it first began calculating then in 1982.

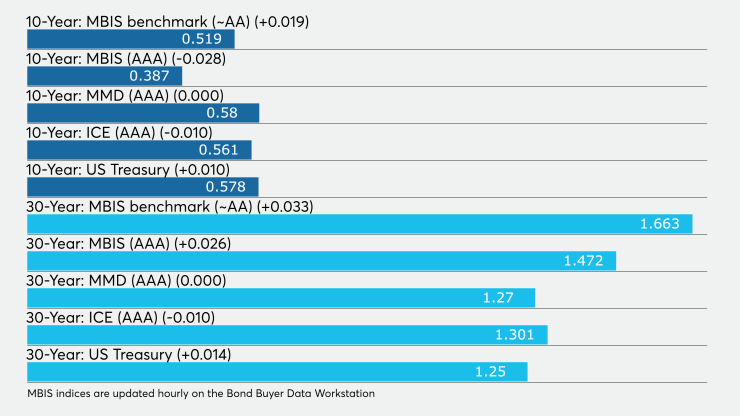

Yields were steady at 0.08% in the 2021 GO muni and flat at 0.09% in 2023. The yield on the 10-year muni remained at 0.58% while the 30-year yield stayed at 1.27%.

The 10-year muni-to-Treasury ratio was calculated at 100.0% while the 30-year muni-to-Treasury ratio stood at 101.6%, according to MMD.

“Municipal bonds are continuing where they left off last week, posting slow but steady improvement,” ICE Data Services said. “Yields at all points are at or near their all-time lows. The muni percentage of Treasury yields are below 100% for half the curve points, the first time since early March.”

The ICE AAA municipal yield curve showed the 2021 maturity flat at 0.070% and the 2022 maturity steady at 0.070%. The 10-year maturity was off one basis point to 0.561% and the 30-year dropped one basis point to 1.301%.

ICE reported the 10-year muni-to-Treasury ratio stood at 102% while the 30-year ratio was also at 102%.

The IHS Markit municipal analytics AAA curve showed the 2021 maturity yielding 0.08% and the 2022 maturity at 0.09% while the 10-year muni was at 0.58% and the 30-year stood at 1.27%.

The BVAL AAA curve showed the 2021 maturity yielding 0.067% and the 2022 maturity at 0.078%, both unchanged, while the 10-year muni was at 0.545%, unchanged, and the 30-year stood unchanged at 1.289%.

Munis were little changed on the MBIS benchmark and AAA scales.

Treasuries were weaker as stock prices traded mixed.

The three-month Treasury note was yielding 0.103%, the 10-year Treasury was yielding 0.578% and the 30-year Treasury was yielding 1.250%.

The Dow rose 1.10%, the S&P 500 increased 0.19% and the Nasdaq lost 0.51%.