Municipals were steady to weaker in spots on Monday, with yields flat to up as much as one basis point on the AAA scales after last week’s market reversal which saw yields rise by as much as nine basis points on the week.

“Tax-free bonds had been on a winning streak up until last week when the market saw something it hadn't in a long time: price cuts,” Eric Kazatsky, senior municipal strategist at Bloomberg Intelligence, said in a report. “While the magnitude of rate increases paled in comparison to the moves in U.S. Treasuries, the end to the months-long rally happened nonetheless.”

However he noted that month-to-date performance for tax-exempt bonds remains positive, with returns for the Bloomberg Barclays Municipal Bond Index coming in at 0.25% and at 4.08% year-to-date.

“While no one is rooting for munis to post losses, the increase in rates could be a welcome sight for those investors, especially retail buyers, who have been somewhat absent in the past month or so given the levels of absolute rates,” Kazatsky said.

Tax-exempt municipals outperformed taxable asset classes as Treasury supply weighed on fixed income markets last week, Wells Fargo Securities said in a Monday research report.

“With rates under pressure, the front end of the curve outperformed the long end providing 20 basis points of excess return, steepening the muni curve,” Wells Fargo said. “High-yield munis continued to outperform the broader MBI benchmark by 28 basis points week over week and the corporate high-yield index by 44 basis points richening the high-yield muni-high-yield corporate ratio to 79%.”

Muni bond yields rose last week, following rising Treasury yields, Nuveen said in a Monday market comment.

“The rise in municipal bond yields marks their first increase since late June. Weak demand for new Treasuries in last week’s auction contributed to the selloff,” Nuveen said. “While there is little value at these historically low yields on an absolute basis, municipal yields remain attractive relative to Treasuries. Strong demand for municipals should continue as yields remain lower for longer.”

Some said investors may need to make a portfolio adjustment.

“We emphasize a positive outlook for risk assets, but advise investors that they may need to adjust their strategies to optimize their portfolio for the next phase of the recovery,” said UBS Global Wealth Management’s Chief Investment Officer Mark Haefele. “Adding risk exposure with markets at or near all-time highs can be daunting, but studies continue to show that time in the market is far more important than timing the market.”

Primary market

Volume for the week is estimated at $11.46 billion, with $8.38 billion of negotiated deals and $3.08 billion of competitive sales.

On Monday, BofA Securities priced for retail the New York City Transitional Finance Authority’s (Aa1/AAA/AAA/NR) $1.33 billion of tax-exempt future tax secured subordinate bonds.

The $1.253 billion of Fiscal 2021 Series A bonds were priced for retail to yield from 0.23% (+10 basis points to MMD) with a 5% coupon in 2021 to 2.08% (+95 basis points to MMD) with a 3% coupon in 2039.

The $76.63 million of Fiscal 2021 Series B1 bonds were priced for retail to yield from 0.91% (+40 basis points to MMD) with a 3% coupon in 2028 to 1.13% (+47 basis points to MMD) with a 4% coupon in 2030.

The bonds will be priced for institutions on Wednesday. Also Wednesday, the TFA is competitively selling $275 million of taxables in two offerings.

This week sizable deals in both the short- and long-term tax-exempt markets aree expected to appeal to municipal investors who are starved for bonds — and are looking to spend their available cash on attractive paper.

Both the $1.3 billion NYC TFA deal and the $7.2 billion Texas tax and revenue anticipation note deal were high on investors’ shopping list, according to a New York trader.

“Compared to anything in the secondary market, the pricing is very attractive,” he said of the TFA deal on Monday afternoon as underwriters were busy with the retail order period.

“It’s really something to watch,” he said of the 10-year bond in 2030 which was structured with a 5% coupon and a preliminary yield of 1.15% during the order period.

“It’s cheaper than comparable names like Dorm PITs with the same rating,” the trader said. “Versus other similar ratings, they priced these cheaper by 10 basis points,” he added.

Slightly shorter, the preliminary scale of the Series A bonds appeared 12 basis points cheaper at 0.79% in 2027 when compared to similarly rated bonds appearing on secondary bid wanted lists Monday, which were yielding 0.67% in 2027, he noted.

“If they do well, they will bump it; if not they might cut it, but it will be interesting for New York buyers,” he said, adding that 10 to 12 basis points of extra yield will be enough to turn institutional buyers’ heads.

The trader said retail investors are suffering from a case of sticker shock during the summer doldrums when yields are historically low — especially in the short end of the market.

“There’s almost no retail at these low rates” he said, noting the 0.23% yield on five years is forcing mom and pop investors to search for yield on the long end of the new-issue market.

The retail crowd is more reluctant to participate in deals priced with ultra-low yields in today’s current climate and want more yield to spend their available cash, according to the trader.

“There’s a ton of money, but the longer range is more attractive for retail,” he said, pointing to triple-A paper in 2050 yielding 1.36%.

Individual investors, he said, believe the long yields look more attractive than the sub-1% yields on the short end of the market — especially for a “nice name,” like the TFA bonds.

“There’s a lot of money out there,” but most of it is institutional investors and banks, the trader said.

Municipals have rebounded from last week’s sell-off and many institutional buyers are finding better investment alternatives in municipals.

“There are continued inflows and the market feels strong,” the trader said.

He said the forward calendar includes a significant amount of deals from municipalities that want to take advantage of the current low rates.

Meanwhile, he said the mammoth Texas TRANs deal should be swallowed up by eager institutional investors — or even crossover buyers.

“These guys have a lot of money — it’s definitely not a problem because there’s a lot of money out there,” he said. “I’m sure the deal will not be a problem and they will gobble this thing up.”

On Tuesday, JPMorgan Securities is set to price the San Francisco Bay Area Rapid Transit District’s (Aaa/AAA/NR/NR) $700 million of general obligation bonds.

In the competitive arena Wednesday, Texas is selling $7.2 billion of tax and revenue anticipation notes (MIG1/SP1+/F1+/) while Georgia (Aaa/AAA/AAA/) sells $1.139 billion of general obligation bonds in five offerings.

In negotiated action Wednesday, Goldman Sachs is expected to price the Los Angeles Department of Airports’ (Aa2/AA-/AA/NR) $1 billion of bonds for the L.A. International Airport. JPMorgan is also expected to price Louisiana’s (Aa2/NR/AA-/NR) $551 million of taxable gasoline and fuels tax revenue bonds.

Secondary market

Trading in large blocks Monday still show high-grade names getting play.

Maryland GOs, 5s of 2023, traded at 0.15%-0.14%. Harvard 5s of 2028 at 0.53%-0.51%. Forsyth School District Georgia 5s of 2029 at 0.61%. Maryland GOs, 5s of 2029, traded at 0.64%.

Outside of 10-years, Fairfax County, Virginia GOs, 5s of 2034 at 0.94%-0.92% — well below the 1% mark but on point with benchmark yields. Fort Worth, Texas ISD 4s of 2039, traded at 1.27% to 1.21%. Ohio waters 5s of 2040 at 1.31%. Leander, Texas ISD 4s of 2045 at 1.50% to 1.44%.

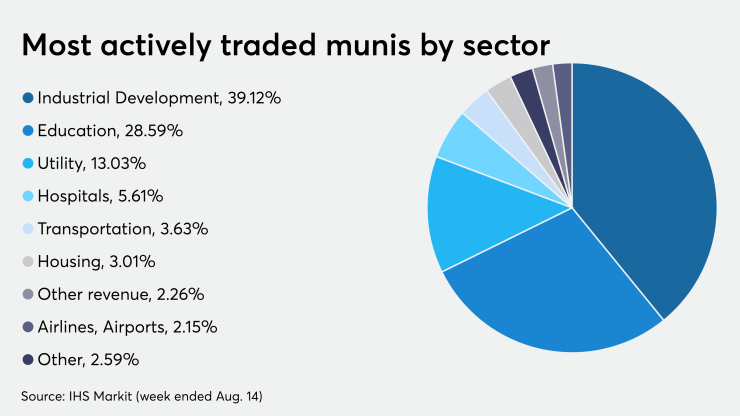

Last week, the most traded muni sector was industrial development followed by education and utilities.

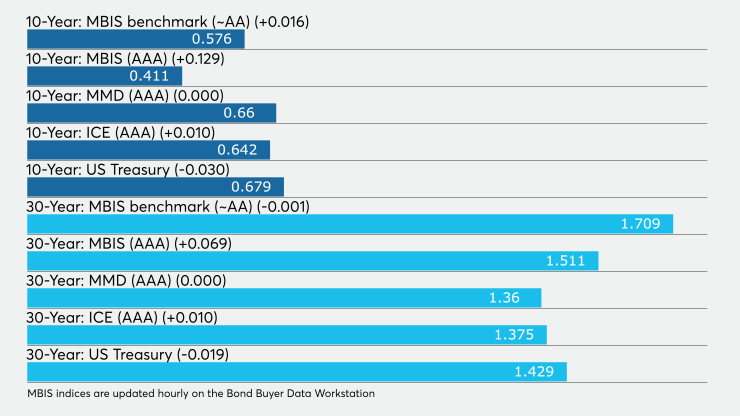

Municipals were steady, according to the final readings on Refinitiv MMD’s AAA benchmark scale.

Yields were unchanged at 0.13% in 2021 and 0.14% in 2022. The yield on the 10-year muni was flat at 0.66% while the 30-year yield was unchanged at 1.36%.

The 10-year muni-to-Treasury ratio was calculated at 96.8% while the 30-year muni-to-Treasury ratio stood at 95.7%, according to MMD.

“Muni yields are drifting higher, continuing the move started late last week,” ICE Data Services said. “The ICE muni curve is about a basis point higher across the entire curve. Trade volumes are quiet, but in line for a summer Monday.”

The ICE AAA municipal yield curve showed the 2021 maturity rising one basis point to 0.120% and the 2022 maturity gaining one basis point to 0.135%. The 10-year maturity was up one basis point to 0.642% and the 30-year increased one basis point to 1.375%.

ICE reported the 10-year muni-to-Treasury ratio stood at 99% while the 30-year ratio was at 95%.

The IHS Markit municipal analytics AAA curve showed the 2021 maturity yielding 0.13% and the 2022 maturity at 0.14% while the 10-year muni was at 0.63% and the 30-year stood at 1.35%.

The BVAL AAA curve showed the curve mostly unchanged with the 2021 maturity yielding 0.10% and the 2022 maturity at 0.12%, while the 10-year muni was at 0.63%, and the 30-year at 1.36%.

Munis were little changed on the MBIS benchmark and AAA scales.

Treasuries were stronger as stock prices traded mixed.

The three-month Treasury note was yielding 0.094%, the 10-year Treasury was yielding 0.679% and the 30-year Treasury was yielding 1.429%.

The Dow fell 0.30%, the S&P 500 increased 0.30% and the Nasdaq gained 0.26%.