-

Key institutional players like banks and insurance companies may have less incentive to buy tax-exempt munis if the provision becomes law.

October 29 -

Amid a flattening municipal yield curve and inversion of the Treasury market, new issues fared better than the secondary on Thursday as participants prepared for month end.

October 28 -

The lack of inclusion of the muni market's priorities in the reconciliation framework sends a strong signal they're unlikely to be included in the final legislation.

October 28 -

ICI reported the lowest inflows since outflows in March, while exchanged-traded funds saw an uptick.

October 27 -

As of now, returns for the month will very likely end in the red. The Bloomberg U.S. Municipal Index is at -0.40% for the month and +0.39% for the year.

October 26 -

S&P lifted its outlook to stable on Minneapolis' AAA rating and Fitch went positive on its AA-plus rating.

October 26 -

The $162 million tax-exempt new money deal is bolstered by two ratings upgrades and analysts say it will generate a lot of investor interest on Wednesday.

October 26 -

Despite a short-end U.S. Treasury rally, municipals face pressure on the one- and two-year as participants look to month-end positioning.

October 25 -

The fast pace of the Democratic negotiations may act in muni market's favor.

October 25 -

Volume falls slightly in the week of October 25 with total potential volume estimated at $7.408 billion: $6.036 billion of negotiated deals and $1.372 billion in the competitive market.

October 22 -

Borrowers are enjoying the strongest market in decades while investors are forced to take what they can get.

October 22 -

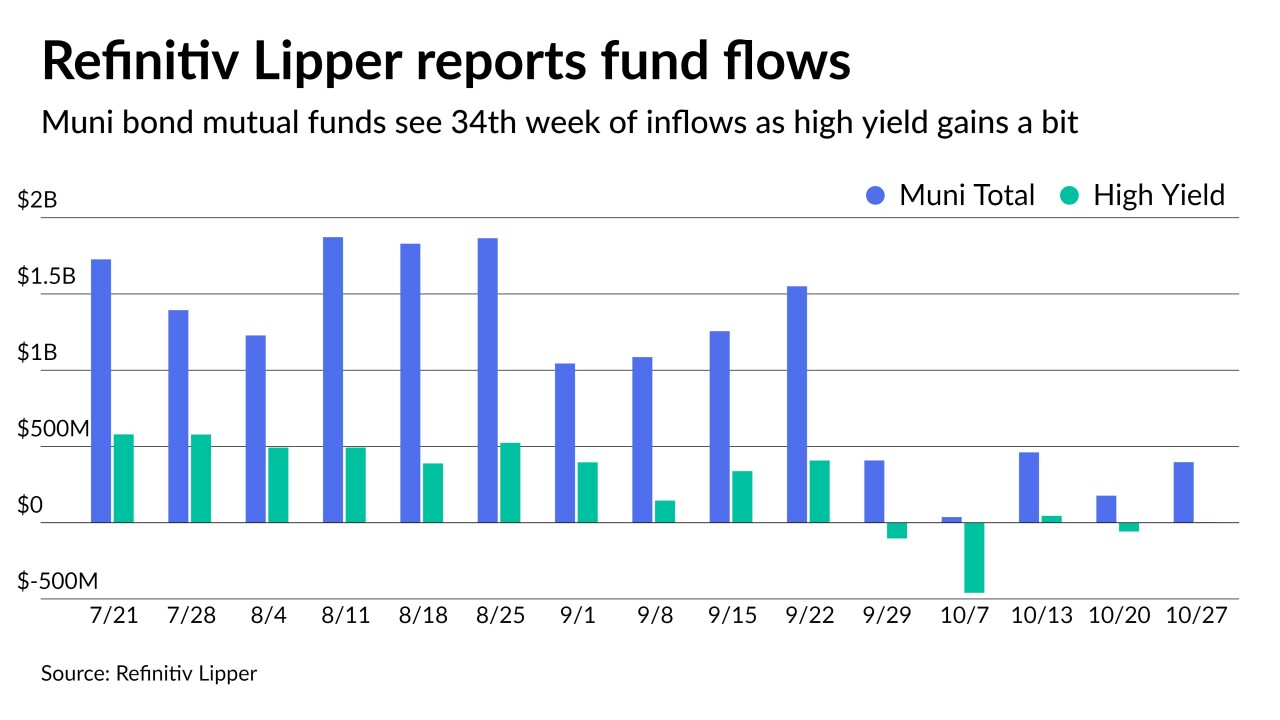

Municipal bond mutual fund inflows fell to $177 million while high-yield is back to outflows, both signaling selling may be moving the market toward another larger correction.

October 21 -

The Investment Company Institute reported $385 million of inflows while ETFs fell to $124 million.

October 20 -

Wisconsin reported healthier-than-expected fiscal 2021 results that should benefit a new money deal planned for next month.

October 20 -

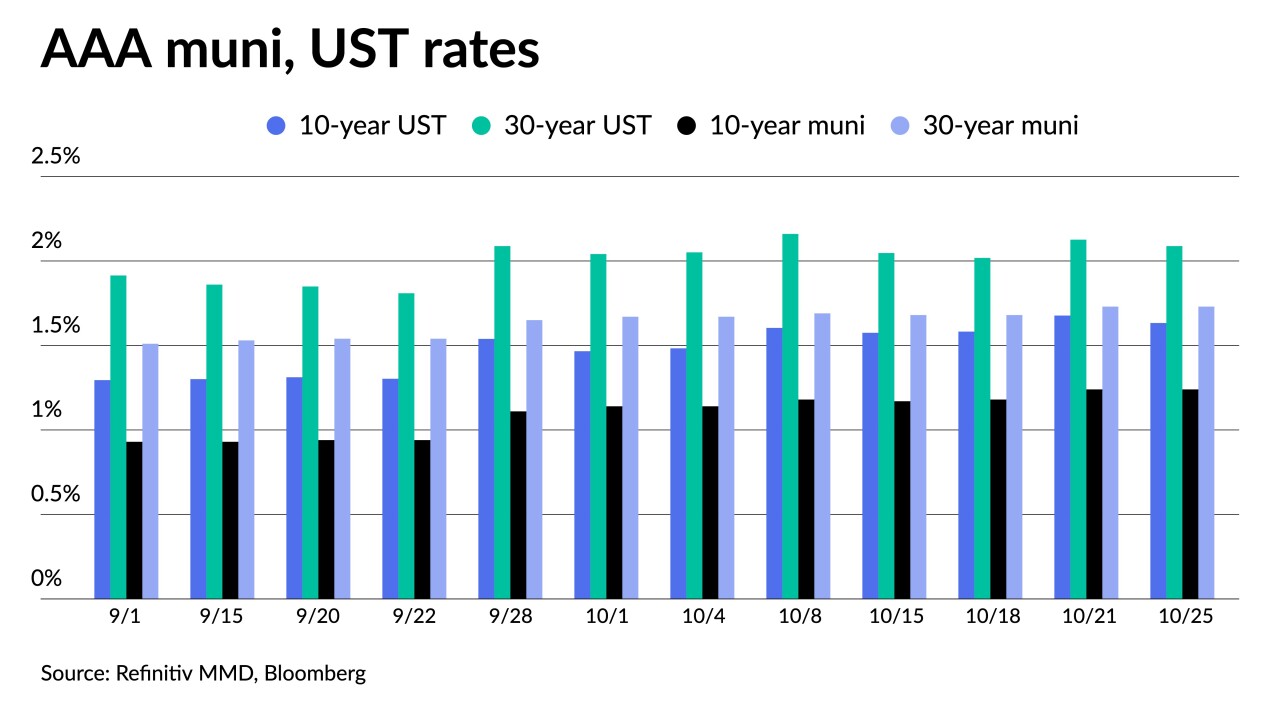

Spreads have been widening, but secondary trading was on the light side and triple-A benchmarks were cut by only a basis point in spots even as U.S. Treasury yields once again rose on the 10- and 30-year.

October 19 -

Illinois passage of clean energy legislation cleared the deck for AMP Ohio's stalled refunding of Prairie State bonds, but mandates that would force the plant's eventual closure loom large.

October 19 -

Triple-A benchmarks saw one basis point cuts in spots inside 10 years while the five-year U.S. Treasury hit a high of 1.154%.

October 18 -

Several Midwest-based not-for-profit health systems are set to borrow for new or acquired facilities and to refund debt with green bonds and taxables in the mix.

October 18 -

Developers of a $240 million hotel at the U.S. Air Force Academy Visitors Center in Colorado Springs are appealing to investors with an appetite for risk.

October 18 -

Friday’s data suggested inflation remains a problem, as the voices calling for Federal Reserve action increase.

October 15