Ohio-based American Municipal Power Inc.’s stalled $141.6 million Prairie State revenue bond refunding will price this week, a month after Illinois approved

AMP, the largest stakeholder among nine municipal owners of the $5 billion Illinois-based plant, had

Lawmakers passed and Gov. J.B. Pritzker signed in mid-September the sweeping legislation aimed at ending carbon emissions by 2050. It calls for municipally owned coal plants to cut all carbon emissions or face closure by the end of 2045.

By early 2035, they must reduce emissions by 45% but they will have another three years to meet that mandate by either partially shutting down or through so-far only theoretical carbon capture technology.

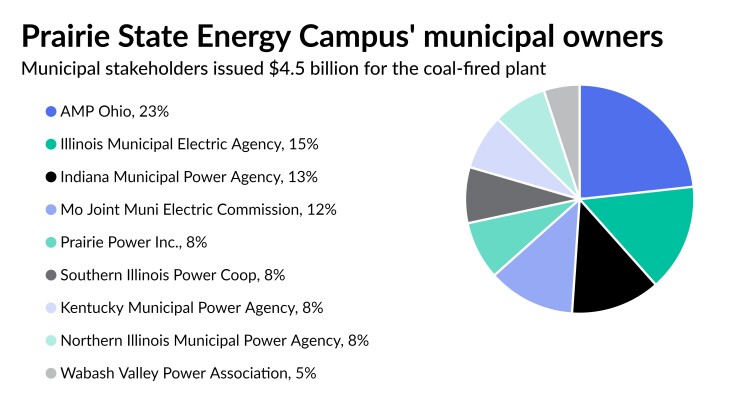

Prairie State’s municipal owners sold $4.5 billion to fund construction of the plant with a final maturity in 2047. And unless technology is developed to meet the 45% reduction, the plant will need to decommission one of two generating units in 2038 when about $1 billion will remain outstanding.

While a clearer picture is now known, the deal still faces headwinds even with its ratings affirmed and sturdy position to manage the future impact.

“Given considerable environmental, political, headline and possible legal risk ahead, we suggest avoiding bonds tied to Prairie State unless spreads are considerably wide of what the ratings imply,” John Ceffalio, senior municipal research analyst and Patrick Luby, senior municipal strategist write in CreditSights' Muni New Issue Notes. "Credit risk increases considerably for longer-dated bonds."

“Also the growing desire to incorporate environmental scores into investment policies could push spreads wider, even absent material credit changes," CreditSights said.

Future rating pressures will vary among the power agencies depending on an individual agency’s share of the burden, when their debt matures, how many local government and utility participants are on the hook to share in the pain of continuing to repay PSEC debt while also purchasing alternative energy sources, and what actions are taken over the next decade, Moody's Investors Service said in a deep dive into the legislation's impact.

“The new law is credit negative for several municipal joint action agencies that we rate because it will likely require many of them to raise customer rates to repay their PSEC debt,” Moody’s analyst Thomas Brigandi said in the report, “New Illinois law exposes municipal owners of Prairie State plant to risk of higher costs,” published late last week.

“PSEC's compliance with emissions-reduction mandates will pressure most municipal participants,” Brigandi said. If forced to shutter one of its units in 2038, “participants would need to acquire baseload power that will likely be more expensive than power generated at PSEC.”

Moody’s rates six of the 10 owners and while the pressures will weigh on the stakeholders, investor risks are limited due to the lockbox structure of the repayment obligations in the absence of a legal challenge.

The municipal participants of four of the six Moody’s rated joint power agencies have take-or-pay contractual obligations requiring the municipal participants to continue making payments to cover PSEC debt obligations, irrespective of the plant’s operational status, Moody’s said.

The other two have all-requirement obligations secured by long-term power sales contracts with their respective municipal participants and for those entities PSEC is one of numerous resources intended to help satisfy joint power agency obligations to provide their participants with all their power needs.

Northern Illinois Municipal Power Agency at A2 with a 7.60% stake and Kentucky Municipal Power Agency at Baa1 have just a few participants each so they face the greatest concentration risk. AMP at A1 has the most diverse and sizable participant pool but also the longest debt maturity.

The Missouri Joint Municipal Electric Commission with a 12.33% stake carries an A2 rating and has 41 local participants, the Illinois Municipal Electric Agency with a 15.17% ownership stake carries an A1 rating and has 32 participants; the Indiana Municipal Power Agency with a 12.64% stake carries an A1 rating and has 61 participants; and AMP with a 23.26% stake and A1 rating and has 68 participants.

The owners not rated by Moody’s include Prairie Power Inc., Southern Illinois Power Cooperative Inc., and the Wabash Valley Power Association.

In 2038 when emissions must be cut by 45%, only the Illinois Municipal Agency will have no debt outstanding, with others ranging from the Northern Illinois agency on the low end with $103 million to AMP on the high end with $678 million.

The power agencies have options to offset the potential rate impact by reducing expenses, extending the debt beyond the likely operation of the asset or they could attempt to challenge the contracts due to the loss of asset value.

“The latter approach would be credit negative … considering the uncertain outcome of such actions,” Moody’s warned.

A joint power agency’s local utility and government participants could also attempt to legally challenge the validity of their contracts “but this is unlikely because of the relatively small amount of debt that would remain for most participants by 2038 and the substantial costs associated with a legal challenge,” Moody’s said.

Only two take-or-pay contract challenges have succeeded nationally, with both occurring during the construction phase of over-budget, behind-schedule nuclear projects, Moody’s said.

In AMP’s case, bondholders benefit from court-validated take-or-pay contracts with most AMP PSEC participants. “Legal opinions have been issued that the take-or-pay contracts are valid and enforceable … which further mitigates the risk of AMP PSEC's participants not paying their obligations.”

S&P Global Ratings rates seven PSEC owners and the agency will assess “the impact of the legislation on these entities on a case-by-case basis,” S&P analyst Jeff Panger said.

Fitch Ratings rates seven of the owners.

The legislation does provide the state some leeway to potentially push off the hard closure date in the event that closure would materially impact grid reliability.

AMP deal

“The ultimate impact on the PSEC, AMP, and the participants may be material, particularly after 2035,” AMP tells potential investors in updated offering documents. “AMP has identified two means to meet the 2038 emission standard without retiring either unit, a change in the manner by which the units are dispatched and/or construction of a carbon capture sequestration system.”

The refunding bonds mature from 2032 to 2038. BofA Securities Inc. is the senior manager.

Investors are protected by lockbox sales contracts that support bond repayment whether the plant is operational or not and extend 10 years past final maturity of AMP’s PSEC bonds and AMP highlights that the plant’s closure does not terminate contracts or relieve participants of their payment obligations.

Contracts also carry a default provision that requires other AMP members to step up and cover any member’s default.

S&P last this month affirmed AMP’s A rating and stable outlook on its PSEC bonds, noting the legislation’s downsides, as it expects in the absence of technology to capture emissions, one unit will be shuttered in 2038 and the other in 2045.

“We anticipate that the combination of stranded investments and the need to procure replacement power could result in higher power costs for AMP's participating members, which in turn could put upward pressure on the retail rates that they charge their end-use customers,” S&P said.

“Nevertheless, we note that the Prairie State project participant shares are spread among 68 AMP members, and that the project constitutes small-to-moderate shares of each participant's overall energy requirements. Therefore, we believe that the rate impact to participants will be manageable, and not pose a risk to the credit quality of AMP's Prairie State project,” S&P said.

Moody’s affirmed its A1 rating and stable outlook saying a downgrade could occur in the event “any participant successfully challenges, through litigation, their take-or-pay Prairie State contract, AMP Prairie State participant credit quality weakens, production cost rises significantly and impacts participant retail electricity prices, and both unit net capacity factors decline significantly.”

Supporters of Prairie State promote it as one of the cleanest-burning coal plants in the country but environmental groups counter that it’s still the largest carbon dioxide emissions polluter in the state and in the top 10 nationally.

Prairie State early on proved a headache for some of the public utility stakeholders due to construction delays, regulatory probes, and cost overruns but they say it’s now an affordable source of energy.

Peabody Energy Inc. initially sponsored the project in Washington County promoting it as an affordable source of energy with state-of-the-art anti-pollution technology at the time. Bechtel Power Corp. built it. It initially carried a $2 billion price tag, but cost overruns drove the price tag up to $5 billion.

The plant became fully operational in 2012. The campus includes a two-unit 1,629 megawatt pulverized coal, supercritical coal-fired generating facility supplied by an adjacent coal mine. It initially experienced outages and capacity reductions that were a drag on its operating performance.

The

The SEC launched its probe in 2013 with the disclosure that Peabody and AMP had received subpoenas related to the development of the project. It was