Developers of a hotel at the U.S. Air Force Academy are ready to issue $240 million of revenue bonds that were delayed more than a year by the COVID-19 pandemic.

Louisiana-based nonprofit Provident Group-USAFA Properties LLC is issuing the bonds through the Industrial Development Authority of the City of Phoenix, with RBC Capital Markets as senior manager.

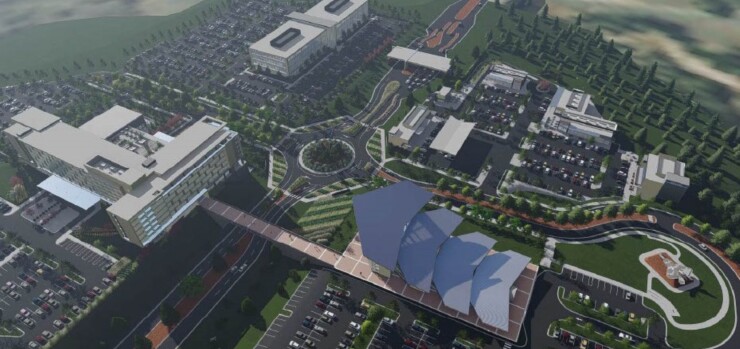

The hotel is a key element of a new 88-acre visitors center financed by public and private investment.

Financing for the visitor center includes $90 million of bonds approved by the City of Colorado Springs for a business improvement district that is part of a broader effort to attract tourists to the academy and the city at the foot of Pikes Peak.

The city council

After approving $80 million of bonds in 2020, the council increased the amount by $10 million in February amid debate about the changing dimensions of the project.

The unrated bonds for the district are coming to market separately from the revenue bonds for the hotel. But both deals are expected to come to market next week, according to an online investor presentation.

Bond counsel Fred Marienthal, partner at Kutak Rock, said the bonds are secured strictly by hotel revenue. “The city has no financial obligation whatsoever for those bonds,” he told the council.

Charae McDaniel, chief financial officer for the city, told the City Council in January that the bonds for the district and the hotel were “unrelated.”

“The only way they are related is that they happen to be located in the BID,” she said.

However, at-large council member Bill Murray, a retired colonel in U.S. Army intelligence, disputed that description.

“To authorize the expansion of this, to include a 425-room, nonprofit hotel that competes directly with every hotel in our community, I mean we’ve passed a line,” Murray said. “And, yes, they’re related.”

Calling the hotel “marginal to begin with,” Murray said the original plan was to build the visitors center adjacent to the academy’s football stadium using foundation grants with no hotel.

“We as public officials should never put in infrastructure that is related to a non-profit hotel,” he said. “Now, we’re looking at costs approaching $500 million for the whole thing. And none of it is going to come back here to taxes.

"We should not be involved in this,” Murray said. “The public should be outraged at this particular project.”

Developer Daniel Schnepf of Blue and Silver Development Partners told the council that the hotel had been scaled back to 373 rooms. The developers will have a 50-year lease on the site.

“Once those bonds are paid off all those taxes accrue back to the city,” Schnepf said. “This not-for-profit hotel is absolutely essential to the success of the Visitors Center and the payment of the bonds for the infrastructure.”

Developers have applied to S&P Global Ratings for a rating on one tranche of hotel bonds worth $144 million, according to the preliminary limited offering memorandum dated Oct. 11.

RBC Capital Markets is senior manager on both the district’s bonds and the hotel bonds.

After issuance of the bonds, the business district will be renamed TrueNorth Commons BID, per the

The company behind that will be Blue & Silver based in Colorado Springs.

The memorandum cautions that there is no assurance that the property “will be developed in the manner described herein or at all.” The actual amount and type of development is subject to change and may require approval of the U.S. government, the memo warns.

Schnepf told the

“We’re very excited about changes in market conditions and progress in the project,” he said. All of the infrastructure is shovel-ready. The most exciting element is the bond market heating up, especially the high-yield capital market.”

The city expects the BID bonds to pay from 5.25% to 7.75%, according to a presentation from staff.

Schnepf said the developers had investors lined up to buy the bonds before the pandemic but had to pitch the project anew when better conditions returned.

He said the Air Force Academy Foundation had pledged $6 million toward the project, but Murray countered that buying $6 million of bonds was not what he considered a "contribution."

Commissioners for El Paso County, of which Colorado Springs is the seat, pledged $10 million in future sales and property tax revenues to help pay for the new welcome center.

The center would be built outside the academy’s north entrance, eliminating security barriers that have limited access in the past.

“I am grateful it is not going to be next to the stadium,” said council member Wayne Williams, countering Murray’s complaint about the shift outside the campus gates. “The change in location is a vast improvement.”

The Air Force Academy, one of the nation’s four military academies, was once one of Colorado’s top tourist destinations. After the terrorist attacks on Sept. 11, 2001, academy visitors fell from 700,000 annually to 200,000, as security for the campus took priority over visitor access.

The AFA center is one of five projects in the city’s City for Champions tourism attractions launched in 2013. Other projects are the United States Olympic & Paralympic Museum and Hall of Fame, the William J. Hybl Sports Medicine & Performance Center, and two downtown sports facilities.

The bonds for the hotel are backed by property taxes, ownership taxes, public improvement fees and property and sales tax increment financing from the urban renewal area and the state Regional Tourism Act revenues, according to city officials.

TIF funding is 1.75% in sales tax.

Business improvement districts require city council approval but are legally separate from the city. The development can impose public improvement fees of 3% on sales and a lodgers fee of 2%.

Colorado Springs, home to the U.S. Olympic Training Center, has built its economy around headquarters for non-profit organizations along with tourism. The effort to attract nonprofits was guided in part by the powerful El Pomar Foundation, whose founder Spencer Penrose built the historic Broadmoor Hotel.

With a population of 478,961 as of the 2020 census, the city has grown more than 15% in a decade. The Air Force Academy opened in 1958.

On campus, the Air Force is investing $158 million to restore the iconic Air Force Chapel.

In August, The U.S. Space Force established the Space Training and Readiness Command at Peterson Space Force Base in Colorado Springs.

Murray told The Bond Buyer via email that he considers the Visitors Center deal “Young Frankenstein financing,” based on the movie in which “no one seemed to know where the head came from,” he said.

“Do I have a problem with these arrangements? Yes. Do I believe these actions are abusive based on my knowledge of the intent of this legislation (blight, URA, tax exempt)? Yes. Will someone make a profit? Yes. Will I be at the ribbon cutting? No.”

Update: The story was updated with a timeline for the bond pricing.