-

Increasing private school enrollment has little to do with falling California public school enrollment, according to the Public Policy Institute of California.

September 12 -

The bond issue, which was delayed due to litigation, would be the first debt sold by the turnpike authority for its $5 billion, 15-year toll road program.

September 12 -

When Los Angeles World Airports CEO Justin Erbacci steps down next month, Beatrice Hsu will step up as interim CEO.

September 8 -

With around 30% of bonds trading near the de minimis threshold, a new study takes a deep dive into how the rule drives illiquidity as mutual funds dump paper that's approaching the threshold.

September 7 -

The Des Moines Airport Authority wants to take advantage of Polk County's triple-A ratings to lower borrowing costs for a terminal project.

September 7 -

Trinity Regional Hospital Sachse filed for Chapter 11 bankruptcy after problems left it unable to pay municipal bond debt service or cover operating expenses.

September 6 -

While the university remains current on bond payments, it is not financially stable, sources say.

September 6 -

"As an investor I'm not looking at the activity of the stadium as the security," said an Illinois sports authority bondholder of potential exits by the White Sox and Chicago Bears.

September 5 -

The city, which issued POBs in 2005, is awaiting recommendations from an actuary on how to deal with a $3 billion unfunded liability in its public safety fund.

September 1 -

Despite this, August saw the largest monthly volume of 2023, helped by several billion-dollar deals and multiple Texas school district deals.

August 31 -

The state's Council of Bond Oversight will once again consider $500 million of bonds for a controversial $5 billion Oklahoma Turnpike Authority expansion.

August 30 -

The upgrades mark the second in a year for the tollway authority's ratings, which were raised last August by S&P Global Ratings.

August 29 -

Fitch analysts mentioned the tardy ACFR in the ESG section of its most recent rating report on California general obligation bonds.

August 29 -

-

The state is capping transfers of fossil fuel-related revenue to its general fund and will invest money that exceeds the cap through a Severance Tax Permanent Fund.

August 28 -

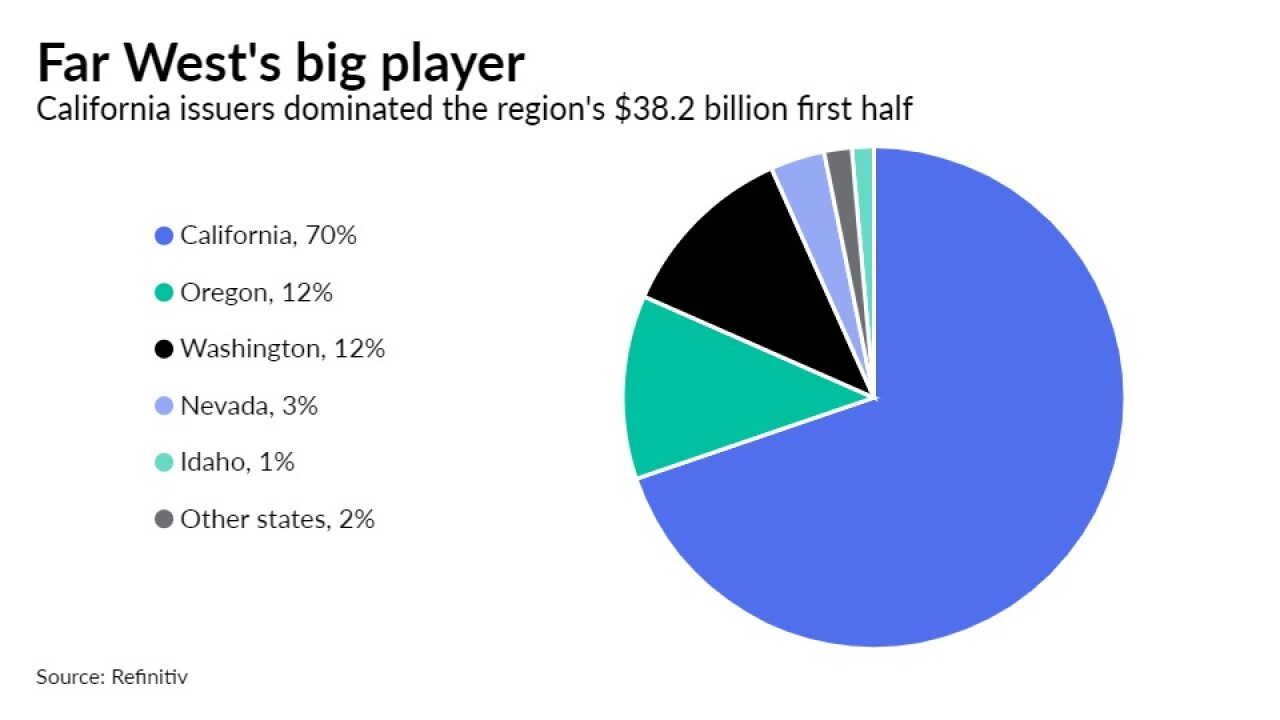

Municipal bond issuance in the Far West was down 2.3% in a first half that saw volume drop 17.1% nationally.

August 24 -

The region's issuers sold $30.3 billion of municipal bonds in the first half of 2023, 29.9% less than they did during the same period last year

August 23 -

The rating agency cited the Illinois county's accumulated reserves, as well as required pension contributions for the move.

August 23 -

Healthcare and transportation had the biggest contraction in issuance volume.

August 21 -

Total volume in the first half of the year was $180.882 billion in 3,853 deals, down 17.1% from the $218.230 billion in 5,444 over the same period in 2022, according to Refinitiv data.

August 21