-

Six years after opening, the mall has higher sales, more attractions, and a lower property value assessment.

August 11 -

Issuance for the week of Aug. 11 remains elevated at an estimated at $10.713 billion, with $8.857 billion of negotiated deals and $1.857 billion of competitive deals on tap, according to LSEG.

August 8 -

"Nothing could delay a restructuring or a consensual deal [more] than the existing board was doing," said Assured Guaranty CEO Dominic Frederico of the Trump administration's removal of Puerto Rico oversight board members.

August 8 -

Generous federal support is offset by a small and volatile economy, the agency said.

August 8 -

Hospital acquisitions, expansions and the anticipation of federal policy changes has increased bond issuance from the California Health Facilities Financing Authority.

August 8 -

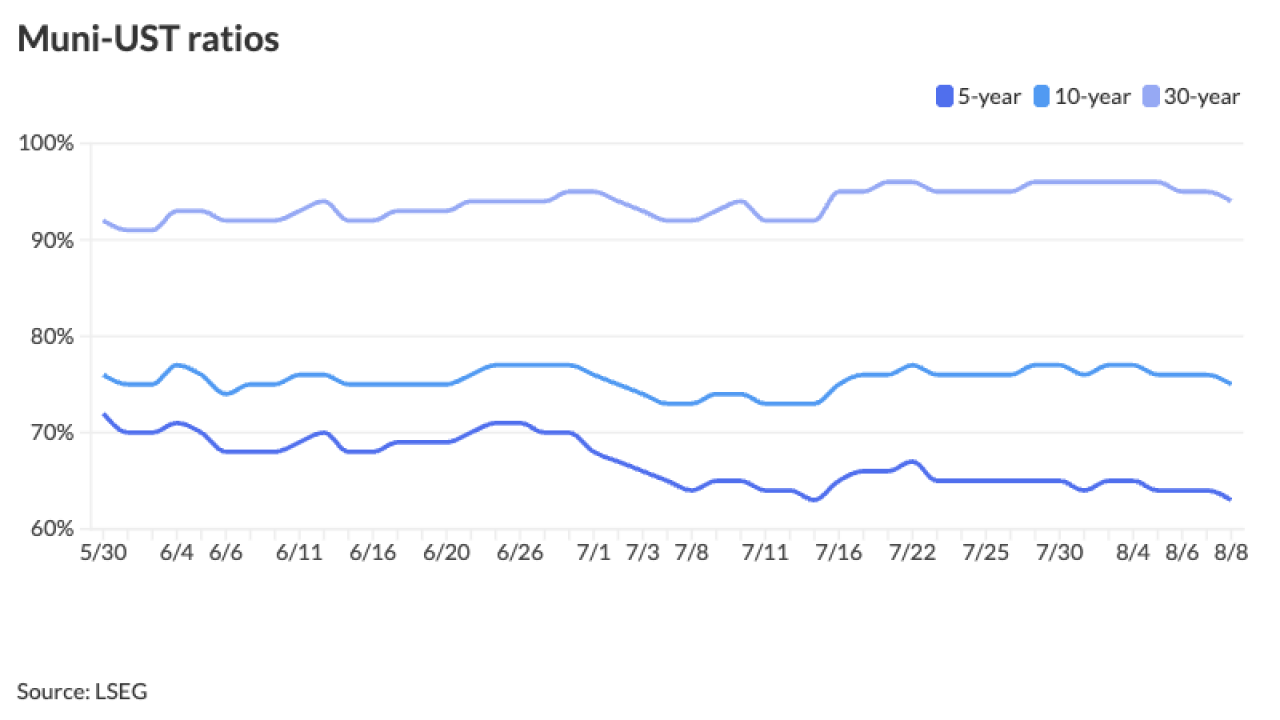

While UST yields "consolidate" following Friday's massive rally after the July jobs report, muni yields remain resilient, according to Kim Olsan, senior fixed income portfolio manager at NewSquare Capital.

August 7 -

Miran, if nominated and approved by the Senate, is only expected to serve a term that expires in January, according to the person, who requested anonymity to discuss internal deliberations.

August 7 -

The Local Government Commission approved issuance of notes that will be taken out gradually in the next few years.

August 7 -

Taylor Raymond has joined Norton Rose Fulbright as a senior counsel in its Austin and Dallas offices, according to the law firm.

August 7 -

Provisions of the One Big Beautiful Bill Act are beginning to take effect as the FHFA has doubled the cap on Low Income Housing Tax Credits, which should boost the issuance of private activity bonds.

August 7 -

The measure would lower the percentage increase in property tax revenue larger cities and counties can tap for operations without seeking voter approval.

August 7 -

Florida is poised to reap the rewards of spaceport financing legislation, even if some headwinds remain.

August 7 -

This year's portfolio growth will save the city $2.18 billion over the next five years, Comptroller Brad Lander said.

August 6 -

The municipal bond market is "doing pretty good for the moment," said Jeff Timlin, a managing partner at Sage Advisory.

August 6 -

The risk Brightline Florida poses to the rest of the high-yield market may manifest in fund flows, investors said.

August 6 -

The Minneapolis Fed chief added that tariffs still represent a significant uncertainty and it's unclear what impact they'll have on inflation.

August 6 -

Mayors and city leaders are using a combination of bond financing and public private partnerships to build and preserve affordable housing while working with a patchwork of regulations and facing opposition.

August 6 -

Officials are considering selling more voter-approved bonds for the stalled project, which could be jumpstarted with a phased-in construction approach.

August 6 -

St. Paul, Minnesota, is recovering from a cyber attack that overwhelmed the city's defenses ahead of its Aug. 19 bond deal close.

August 6 -

Analysts unsure about the impact of the firings on bondholders.

August 5