-

Mississippi's largest city is without running water. It has $191 million in outstanding water and sewerage revenue bonds, according to Moody's.

August 31 -

Many market players have revised their supply projections downward since rising interest rates have slowed down refunding and taxable volumes and general market volatility has stopped some issuers from participating.

August 31 -

Modeled after New York City's Hudson Yards, the plans call for a high-density urban district with a transit terminal and at least 35% affordable housing.

August 31 -

A three-judge panel reversed a district court's ruling in favor of the city's Firefighters' Relief and Retirement Fund that the law was unconstitutional.

August 31 -

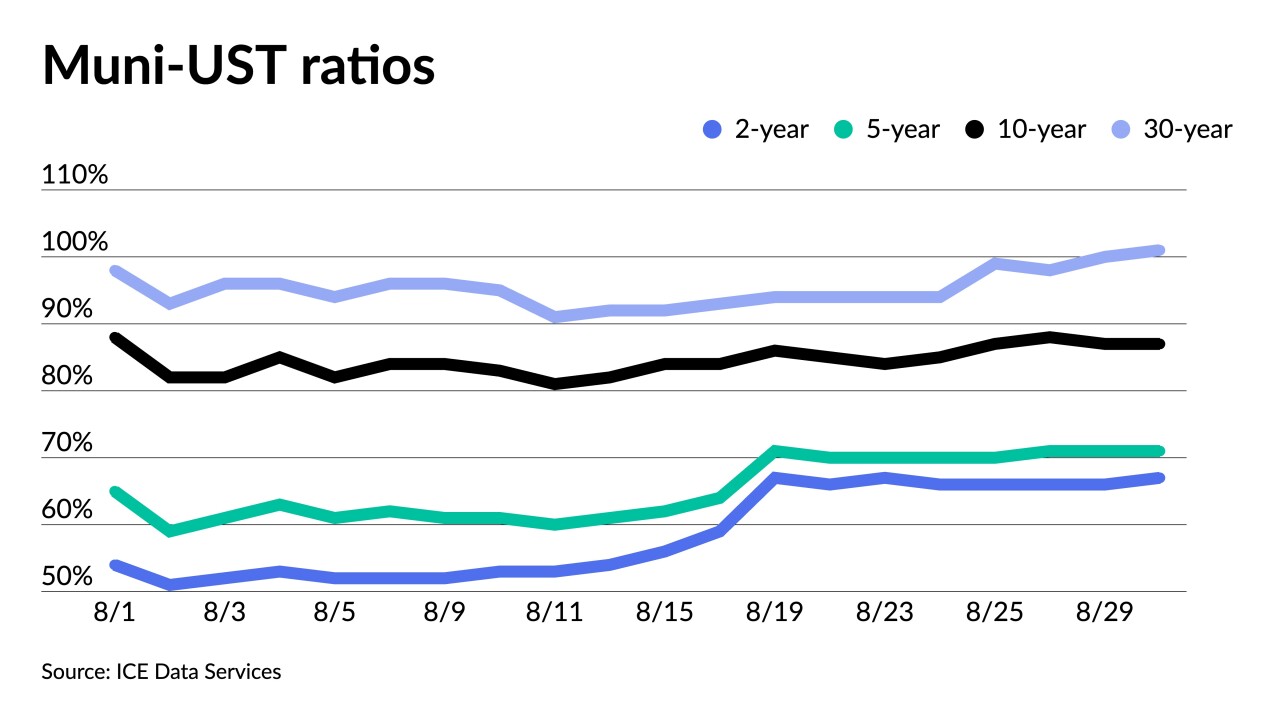

After underperforming USTs last week, "munis have given up their earlier performance advantage for August with both asset classes currently earning virtually the same negative returns," said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

August 30 -

Although he called them "excessive and arbitrary," Gov. Pedro Pierluisi agreed to create a reserve fund, reduce the maximum conservation easement tax credit, and freeze implementation of a physician tax incentive.

August 30 -

Ben Watkins, Director of the State of Florida's Bond Division, talks with Chip Barnett about the latest news coming out of the Sunshine State and takes a look at what's happening in Reedy Creek. He discusses Florida's bonding and debt, infrastructure plans and dives into the state's ESG priorities. (30 minutes)

August 30 -

Fed Chair Jerome Powell's message on rates last week combined with seasonal factors to give the market a "weird" vibe this week, one trader said.

August 29 -

The authority maintained positive rating momentum by drawing outlook changes from Moody's on both its water and sewer bonds and from Fitch on its sewer debt.

August 29 -

Moody's says the cut is a credit negative for the U.S. Virgin Islands' matching fund bonds.

August 29 -

The American Rescue Plan was passed without waiving the Pay As You Go Act, which could prevent municipalities from receiving payments on bonds already issued.

August 29 -

The "after-action" report concluded that the Great Hall project would have been better served with a more traditional finance and contracting approach.

August 29 -

UBS was the only bank that underwrites municipal bonds on the list of 10 financial companies determined to be boycotting energy businesses under a Texas law aimed at protecting the state's oil and natural gas industry.

August 29 -

Investors will be greeted Monday with decreased supply with the new-issue calendar estimated at $5.882 billion, down from total sales of $6.134 billion in the week of Aug. 22.

August 26 -

UBS was the only municipal bond underwriter included on the Texas comptroller's list of 10 financial companies determined to be boycotting energy businesses.

August 26 -

The congestion pricing plan that puts tolls on vehicle traffic coming into lower Manhattan still faces many hurdles before it would take effect.

August 26 -

The pension system has sued WAPA demanding immediate payment of more than $2 million in employee contributions.

August 26 -

The state's Board of Public Works could vote on the 50-year concession this fall as Gov. Larry Hogan aims to button up the project before he exits office in January.

August 26 -

The Securities and Exchange Commission has approved the Municipal Securities Rulemaking Board's proposed changes to Rule G-34 on CUSIP applications, removing the requirement for municipal advisors to file new issue applications in one business day, among other changes.

August 26 -

Climate science data that guides where and what to build will be key to effective use of new federal dollars.

August 26