-

Mayor Eric Adams executive budget "will be released in just 51 days, giving us limited time to marshal the substantial resources we will need to stay balanced in fiscal 2023 and 2024," said OMB Director Jacques Jiha.

March 7 -

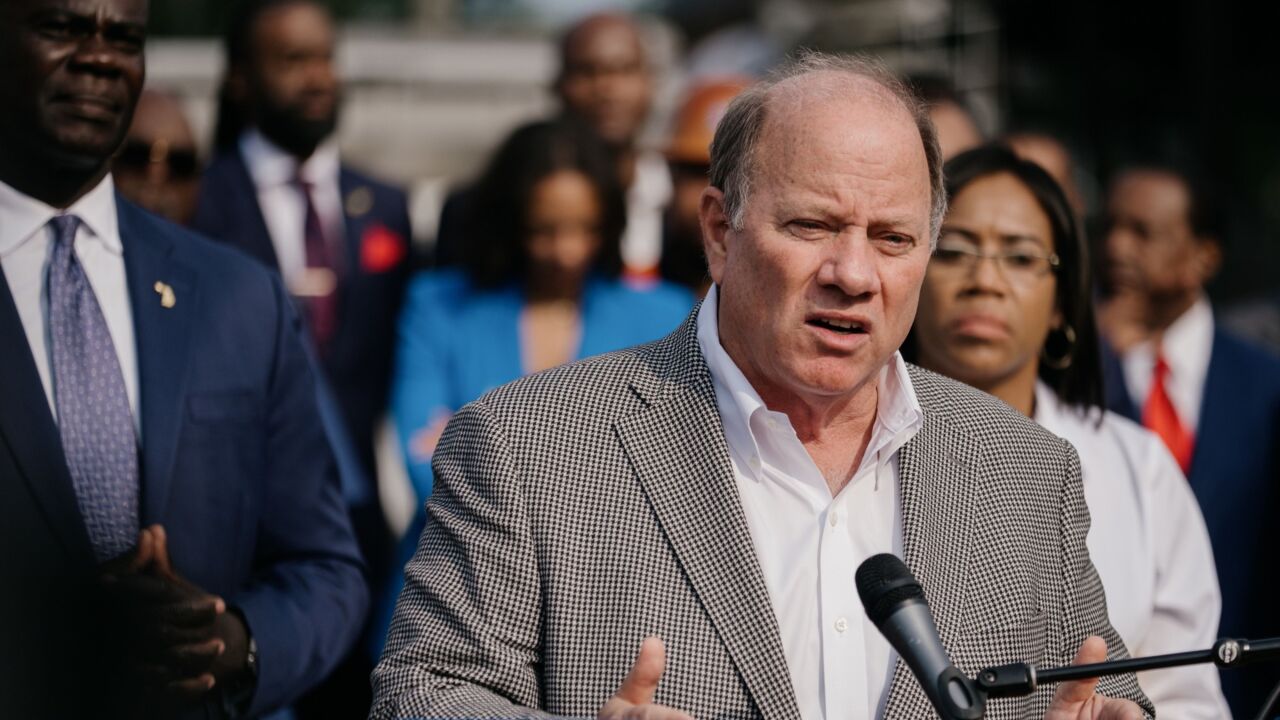

Mayor Mike Duggan proposed a budget that includes the resumption of general fund pension contributions, meeting a timetable set in the city's bankruptcy exit.

March 7 -

Municipal securities could be exempt from the proposal and the Commission invites commenters to lay out why that should be the case.

March 7 -

Revenue bonds sold in 2018 for the project would be paid over seven years at lower rates under the Chapter 11 exit plan for the Bridgemoor at Plano debt.

March 7 -

Ellis Phifer, managing director and senior strategist in the fixed income research department at Raymond James, talks with Chip Barnett about the state of the bond markets. (Taped Feb. 16; 15 minutes)

March 7 -

High turnover rates in key government positions make it hard for the town of Wellfleet, Massachusetts, to stabilize its finances, a state report said.

March 6 -

Each would preserve their individual brands with a new organization functioning as the parent company with the aim of cutting administrative costs.

March 6 -

Federal Reserve Chair Jerome Powell will testify beore Congress twice this week and Friday brings the latest employment report.

March 6 -

Turmoil at the community college has placed its accreditation in jeopardy and resulted in a rating downgrade.

March 6 -

A stronger 2021 aided hospital balance sheets for those whose fiscal years end on June 30 based on a review of hospital operating medians

March 6 -

The ruling could set a precedent for the board's control over local government policies affecting the economy.

March 6 -

Mark Cappell is the president of the National Federation of Municipal Analysts for 2023, its first bond insurer to take the role since 2009.

March 6 -

More than half of the 163 bills introduced in state legislatures across the country propose one-time funding for transportation projects using bonds, excess COVID relief or budget surpluses.

March 6 -

The much-delayed $3.5 billion deal has an optional limited make-whole redemption if state lawmakers appropriate funds to defray costs for natural gas customers.

March 6 -

"The outlook revision reflects recent state legislation that provides for the district's continued ability to levy ad valorem taxes," said S&P analyst Christian Richards.

March 3 -

The "week's substantial primary market calendar of $10-plus billion will be a big test for where market demand stands," said Tom Kozlik, head of public policy and municipal strategy at HilltopSecurities Inc.

March 3 -

Gov. Phil Murphy's proposal doesn't include new major programs or initiatives but addresses long-term liabilities and reserves ahead of a potential recession.

March 3 -

The measure prohibits government contracts with companies deemed to be "boycotting" the fossil fuel, firearm, timber, mining, and agriculture industries.

March 3 -

The legislation would allow the New Mexico Finance Authority to issue revenue bonds for transportation and broadband projects.

March 3 -

Fitch Ratings raised Miami-Dade County's $4.9 billion of aviation revenue and revenue refunding bonds to A-plus from A.

March 3