-

The secondary was quiet and the sole deal of size came from a $400 million-plus competitive water and sewer loan from Portland, Oregon. The recent rise in yields makes for more compelling levels.

May 3 -

Despite legislation and political rhetoric, demand for environmental, social, and governance focused debt remains strong.

May 3 -

"When the rating agencies developed and rolled out their ESG scores, they said their ESG scores would not impact an issuer's credit rating. We are holding them to their word," said Ben Watkins, director of the state Division of Bond Finance.

May 3 -

An expansion of the Northeast Corridor rail link and a proposed bullet train between Portland and Vancouver are two of the infrastructure developments in muni finance.

May 3 -

The state Senate on Tuesday gave a green light to the general appropriations act, which now goes into a constitutionally required 72-hour cooling off period before a Friday vote.

May 3 -

Sale of the tax-exempt notes is expected on May 9 and proceeds will support improvements to educational technology in school's statewide.

May 2 -

"The market is expecting a 25 basis point rise in the Fed funds rate, but more importantly, investors are waiting for the comments for a better idea of what to expect going forward," said SWBC Investment Company's Roberto Roffo.

May 2 -

Increasing electric rates to pay the debt would lead to economic contraction, a University of Puerto Rico professor said.

May 2 -

Streamlining the federal grant process should start with getting rid of the "government legalese" that complicates notice of funding opportunities, experts said.

May 2 -

Additional spending was permitted by a rosier revenue forecast that lifted expected general fund revenues through the next biennium.

May 2 -

The Chapter 11 filing follows defaults by nonprofit Legacy Cares on $284 million of mostly tax-exempt bonds sold through the Arizona Industrial Development Authority.

May 2 -

The Treasury Department's Bureau of Fiscal Service has suspended the sales of State and Local Government Series securities in efforts to avoid defaulting on the debt limit.

May 2 -

In a supply-challenged market, foreign investors can play a role in buying taxable munis. 16Rock Asset Management's James Pruskowski discusses a 2023 reset in the muni market. Lynne Funk hosts (29 minutes)

May 2 -

The bond market is not an inherently racist market but, it does not exist in isolation from society at large. As a result, it has acted against the financial interests of municipalities whose residents are predominantly Black.

May 2 ArentFox

ArentFox -

"Dave has always worked hard, maintained the highest analytic integrity and role modeled independent thought," said Eden Perry, S&P head of U.S public finance. "He will be missed."

May 2 -

Las Vegas sees March visitor totals similar to pre-pandemic March 2019, putting in on solid fiscal footing.

May 1 -

The bondholders and bond insurers submitted four expert reports to support their belief they deserve more money than what's being offered in the PREPA bankruptcy.

May 1 -

"The latest upgrade is further recognition of the work we have put into responsible budgeting," said Treasurer Elizabeth Maher Muoio.

May 1 -

Municipals were in the red to close out April, down 0.2%, per the Bloomberg Municipal Index, but are in the black 2.5% year-to-date.

May 1 -

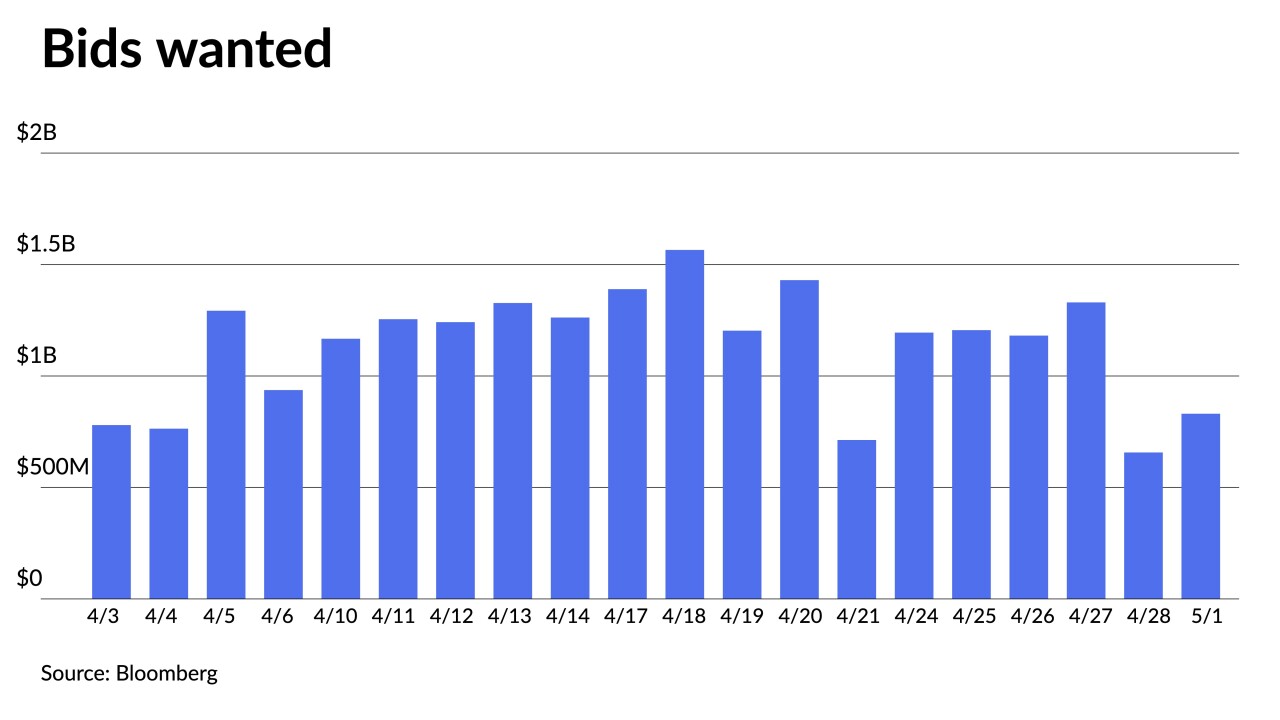

JPMorgan's move to acquire First Republic and its muni portfolio eases the risk of nearly $20 billion of munis flooding the market.

May 1