-

Municipalities are facing a deadline to obligate COVID-relief money.

August 24 -

The Uinta Basin Railway, which aims to transport crude oil, is eying up to $2 billion in private-activity bond authorization.

August 24 -

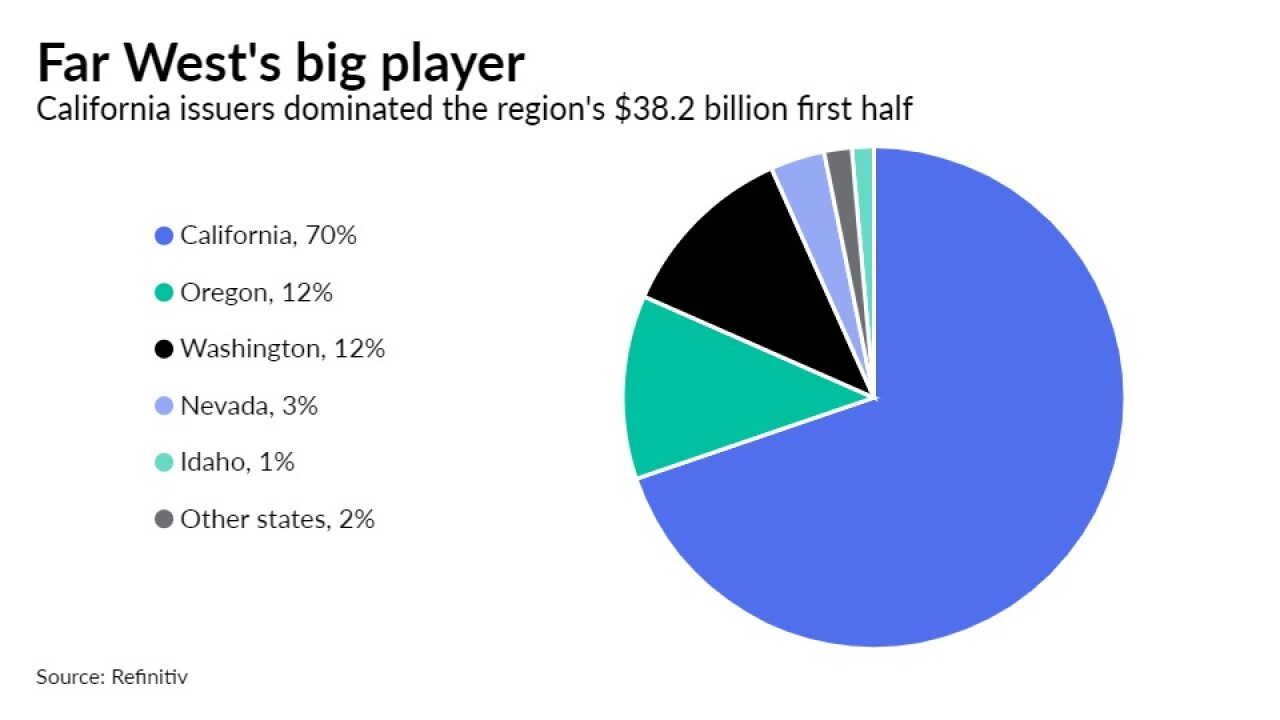

Municipal bond issuance in the Far West was down 2.3% in a first half that saw volume drop 17.1% nationally.

August 24 -

"The improved rating outlooks are critical for the Power Authority to ensure that we can continue leveraging the capital markets," said NYPA President and CEO Justin E. Driscoll.

August 24 -

A state-by-state review of first half 2023 issuance in the Southeast.

August 24 -

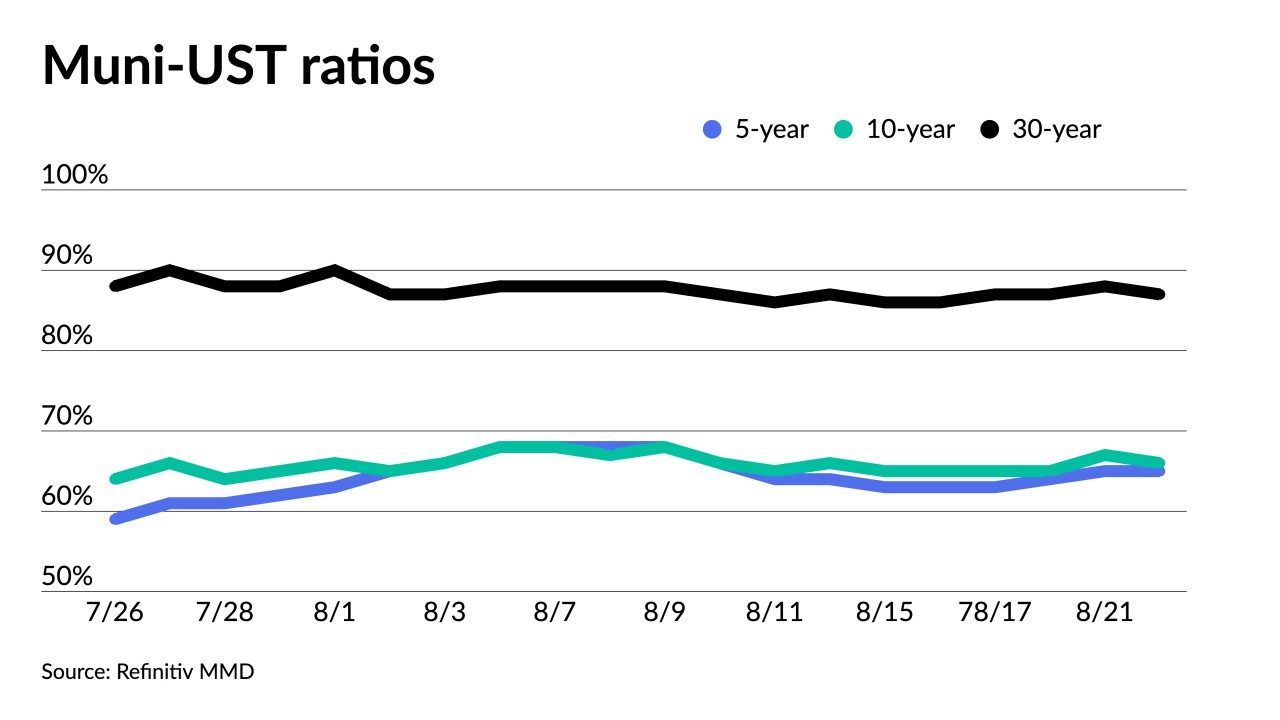

Supply scarcity is helping the market through the Treasury volatility. Bond Buyer 30-day visible supply currently sits at $4.72 billion.

August 23 -

The region's issuers sold $30.3 billion of municipal bonds in the first half of 2023, 29.9% less than they did during the same period last year

August 23 -

The $1.4 billion span would mark the second major bridge that the two states have built together following the $2.6 billion Ohio River Bridges project that opened in 2016.

August 23 -

The rating agency cited the Illinois county's accumulated reserves, as well as required pension contributions for the move.

August 23 -

The Tax Cuts and Job Act will be up for renewal by the winners of the next election cycle

August 23 -

A state-by-state review of first half 2023 issuance in the Midwest.

August 23 -

Tuesday's competitive new money sale is to be followed with a negotiated refunding deal later this week.

August 22 -

This week's new-issue supply needs to be "priced to sell to pique investor interest," said noted Nuveen's Daniel Close and Anders S. Persson.

August 22 -

The state did not rule out a future public-private partnership but said it's current focus is on public funds.

August 22 -

José Pérez Riera will fill the post that has been vacant for over three years.

August 22 -

The budget impasse is closely watched by cities, colleges and other government entities that receive federal aid.

August 22 -

Mainly attributable to high inflation and increasing interest rates, costs have been increasing for retail sized trades but remained steady for institutional sized trades.

August 22 -

Issuers in the Midwest sold $32.6 billion of debt spread over 1,223 deals in the first half, down from $40.5 billion a year earlier.

August 22 -

Tracey Manzi, senior investment strategist at Raymond James, talks with Chip Barnett about the fixed income markets today and how munis and Treasuries are doing. She says the number one issue clients are asking about is inflation. (20 minutes)

August 22 -

A state-by-state review of first half 2023 issuance in the Southwest.

August 22