Municipal bond issuers in the Midwest largely tracked their national peers in the first half of 2023, with volume down 19.4% compared to the first half of 2022.

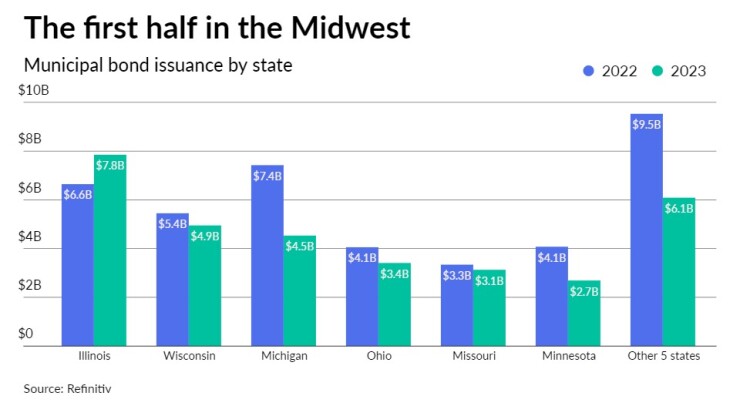

They sold $32.6 billion of debt spread over 1,223 deals in the first half, down from $40.5 billion in 1,764 deals in the year-ago period, according to Refinitiv data.

Nationally, municipal

It's a bit of a missed opportunity for municipal issuers, who would have little trouble finding takers for debt, said Richard Ciccarone, president emeritus of Merritt Research Services.

"If you have a strong supply, with interest rates going up, they'd be a lot more attractive. New buyers would be coming in and buying all these bonds."

But the implications go far beyond the mechanics of the municipal bond market.

"It's obvious that infrastructure is at least not being rebuilt at any burst of speed," Ciccarone said. "That's not happening, and it's across the board."

Midwest issuers did gain momentum in the second quarter, selling $20 billion of debt compared to $12.6 billion in the first quarter — second quarter volume was only down 3.5% year-over-year, after a 36.1% fall in the first quarter.

Illinois issuers led the way, posting the only gain among the region's 11 states, up more than 18.3% in the first half to $7.85 billion.

The state's issuers were particularly buoyant in the second quarter, selling $5.26 billion of debt, more than doubling the first-quarter number and up more than 75% from the second quarter of 2022.

Deals classified by Refinitiv as being for education were down 26.4% to $12.12 billion, but still the most issued by any sector in the Midwest.

"People have a desire to maintain their primary facilities for education," Ciccarone said.

But the education sector decline underscores difficulties faced in much of the region, he said, including challenging demographics and a lack of economic growth.

But the longer governments and school boards wait to renew their infrastructure, the harder it gets.

"The price is going up to build these capital facilities," he said. "Not only interest rates, it's also the price of construction itself, which has also gone up significantly."

The utilities sector was basically flat in the first half at $2.21 billion, and transportation was up 17.5% in a down year to $1.5 billion.

Healthcare volume was down more than half to $2.18 billion.

"You see them put emphasis right now on operations, less time on brick and mortar," Ciccarone said of the healthcare sector, which was ground zero for the fiscal impacts of the COVID-19 pandemic and hit particularly hard by ensuing inflation and rising labor costs.

"Not just their financial officers' time [but also] their dollars are going into adjusting to the higher cost of doing business at the operating level," he said.

"It also could be an influence of the reduction of mergers and acquisitions," Ciccarone said.

A wave of mergers and acquisitions in not-for-profit healthcare

Wisconsin's issuers were the second most active in the Midwest, selling $4.95 billion of bonds, down 9.2% from the first half of 2022.

Next on the table is Michigan, where issuers sold more than $4.5 billion of bonds in the first half, down 38.9% from the previous year.

Those states were followed by Ohio, down 15.9% to $3.4 billion, Missouri, down 6.3% to $3.13 billion, and Minnesota, off 34% to $2.69 billion.

The biggest drop-off came in North Dakota, where issuance fell 64.9% to $324 million, the lowest in the region.

The biggest deal of the year came from the Illinois state government, which sold $2.5 billion in an April general obligation deal.

The deal was buoyed

Both rewarded the state for building up reserves and paying down debts with surplus tax revenues.

The state reaped the rewards, with

That $2.5 billion amount was enough to make the state of Illinois the Midwest's top issuer in the first half.

The region's second-biggest deal of the half came from Chicago, where the Sales Tax Securitization Corp. priced $740 million of bonds, of which a $156 million new money portion

The Indiana Finance Authority's $693 million June pricing for Indiana University Health came in at number three for the first half.

The state of Wisconsin came in second in the volume ranking of the region's issuers, with $1.47 billion sold, ahead of the city of Chicago with $1.03 billion and Chicago's separately tallied Sales Tax Securitization Corp. with $960 million.

The first-half league table of municipal bond underwriters was topped by Stifel Nicolaus & Co., credited by Refinitiv with $4.25 billion. It was followed by BofA Securities at $3.5 billion, RBC Capital Markets at $3.4 billion and Robert W. Baird & Co. at $2.43 billion.

PFM led the region's financial advisors, credited with $7.3 billion, followed by Columbia Capital Management at $3.69 million, Baker Tilly Municipal Advisors at $2.73 billion, CSG Advisors with $1.24 billion and Ehlers & Associates at $922 million.

Chapman and Cutler topped the Midwest bond counsel table, credited with $2.69 billion. It was followed by Quarles & Brady at $2.67 billion, Gilmore & Bell at $2.33 billion, Ice Miller at $2.13 billion and Kutak Rock with $2 billion.

Taxable bond sales were off by half year-over-year, to $3.97 billion.

Bond insurers made inroads, on a volume basis anyway, credited with wrapping $3.86 billion, up 19.2% compared to the first half of 2022, though the number of deals they insured was down to 182 from 226.