Illinois navigated a rocky market to clear its $2.5 billion general obligation sale Wednesday, paying more on the shorter end than its bonds have been trading, but seeing healthy demand on the long end for the newly stamped-A level rated paper.

The

Market participants said the oversubscription came on the long end, which was reflected in the repricing to lower yields there in the final pricing scale. Some earlier maturities struggled and additional concessions were needed, reflecting the market's current appetites and a correction that's hammered the front end.

The sale followed Gov. J.B. Pritzker and the state finance team's

The 2047 maturity — the largest of the transaction offering $192 million — with a 5.5% coupon attracted strong interest and was 14 times oversubscribed, said Jason Appleson, managing director and head of PGIM Fixed Income's municipal bond team. The yield was lowered by 10 basis points.

"That's the biggest maturity in the stack and it did pretty well," Appleson said. "For the right structures and the right names, you'll get decent activity."

But tranches with nearer-term maturities that are on the inverted part of the yield curve "had some holes that were later cleaned up," he said. The full deal "came with a pretty hefty concession."

The state "did their pre-marketing" and had its customer base lined up, said Peter Franks, director of market analysis at Refinitiv MMD. "Illinois has a wider audience of investors" with the A ratings "but they still offer more yield than what's available from most other A-rated" borrowers.

S&P Global Ratings in February

Fitch Ratings followed in late March, lifting the state's outlook to positive from stable on its BBB-plus rating, signaling the potential upgrade, possibly soon after passage of a fiscal 2024 budget that makes further progress on chronic fiscal strains.

The deal included a $1 billion tranche that will fund capital work including projects authorized under the Rebuild Illinois capital program, $150 million for information technology projects, a $200 million taxable series for accelerated pension payments under two ongoing buyout programs, and $1.16 billion refunded debt for savings.

The refunding achieved $102 million or 8% present value savings. The true interest cost on the transaction was 4.228%, according to the state.

Wells Fargo Securities, Goldman Sachs, and Loop Capital Markets were joint senior managers.

With the market opening weaker this week, a rare heavy supply and tax-season effects in play, some market participants believed Illinois would hold off in hopes of capturing lower rates when redemptions pick up. Others said the state would garner the most attention and the combination of its higher-rated paper that still offers healthy yields would fare well and waiting had its own risks.

"We had a carefully developed plan for this sale and we followed it. Despite choppy waters yesterday, we had a very successful sale enhanced by Gov. Pritzker's trip to New York, the size and variety of our offering, and our recent credit upgrades," the administration said. "The state had the market's full attention and was more than four times oversubscribed while other deals struggled or were downsized."

One market analyst said timing is a tough call to make. "They definitely had to give concessions, but they also benefitted from the higher ratings. They had done a lot of marketing and if you need the money then you borrow," the analyst said. "No one has a crystal ball to see what the market will look like in the future."

Deal spread details

The state's one-, 10-, and 25-year bonds headed into the pricing at spreads to Refinitiv MMD's AAA benchmark of 55/125/145, respectively, on Monday.

The final spreads settled at 90/129/145 although the final bond came with a 4.5% coupon and the MMD scale is set based on a 5%.

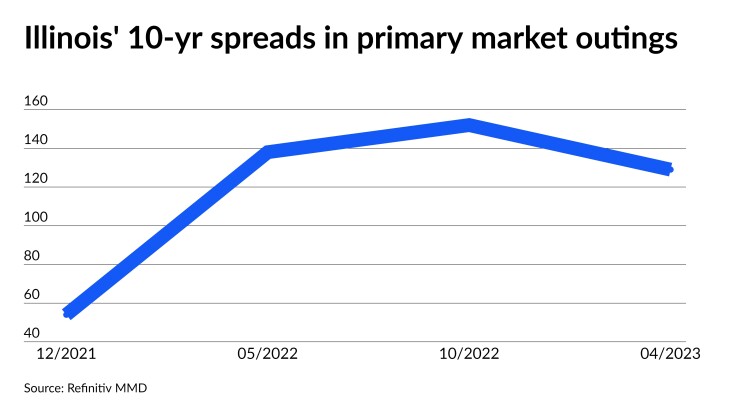

The 10-year and 25-year bonds both tightened from the state's last primary outing with GOs.

State spreads in mid-February began trending down — at 110/163/175 basis points — after rising to 120/173/185 in mid-January. In mid-December spreads were at 100/163/175.

The one-year settled at a yield of 3.52%, for a 90 basis point spread which was five basis points better than the initial wire as well as the 95 basis point spread offered in the pre-marketing wire distributed Tuesday, but far wider than where the maturity had been trading at in the secondary market heading into the deal this week at 55 basis points.

The state offered concessions in the final pricing of three to five basis points on maturities from 2030 to 2034 before leveling off and seeing cuts beginning in 2036 of five to 20 basis points further out on the scale.

The final put the 10-year maturity at 3.60%, a 129 basis point spread, which was four wide to the initial pricing and the pre-marketing wire. It had been trading at 125 basis points heading into the deal.

The 2047 maturity with a 5.5% coupon settled at a yield of 4.50%, a 120 basis point spread which was 10 basis points better than the preliminary pricing and 15 basis points narrower than the marketing price Tuesday. The 2048 maturity with a 4.5% coupon settled at a 4.73% yield, a 140 basis point spread, which was also 15 basis points better than the initial pricing and 20 basis points better than the pre-marketing price. The state's long bonds had been trading at a 145 basis point spread ahead of the sale but those levels are based on a 5% coupon.

The state's October issue saw the 10-year in the deal land at a 152 basis point spread while the 25-year landed at a 168 basis point spread. Facing market tailwinds, the state's May 2022 issue saw its 10-year maturity widening to a 138 basis point spread from a recent low of a 54 basis point spread in December 2021.

The state's spreads remain wide to both the single A and BBB MMD benchmarks.

The taxables, which priced off an inverted yield curve, settled at yields 100 to 145 basis points over comparable U.S. Treasuries.

Caitlin Devitt contributed to this story