ESG

ESG

-

Join Peter O'Neill, Director and Senior Fixed Income Portfolio Manager, at Bank of America, and Blake Lynch, Head of Business Development, IMTC, as they discuss the role of separately managed accounts in the muni market with The Bond Buyer's Lynne Funk.

-

Fitch is bulking up its public finance group with the addition of six municipal bond analysts for its offices in San Francisco, New York and Austin.

August 17 -

The debt issued through conduit Gallatin County, Montana, benefits an aerial firefighting company that went public through a SPAC weeks after the bonds sold.

August 11 -

A key distinction commenters raised is the difference between ESG-related credit risk disclosures and non-credit risk ESG information about the issuer or the bonds.

August 10 -

Due to their policies on fossil fuels, BlackRock, Goldman Sachs, J.P. Morgan, Morgan Stanley and Wells Fargo can't bid on state banking contracts in the Mountain State.

July 28 -

A proposal would prohibit fund managers at the State Board of Administration from considering ESG factors when investing the state’s money and require them to only consider maximizing returns on investment.

July 28 -

The Louisiana Bond Commission approved $600 million of notes to help pay Hurricane Ida damage claims after several insurers went bankrupt and up to $1.1 billion to build a biorefinery.

July 27 -

Mayor Daniella Levine Cava said her proposed $9.3 billion fiscal 2022-2023 budget, with the tax cut, safeguards the county's fiscal stability and maintains critical services.

July 22 -

Bond premiums decrease when a city facing flood risk adopts measures that will reduce those risks, according to a recent study.

July 20 -

Tom Wright, president and CEO of the Regional Plan Association, talks with Chip Barnett about the ongoing Gateway transportation project and its importance to the tri-state region. He also discusses the challenges and opportunities in transit, infrastructure, affordable housing, climate change and ESG. (30 minutes)

July 19 -

A new study found that following the recent law in Texas law barring muni underwiriting by banks discriminating against the oil and gas industry, municipalities face higher borrowing costs after many players exited the market.

July 18 -

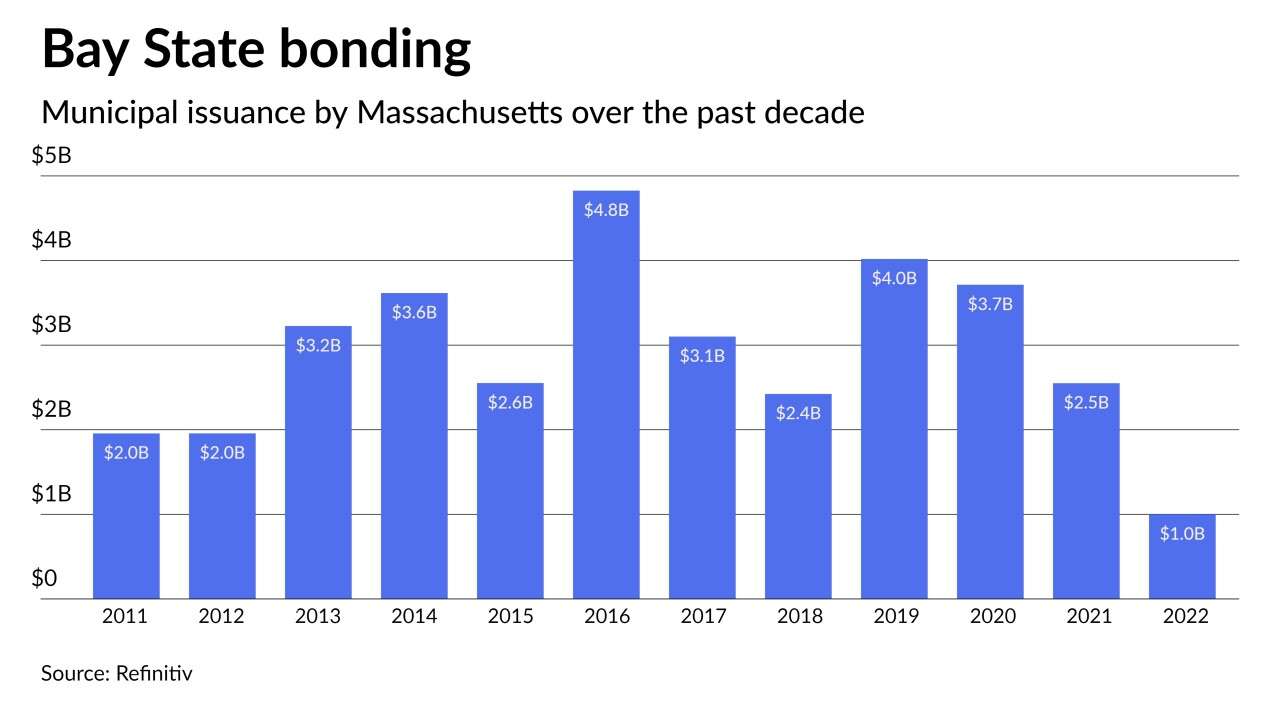

Massachusetts delayed the sale of $2.7 billion of taxable special obligation revenue bonds as state lawmakers consider a bill for their unemployment trust fund.

July 15 -

BlackRock's Head of Municipals Peter Hayes lays out the muni landscape for the rest of the year, highlighting opportunities for the asset class after the severe volatility so far in 2022.

-

-

The “social” part of ESG evaluations poses the most downside risk to governmental and not-for-profit issuers in the Midwest and Central regions, S&P said.

July 13 -

The ISS ESG Muni QualityScore was previously designed for the buy- and sell-side, but it has expanded its offerings to issuers with datasets focused on their specific locations.

July 11 -

Proceeds of the taxable business-tax backed special obligation revenue bonds will pay down federal debt the state accrued during the COVID-19 pandemic for unemployment insurance costs.

July 8 -

More frequent and extreme rainfall can produce amounts of stormwater runoff the city’s infrastructure was never designed to capture.

July 7 -

Lawmakers approved the first $500 million for the program as a trailer bill to the fiscal 2023 budget. Bonds may be used to fill the gap.

July 7 -

The Supreme Court’s ruling stripped the EPA of its ability to regulate greenhouse gas emissions, but analysts say utilities are unlikely to feel immediate credit impacts; in some cases, it may ease credit pressures.

July 5