-

Total volume in the first half of the year was $180.882 billion in 3,853 deals, down 17.1% from the $218.230 billion in 5,444 over the same period in 2022, according to Refinitiv data.

August 21 -

New York deals dominated the top ranks of regional issuers in the first half of 2023 even as supply sank around the Northeast and around the country.

August 18 -

July's total volume was $25.939 billion in 542 issues, down from $28.258 billion in 619 issues a year earlier, the smallest percentage drop in monthly issuance year-over-year in 2023, according to Refinitiv data.

July 31 -

Total volume for the month was $34.436 billion in 744 issues, down from $37.775 billion in 984 issues a year earlier, according to Refinitiv data.

June 30 -

Market participants agree issuance will not hit the highs seen in 2020 and 2021, but they are split on whether issuance will surpass the $384.086 billion of debt issued in 2022.

June 20 -

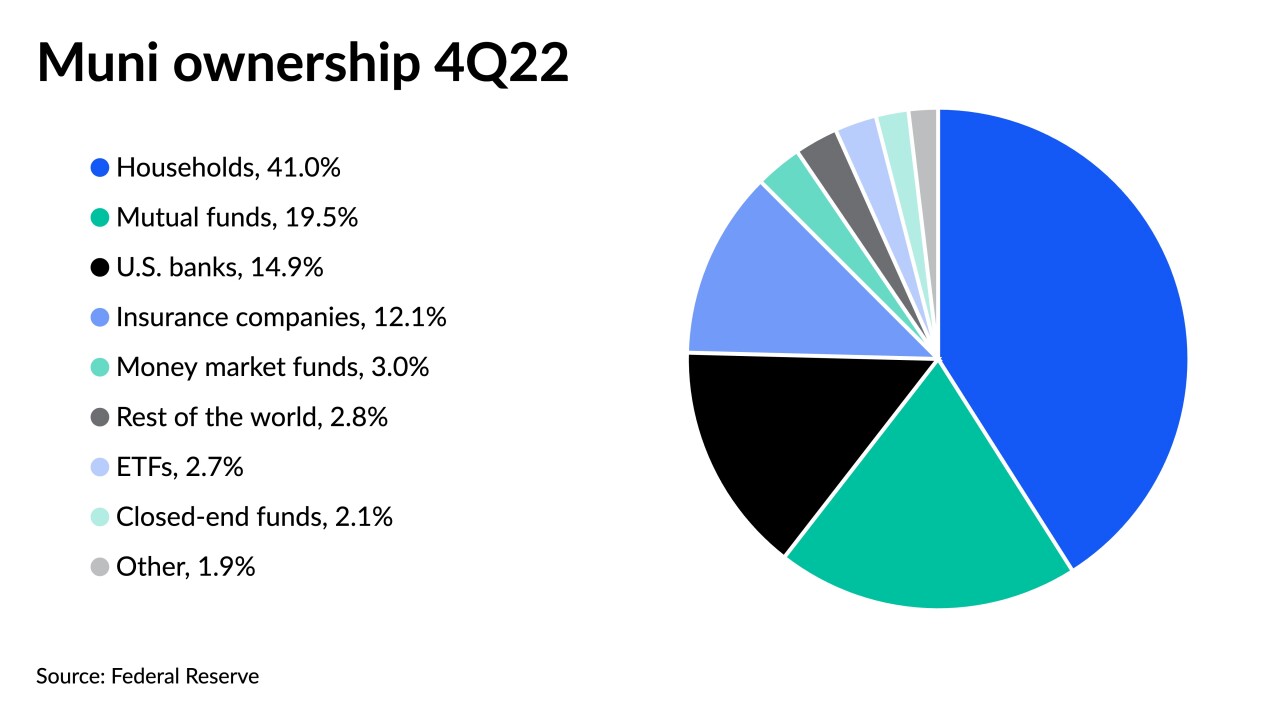

Federal Reserve data shows that retail ownership of municipals rose $58.8 billion, or 3.7% quarter-over-quarter, to $1.67 trillion. Bank ownership fell in the first quarter by $13.3 billion.

June 12 -

Total volume for the month was $26.062 billion in 677 issues, down from $36.583 billion in 928 issues a year earlier, according to Refinitiv data.

May 31 -

Total volume for the month was $30.599 billion in 577 issues, down from $40.423 billion in 900 issues a year earlier. Total issuance year-to-date is at $107.626 billion, falling 25.2% from the same period of 2022.

April 28 -

Household and U.S. bank ownership of individual bonds fell and the total face amount of munis outstanding was down 0.6% quarter-over-quarter and down 1.4% year-over-year, Fed data shows.

April 10 -

Total volume for the month was $31.795 billion in 515 issues, down from $45.555 billion in 985 issues a year earlier, according to Refinitiv data.

March 31