February municipal bond issuance dropped 42% year-over-year, led by a steep decline in taxables and refundings, as issuers dealt with continued market uncertainty, still too-high inflation and states and local governments' ability to wait due to flush coffers.

Total volume for the month was $18.303 billion in 391 issues versus $31.602 billion in 877 issues a year earlier, according to Refinitiv data.

Tax-exempt issuance was down 32.1% to $17.291 billion in 353 issues from $25.472 billion in 761 issues in 2022. Taxable issuance totaled $674.8 million in 34 issues, down 81.9% from $3.724 billion in 106 issues a year ago. Alternative-minimum tax issuance dropped to $337.2 million, down 86% from $2.407 billion.

New-money issuance fell 34.4% to $14.216 billion in 339 transactions from $21.661 billion a year prior. Refunding volume decreased 52.6% to $3.714 billion from $7.842 billion in 2022.

February 2023 issuance falls below the 10-year average of $27.821 billion. The last time issuance in February was below $20 billion was in 2018.

"Looking at February volume, we have a sense of déjà vu," said Jeff Lipton, managing director of credit research at Oppenheimer Inc. "The February volume declines year-over-year reflect an extension of the market uncertainty that was present in this month, and it was that same market uncertainty that had kept the overall volume down throughout 2022."

"We had an aggressive Fed tightening policy to combat outsized inflation and that has effectively given the issuer community pause," he said.

At the start of the month, issuance was particularly light following the January Federal Open Market Committee meeting when the Fed hiked rates 25 basis points, a move expected to be repeated at the March FOMC meeting.

While munis rallied in January, things turned "erratic" in February, Lipton said, following the outsized gains in the January jobs report and the unexpectedly high consumer price index, producer price index and retail sales figures.

Good economic news tends to be received in an unfavorable way, Lipton noted, because it gives the Fed runway to raise the funds rate higher and to keep it there longer.

"With rates backing up in February, current refunding opportunities largely dissipated," he said. In January,

Given higher interest rates, Lipton said, there's a limited compelling argument for taxable advanced refundings.

But while rising interest rates play a role in the lower supply, Eve Lando, a portfolio manager for Thornburg Investment Management, said many issuers understand these interest rates are here to stay and will keep rising.

The bigger factor, she said, is inflation, as it increases project costs, including labor and materials.

"All of the project costs are inflated," she said. "That is one of the reasons why supply has not been as robust."

"Inflation will come down at some point. Labor costs will stabilize, supply will stabilize, the cost of all those ingredients that go into large capital projects" will stabilize, she said.

Issuers "don't want to price it at the peak," Lando noted, leading her to believe that is what is holding back supply right now.

When budget officers were looking at rates during the first half of 2022, she said, there were conversations about them taking a wait-and-see approach to see if rates would stabilize or come down.

"I don't think that is the reality right now," she said. "The message is being heard that the Fed will continue raising rates in this inflationary environment."

Lando said states and local governments have the ability to wait. Flush with unspent federal aid and strong balance sheets, she said, states and municipalities can afford to sit on the sidelines.

"This is a portion of the picture of why supply is diminishing," she said. "Inflationary forces are so strong that [states and municipalities] don't want to commit the capital at the highest form."

While supply is also light this week, Barclays strategists Mikhail Foux, Clare Pickering and Mayur Patel expect to "see issuance picking up in March-April, likely coinciding with the period of seasonally weak municipal performance, and fund outflows related to tax selling (although tax selling might be more subdued this year)," the Barclays strategists said.

Lando, though, wasn't as sure.

"I can't say for sure that issuance will jump in in the next couple of months as inflation costs may be too high," she said. "There's some uncertainty about that scaling and what that would mean for some of their projects."

Additionally, states and municipalities have ample reserves, so it's hard to gauge a timeframe when issuance would pick up, she said.

"I don't think we'll have a fantastic issuance in the next couple of months," she said.

For his part, Lipton believes at some point volatility will lessen, and the muni market will return to a more normalized issuance schedule. However, he noted, "We have to get through the March FOMC meeting first."

Issuance details

Revenue bond issuance decreased 51.7% to $9.901 billion from $20.480 billion in February 2022, and general obligation bond sale totals dropped 24.5% to $8.402 billion from $11.122 billion in 2022.

Negotiated deal volume was down 33.5% to $14.539 billion from $21.869 billion a year prior. Competitive sales decreased to $3.553 billion, or 52.4%, from $7.472 billion in 2022.

Deals wrapped by bond insurance declined to $1.616 billion in 77 deals from $1.656 billion in 131 deals in 2022, a 2.4% decrease.

Bank-qualified issuance dropped 56.4%, to $386.1 million in 100 deals from $885 billion in 214 deals a year prior.

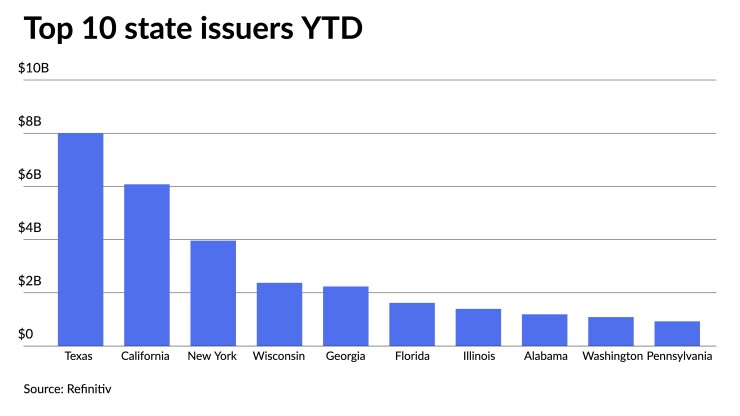

In the states, Texas claimed the top spot year-to-date.

Issuers in the Lone Star State accounted for $8.010 billion, up 5.4% year-over-year. California was second with $6.080 billion, up 15.4%. New York was third with $3.963 billion, down 6.9%, followed by Wisconsin in fourth with $2.377 billion, up 119.6%, and Georgia in fifth with $2.239 billion, a 21.1% increase from 2021.

Rounding out the top 10: Florida with $1.623 billion, down 57.8%; Illinois with $1.398 billion, down 36.2%; Alabama with $1.194 billion, down 19.8%; Washington at $1.088 billion, down 21.3%; and Pennsylvania with $929.5 million, down 55.8%.