Municipal issuers in the Southeast sold $69.5 million of bonds in 2022, a 13.1% year-over-year decline as governments across the region decreased capital spending and braced for a potential recession, according to industry experts.

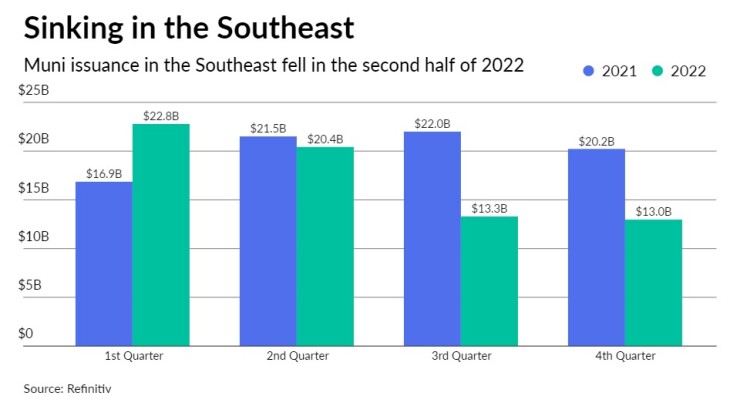

After starting 2022 with volume up 35% year-over-year in the first quarter, third and fourth quarter volume dropped substantially, according to Refinitiv data.

The number of deals also fell, to 1,252 in 2022 from 1,897 the year before.

"What we've seen is issuers were able to continue to complete refunding through the first few months of 2022 but as federal action accelerated, the uncertainty of rising rates drove issuers to the sidelines," said JoAnne Carter, president of PFM Financial Advisors.

PFM Financial was the Southeast's leading advisor, credited by Refinitiv with $13.1 billion in bonds, followed by Municipal Capital Markets Group with $4.3 billion and Public Resources Advisory Group with $3.7 billion.

Tax-exempt issuance was down 5.3% year over year, but taxable bond volume was cut in half.

"The drop in taxable bond issuance in the region parallels similar reductions across the broader municipal market as the rise and fall of issuances was inversely correlated to interest rate movements starting in 2019 through 2022," Carter said. "The sudden interest rate reversal from historic lows quickly took taxable advance refunding savings out of the money and taxable volume fell."

Refunding volume was off almost 60% in the region, to $8.3 billion, but new money volume was up 6.9% to $57.3 billion as issuers financed new projects.

The Southeast's 2022 volume decline

The volume of bonds issued for utilities, at $15.99 billion, general purposes, at $12.5 billion, and education, at $11.6 billion, were all down year-over-year, according to the Refinitiv data.

Governments didn't necessarily need to borrow to fund capital projects last year, said Eric Kim, head of the U.S. state ratings team at Fitch Ratings.

"That was largely driven by revenues coming in well ahead of budgeted forecasts, creating a lot more flexibility for state governments to do cash funding of projects rather than going out to the capital markets," he said "One thing we saw on the state side, certainly in the southeast, were significant revenue surpluses across the board."

After largely outperforming expectations in back-to-back tax seasons, Kim said governments across the country are likely to face a slowing revenue environment going forward.

"There's still a little bit of a hangover in terms of shortages around supplies and labor that may have been a factor," said Michael Rinaldi, a senior director in Fitch's public finance group. "There's still a lot of cash sitting around from federal stimulus that was deployed for one-time purposes and capital investment."

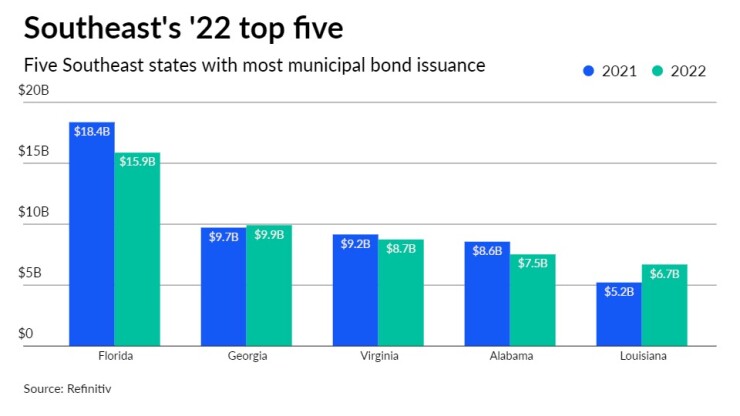

Kentucky and Louisiana were the only two states that saw significant volume increases over 2021. Issuers in Louisiana sold $6.7 billion of bonds, up 28.4%, and Kentucky volume was up 21.4% to $3.8 billion.

Florida was the region's top source of municipal bonds with $15.87 billion, a 13.6% reduction over 2021.

Rinaldi said Florida saw its bottom line buoyed by strong rebounds in the tourism industry. Municipalities that have reported high earnings recently, like Orange County where 2022's revenue total exceeded pre-pandemic earnings by 21%, may have to tailor their future tailor expectations to shifting economic headwinds.

With concerns over inflation and the potential for creeping unemployment amid reduced income growth likely to continue, states nationwide might take a more cautious approach to credit markets "until there was better visibility, both in terms of the timing and severity of the slowdown,' Rinaldi said.

The volume of bonds Refinitiv defined as for electric power was up 15.7% year over year to $3.2 billion.

"Our national electric system is very capital intensive and many projects resource renewal and replacement efforts while also ensuring continued compliance with laws such as the Clean Air Act," Carter said. "Additionally, as renewable resources are placed in more remote areas given the required space for utility-scale development, the role of and investment in transmission assets has increased."

BofA Securities was the leading underwriter in the region in 2022, credited by Refinitiv with $12.7 billion, followed by JPMorgan Securities with $8.2 billion and Morgan Stanley with $6.8 billion. Citi Bank and Wells Fargo placed fourth and fifth.

The Southeast's leading bond counsel for 2022 was Butler Snow, credited with $7.5 billion in 61 deals, followed by Greenberg Traurig at $3.8 billion, Kutak Rock, and then Burr & Forman.

The region's largest issuer was the Louisiana Local Government Environmental Facilities and Community Development Authority with $4 billion of bonds sold in 8 issuances across 2022.

That was buoyed by the region's largest deal, a $3.19 billion May sale of taxable bonds for the Louisiana Utilities Restoration Corp. project, backed by charges to Entergy Louisiana LLC retail electric customers.

The region's number-two issuer was the Black Belt Energy Gas District, which sold $3.4 billion of

The South Carolina Public Service Authority, better known as Santee Cooper, had the Southeast's second-largest deal of the year in a

Across the region, issuance defined as for environmental facilities saw the largest proportional increase, with $649 million bonds sold in 2022, a 68% increase over 2021's $387 million.

Rinaldi said the drastic increase likely has to do with several factors working in tandem, including a widening of the classification criteria for identifying such investments, the availability of federal stimulus dollars, and a growing interest in climate-proofing infrastructure.

"It's certainly taken on a more prominent position within sort of the hierarchy of capital projects at the local level over the last number of years," he said.