-

The New Terminal One project was able to flex its construction progress, which the P3 backers say may have encouraged investors in a deal upsized by $1 billion.

July 8 -

The privately owned, high-speed rail system in the U.S. recently refinanced and broke ground on a new line in the west.

July 2 -

Assured's controlling vote is "important to investors who were reassured to hear that there would be a large sophisticated party with a significant economic interest in the success of the project," the insurer said.

May 3 -

The top two municipal bond insurers wrapped $7.132 billion in the first quarter of 2024, up from the $5.735 billion of deals in the first quarter of 2023, according to LSEG data.

April 12 -

The new hire comes on the heels of the firm's growth in bond insurance in the first quarter of 2024.

April 11 -

Marc Livolsi was promoted to lead U.S. Public Finance New Issue Marketing and Business Development, and Evan Boulukos will lead Assured's Secondary Markets desk, both of whom will report to Chris Chafizadeh, senior managing director and co-head of Public Finance.

March 18 -

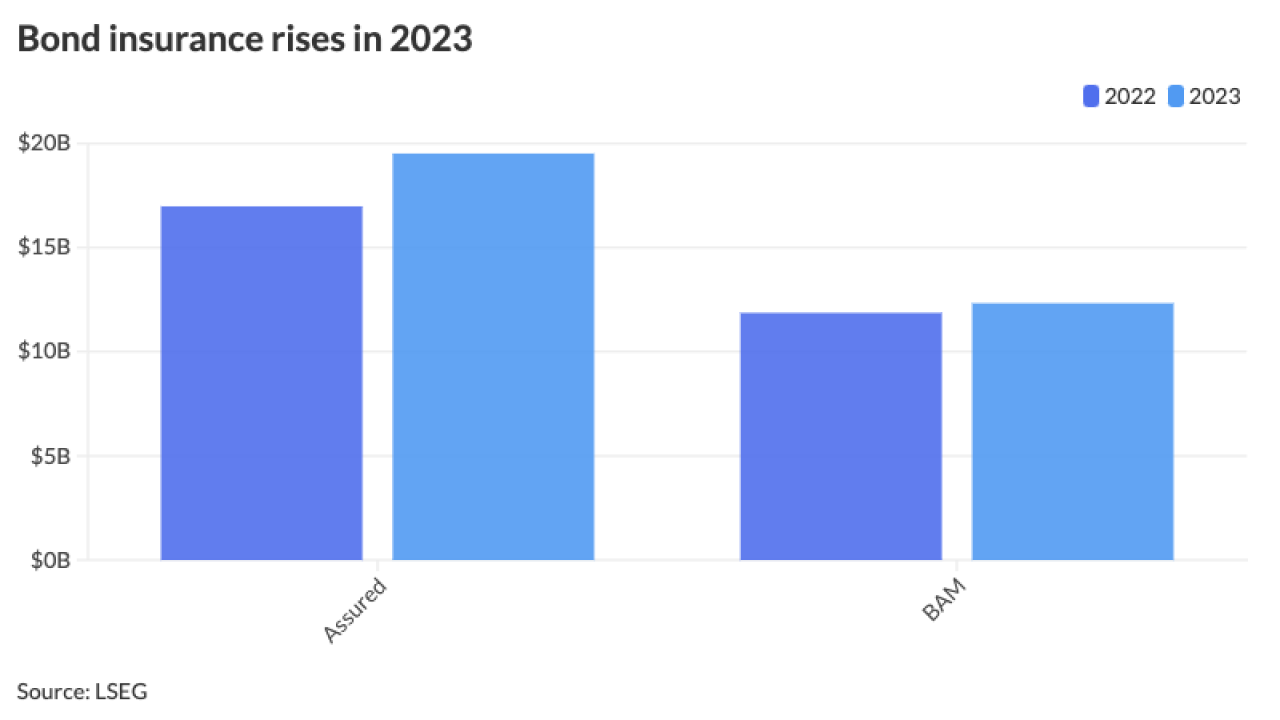

All municipal bond insurers wrapped $35.381 billion in 2023, a 5.8% increase from the $33.428 billion insured in 2022, according to LSEG data.

February 20 -

Texas bond volume climbed 22.5% to lead the nation in a year when issuance in the eight-state Southwest region increased by only 0.6%.

February 20 -

The top two municipal bond insurers wrapped $31.845 billion in 2023, up 10.4% from the $28.847 billion of deals in 2022, according to Refinitiv data.

January 12 -

"The work done by our agency often focuses on the long-term," said Connecticut State Treasurer Erick Russell.

January 5 -

The experts, hired by bond parties, say the Oversight Board's economic and expense assumptions underlying its plan of adjustment are too pessimistic.

December 15 -

The top two municipal bond insurers wrapped $22.814 billion in the first three quarters of 2023, a slight dip of 0.5% from the $22.929 billion of deals done over the same period in 2022, according to Refinitiv data.

October 17 -

The question is raised whether "invitations" to support the plan were the same as "solicitations."

October 4 -

In comparison to the $17.689 billion of transactions completed in the first half of 2022, the top two municipal bond insurers wrapped $15.571 billion in 2023.

August 21 -

The top two municipal bond insurers wrapped $15.571 billion in the first half of 2023, a 12% decrease from the $17.689 billion of deals done in the first half of 2022, according to Refinitiv data. Insurance was up in Q2.

August 15 -

Connecticut's baby bond trust received its initial funding without the need to borrow with the help of a debt reserve insurance policy.

August 11 -

The top two municipal bond insurers wrapped $5.735 billion in the first quarter of 2023.

April 20 -

The deal is expected to close in the third quarter of 2023.

April 6 -

Mark Cappell is the president of the National Federation of Municipal Analysts for 2023, its first bond insurer to take the role since 2009.

March 6 -

It says the plan of adjustment can treat bonds of National Public Finance Guarantee differently and let National vote in a different class.

February 22