While municipal bond issuance is down year-over-year in most sectors, demand for bond insurance has remained strong as issuers turn to it to maximize their market access and tap into the demand from investors, market participants say.

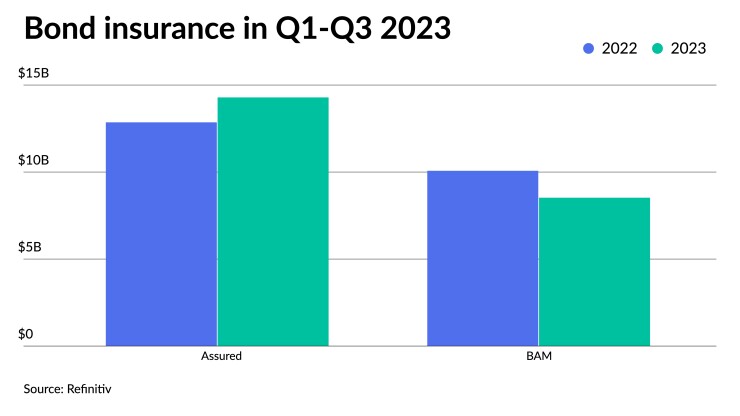

The top two municipal bond insurers wrapped $22.814 billion in the first three quarters of 2023, a slight dip of 0.5% from the $22.929 billion of deals done over the same period in 2022, according to Refinitiv data.

The industry par amount for the top two insurers was achieved in 995 deals in Q1-Q3 2023 versus 1,145 deals over the same period in 2022.

Insurance penetration for the first nine months of the year was 8.5%.

But while bond insurance during the first three quarters of 2023 is relatively flat year-over-year, the overall penetration rate rose "as issuers recognize the intrinsic value of the wrap offering enhanced liquidity and better capital market access for some, lower borrowing costs, and an offset to potential underlying credit diminution," said Jeff Lipton, managing director of credit research at Oppenheimer.

Assured Guaranty accounted for a total of $14.289 billion in 464 deals for a 62.6% market share in the first three quarters of the year, compared to $12.857 billion in 528 deals for a 56.1% market share over the same time period in 2022.

The firm saw a "strong year" and third quarter, "even in the face of constrained overall par volume," said Robert Tucker, senior managing director of investor relations and communications at Assured.

Tucker said the firm has seen the use of insurance by certain single-A-rated issuers and in the double-A rating categories. So far this year, Tucker said the firm has insured a few A-rated credits that have not used insurance in nearly a decade, including $564 million of

In the double-A category, during the first nine months of 2023, the firm "insured approximately $2.8 billion of par and issued 64 policies in this category, 55 of which were for primary market deals with double-A underlying ratings," Tucker said.

During the first nine months of 2023, the firm "guaranteed 27 large transactions that each utilized over $100 million of Assured Guaranty insurance for a total of $7.3 billion," Tucker said.

Build America Mutual insured $8.525 billion, or a 37.4% market share, in 531 deals during 2023, compared to $10.072 billion, or a 43.9% market share, in 617 deals in 2022.

"Increased volatility and the general move toward higher interest rates during the third quarter have made insurance more attractive to both retail and institutional investors, and the demand runs across sectors and in both the primary and secondary markets," said Mike Stanton, head of strategy and communications at BAM.

Revenue bond sectors, like airports and public higher education, are strong users of insurance, but there is also some activity from school districts and water and wastewater utilities, Stanton said.

BAM's large transactions in Q3 showed that, including "Chicago O'Hare Airport's sale of $171 million of customer facility charge revenue bonds, an $86 million sale for the Coatesville Area School District in Pennsylvania, and $81 million for Texas Southern University," Stanton said.

Additionally, the firm saw transactions like "the $381 million debt service reserve fund insurance policy that BAM executed for Connecticut, which will provide the initial financing for the state's innovative

Lipton noted that not only has the primary market been active, but secondary insurance coverage has also been accelerating "as institutional investors desire to better insulate their portfolios from possible credit erosion, which at the very least could mitigate downgrade risk."

Stanton echoed this, noting BAM has seen continued to see strong demand from institutions, "just like we've seen since COVID."

That is "broad demand" where institutions are looking for tools to help with their portfolio management strategies and bought insurance as part of that, he noted.

And as rates increase, there is also a resurgence of interest from more traditional retail investors who have historically preferred bond insurance, according to Stanton.

"As more investors get experience with holding insured bonds and seeing how they perform in the marketplace, they're more likely to buy more," he said.

Additionally, issuers recognize insurance as a tool they can use "to help optimize demand for their transactions," Stanton noted.

The main benefit of bond insurance is that "issuers are locking in a lower interest rate for the life of the issue, and when credit spreads become wider in a higher interest rate environment the cost savings can be even greater," Tucker said.

"There are more opportunities for us to add value in a higher interest rate environment where credit spreads tend to be wider, which can lower financing costs for issuers, while providing yield and safety to investors," he said.

But while "bond insurance makes for a valuable enhancement," Lipton noted it should not be "viewed as credit substitution and the existence of the insurance policy should not give rise to relaxed credit criteria and standards on underlying obligors."

Prior to the COVID-19-induced economic challenges, he noted "municipal credit was being elevated by record economic recovery and was generally secure with upgrades outpacing downgrades, state reserve accounts were funded at cyclical highs, defaults and bankruptcy filings were well-contained, and bond insurance penetration stood at about 6%-8%."

The unexpected recession "with all of the tax and revenue displacement brought on by the national economic suspension made bond insurance that much more relevant," Lipton said.

The insurers argue this is key to their offerings.

"Our product is designed to provide value no matter the market environment, including when credit or market conditions are particularly uncertain," Tucker said. "Market disruptions, including during the COVID-19 pandemic and more recently in 2023, resulted in broader recognition of the protection and value our guaranty provides against unforeseen circumstances, and greater appreciation for the capital and liquidity supporting Assured Guaranty's insurance policies."

Market concerns can be "a positive for bond insurance, as bond insurance can support price stability and provide greater certainty of execution in volatile pricing environments," he noted.

Lipton believes that "current bond insurance trends are likely to continue through the balance of 2023 and into next year as state and local budgets and revenue enterprises may find it challenging to preserve currently strong credit conditions."

The availability of fiscal stimulus has "tapered off and slowing growth will be an issue for certain credits over others," he said.