-

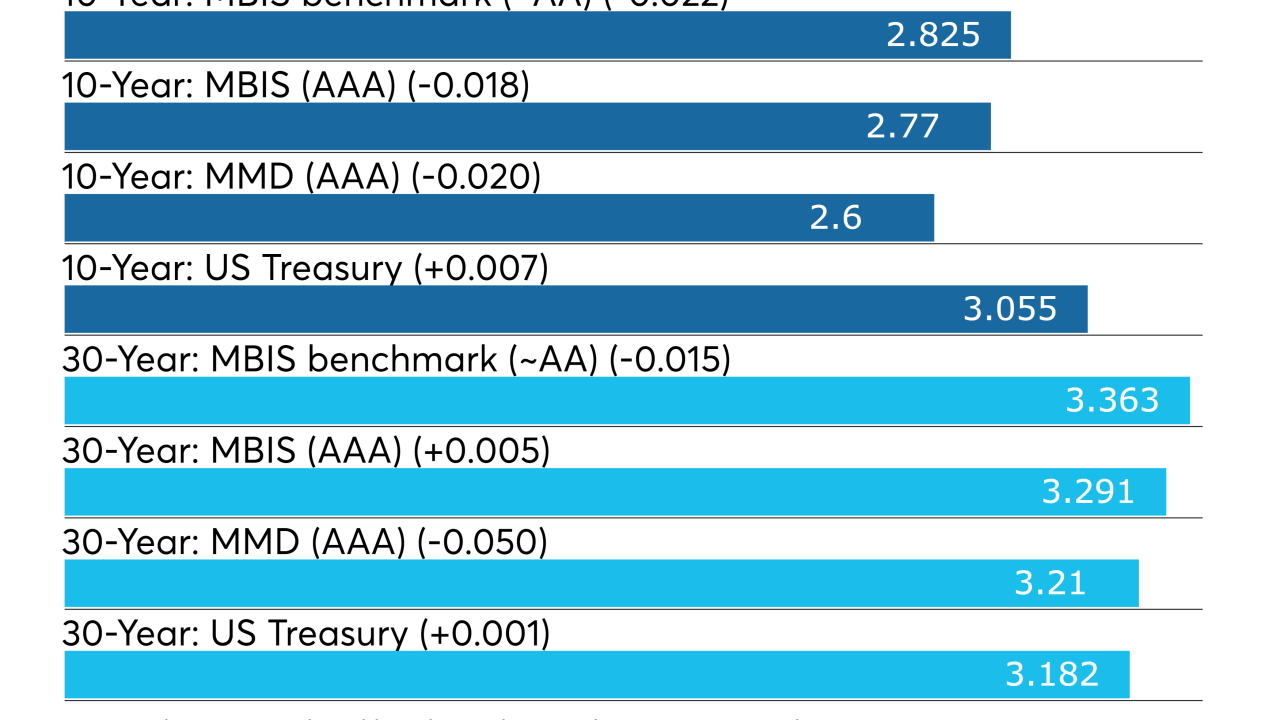

Rising interest rates have created a lot of early October red ink in the bond markets, says J.R. Rieger.

October 9 -

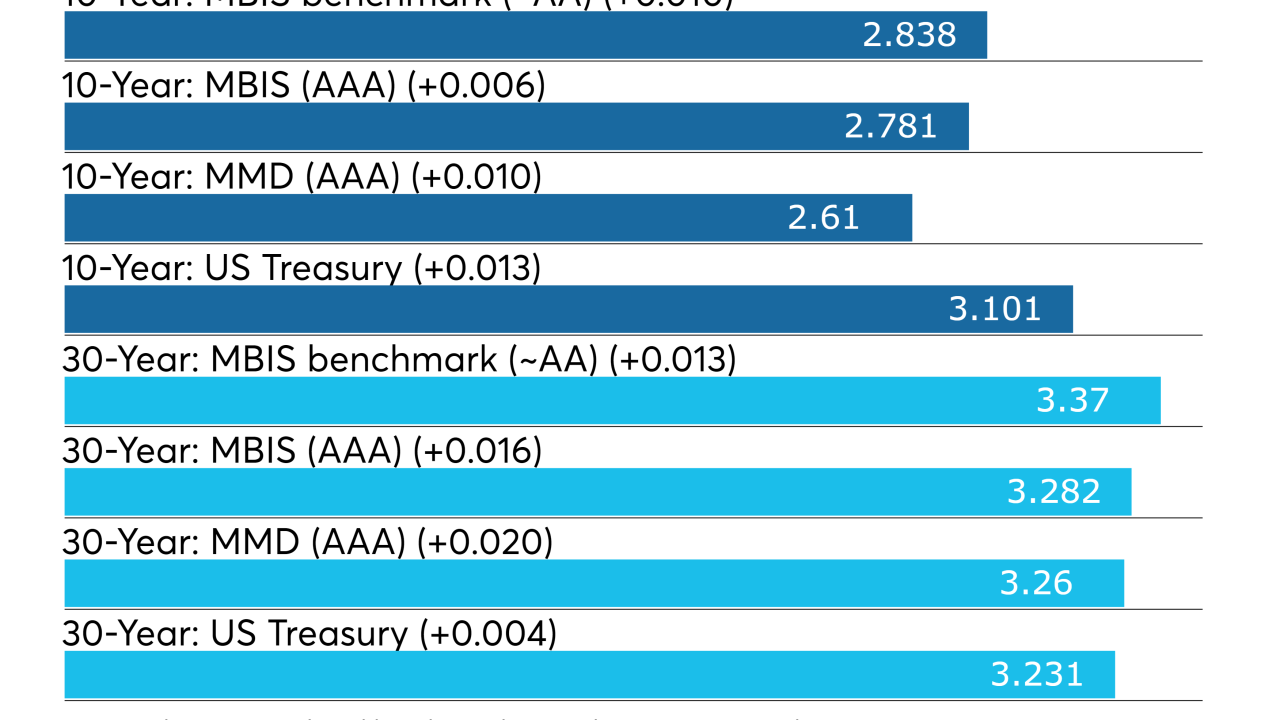

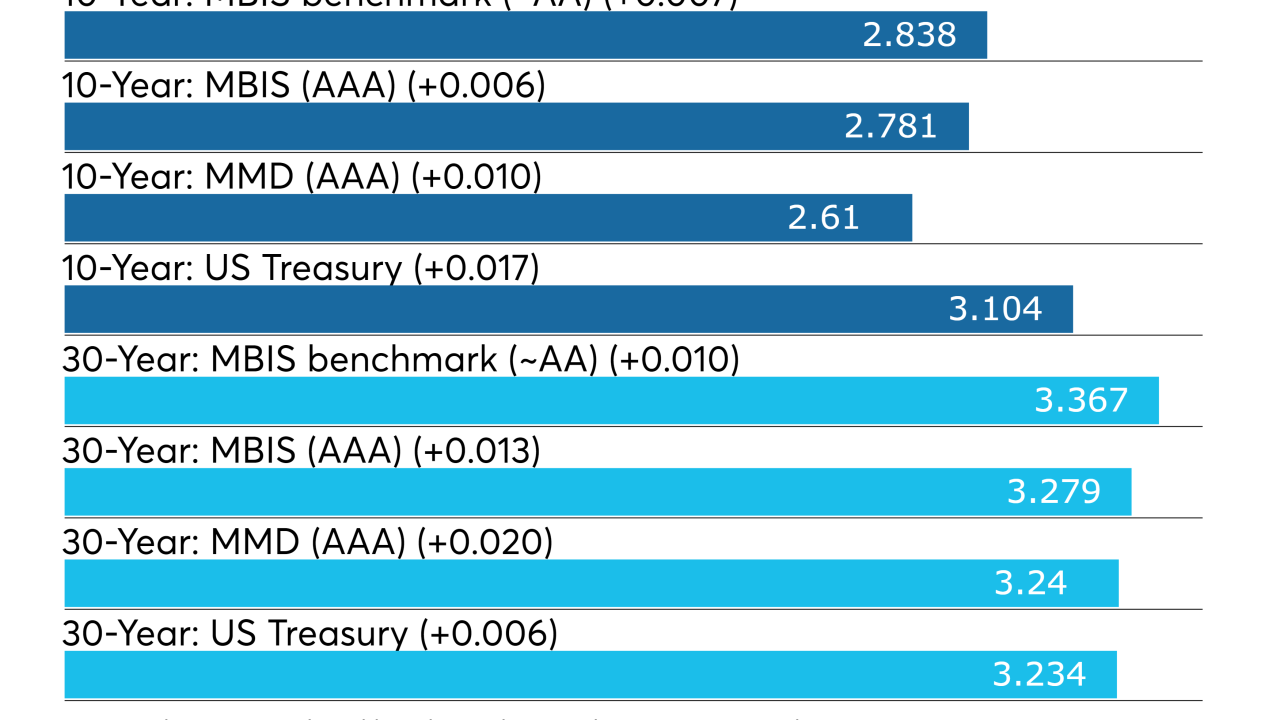

The municipal bond market returned from a three-day holiday weekend only to see action pick up where it left off last week — with yields heading higher.

October 9 -

Municipal bond supply drops off sharply next week with $4.4 billion of volume estimated to hit the screens.

October 5 -

Issuance was light as the municipal bond market got hammered by jumping Treasury yields.

October 4 -

Munis weakened significantly for the second day in a row after the 10-year Treasury hit 3.1268% Wednesday, its highest point since 2011.

October 4 -

Municipal bond prices weakened as supply flooded into the primary sector.

October 3 -

Municipal bond buyers saw more volume hit the screens on Wednesday as the big New Jersey deal came to market.

October 3 -

A wave of municipal bond supply swept into the market, led by New York and California issuers.

October 2 -

Municipal investors saw a wave of supply come to market on Tuesday as New York and California issuers sold debt in the competitive arena.

October 2 -

This week's deals from Dasny and N.J. Transportation may benefit from pent-up demand.

October 1 -

The third quarter ended with a whimper, leaving year-to-date issuance 15% behind last year's pace.

September 28 -

Municipal bond supply jumps next week as the last quarter of the year begins.

September 28 -

Municipal yields strengthened for maturities beyond three years, even though President Trump expressed concern.

September 27 -

The municipal bond market remained in quiet mode a day after the Federal Open Market Committee raised interest rates.

September 27 -

With the Federal Open Market Committee meeting, activity was at a minimum in the municipal bond market on Wednesday.

September 26 -

Wisconsin sold the biggest deal of the week as investors remained wary ahead of the FOMC meeting.

September 25 -

The biggest deal of the week came to market on Tuesday as Wiscon sold general obligation bonds.

September 25 -

The intermediate and long end has moved cheaper, creating an opportunity to add some yield to muni portfolios, says Triangle Park's J.R. Rieger.

September 24 -

Ahead of the FOMC monetary policy meeting and quarter end wrapup, a slim supply slate awaits muni buyers.

September 24 -

Worries about the Fed's monetary policy meeting combined with the looming end of the quarter to keep muni issuance low.

September 21