Municipal bonds showed off their strength Thursday a day after the Federal Open Market Committee raised its target on the fed funds rate by 0.25% to a range of 2% to 2.25%.

It was the Fed’s third interest rate hike this year and the eighth since it started raising rates in 2015. Municipal yields strengthened for maturities beyond three years, even though President Donald Trump expressed concern about the Fed move at a news conference in Manhattan late Wednesday.

“I’m not happy about that,” he said. “I’d rather pay down debt or do other things…create more jobs. So I’m worried about the fact that they seem to like to raise interest rates – we could do other things with the money. But they raised them. And they’re raising them because we are doing so well, much better than I had projected in terms of when I was campaigning.”

Also of note, the Fed in its post-meeting statement removed the word “accommodative.”

“In the press conference, Chairman Powell was effusive in his praise of the U.S. economy (as effusive as a Fed Chairman can be), using the term ‘strong’ several times and stating that ‘it’s a particularly bright moment’ for the U.S. economy,” ICE Data Services said in a Thursday market comment. “The post-meeting did remove the term ‘accommodative’ when referring to monetary policy, which in Fedspeak is being interpreted as a close to neutral policy stance, changing that language for the first time in years.”

The dropping of accommodative from the policy statement ensures the Fed remains on course for further hikes as unemployment heads towards multi decade lows, Fitch Ratings Director Robert Sierra said on Wednesday.

“The Fed continues to be very much focused on strong domestic conditions and neither trade concerns nor recent emerging market turbulence affected today’s decision,” he said. "There does not seem to be consensus of where terminal rates end up among members. The prospect of rates reaching neutral levels has opened up a debate over the extent to which officials want to clamp down on the economy by increasing them further.”

The Summary of Economic Projections, or dot plot, signals another 25 basis point increase by yearend, most likely at the December meeting.

Primary market

In the competitive arena, the Tulsa Public Facilities Authority sold $118.1 million of Series 2018 capital improvements revenue bonds on Thursday.

Morgan Stanley won the bonds with a true interest cost of 2.9859%.

The deal is rated AA-minus by S&P Global Ratings. Proceeds of the sale will provide funds for economic development projects in the city of Tulsa, including Arkansas River development.

Municipal officials are acting as the financial advisors and Hilborne & Weidman along with the state attorney general are acting as bond counsel.

Prior to Thursday’s sale, the authority last sold comparable bonds in a competitive offering on May 17, 2017, when Mesirow Financial won $115.3 million of Series 2017 capital improvements revenue bonds with a true interest cost of 2.6407%.

It was a quiet Thursday, according to a New York trader, who noted that the $6 billion of new issuance on the calendar next week seems very manageable.

The New York State Dormitory Authority announced six competitive deals totaling $1.7 billion next week, which caught the market by surprise, but should get solid demand, he added.

Thursday’s bond sale

Oklahoma

Bond Buyer 30-day visible supply at $4.41B

The Bond Buyer's 30-day visible supply calendar increased $119.9 million to $4.41 billion for Thursday. The total is comprised of $1.66 billion of competitive sales and $2.76 billion of negotiated deals.

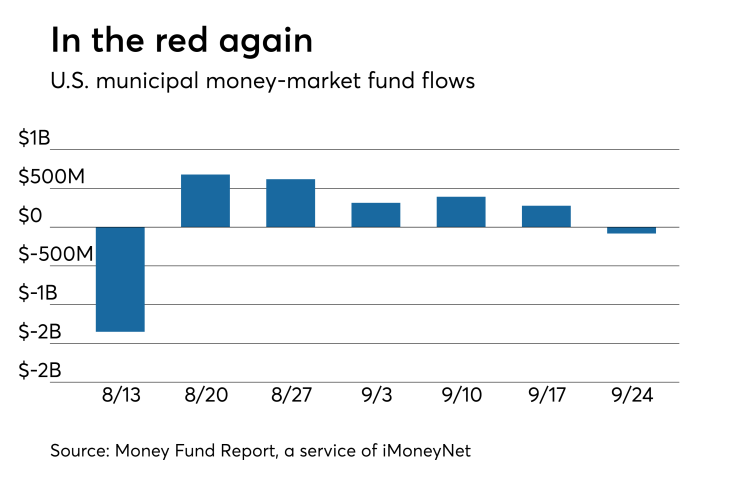

Muni Money Market funds report outflow

Tax-free municipal money market fund assets fell $82.1 million, lowering their total net assets to $131.02 billion in the week ended Sept. 24, according to the Money Fund Report, a service of iMoneyNet.com.

The modest outflow is the first in six weeks and comes after an inflow of $271.6 million in the previous week. The average, seven-day simple yield for the 199 tax-free reporting funds was unchanged at 1.03%.

Taxable money-fund assets increased by $18.27 billion in the week ended Sept. 25, raising total net assets to $2.718 trillion. The average, seven-day simple yield for the 830 taxable reporting funds crawled up to 1.63% from 1.62% last week.

Overall, the combined total net assets of the 1,029 reporting money funds increased by $18.19 billion to $2.849 trillion in the week ended Sept.25.

Secondary market

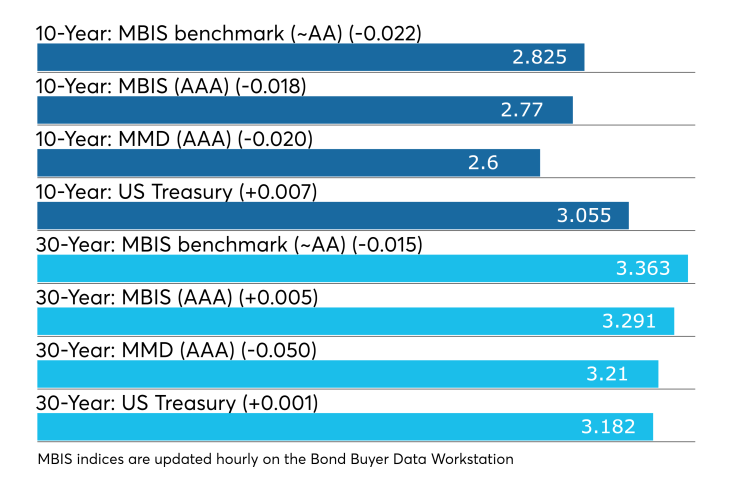

Municipal bonds were stronger on Thursday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell as much as two basis points in the three- to 30-year maturities and rose less than a basis point in the one- and two-year maturities.

High-grade munis were mostly stronger, with yields calculated on MBIS' AAA scale falling as much as two basis points in the one- to 28-year maturities and rising less than a basis point in the 29- and 30-year maturities.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation declining two basis points while the yield on 30-year muni maturity dropped five basis points.

Treasury bonds were stronger as stock prices traded higher.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 85.2% while the 30-year muni-to-Treasury ratio stood at 100.9%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 44,429 trades on Wednesday on volume of $14.24 billion.

California, New York and Texas were the municipalities with the most trades, with Golden State taking 15.607% of the market, the Empire State taking 13.034% and the Lone Star State taking 11.474%.

ICI: Long-term muni funds saw $116M inflow

Long-term tax-exempt municipal bond funds saw an inflow of $116 million in the week ended Sept. 19, the Investment Company Institute reported.

This followed an inflow of $30 million into the tax-exempt mutual funds in the week ended Sept. 12 and inflows of $4 million, $273 million, $531 million, $662 million, $723 million, $163 million, $600 million, $1.765 billion and $1.028 billion in the nine prior weeks.

Taxable bond funds saw an estimated inflow of $4.223 billion in the latest reporting week, after seeing an inflow of $7.177 billion in the previous week.

ICI said the total estimated inflows to long-term mutual funds and exchange-traded funds were $13.335 billion for the week ended Sept. 19, after inflows of $2.088 billion in the prior week.

Treasury auctions 7-year notes

The Treasury Department Wednesday auctioned $31 billion of seven-year notes, with a 3% coupon and a 3.034% high yield, a price of 99.786973. The bid-to-cover ratio was 2.45.

Tenders at the high yield were allotted 15.76%. All competitive tenders at lower yields were accepted in full. The median yield was 2.985%. The low yield was 2.588%.

Treasury to sell bills next week

The Treasury Department said Thursday it will auction $48 billion 91-day bills and $42 billion 182-day discount bills Monday.

The 91s settle Oct. 4, and are due Jan. 2, 2019, and the 181s settle Oct. 4, and are due April 4, 2019.

Currently, there are $61.979 billion 91-days outstanding and no 182s.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.