Rising interest rates have created a lot of early October red ink in the bond markets, according to J.R. Rieger, product manager at Triangle Park Capital Markets Data.

“With exception of investors in the higher tax brackets, the municipal bond short end is still rich (zero to three-year range) relative to other options available such as S&P 500 dividend yield (1.9%), UST bond and corporate bond yields,” he wrote in The Rieger Report, released Tuesday.

The intermediate and long end of the muni curve has shifted, becoming cheaper, and creating an opportunity to bring on bonds with some relative yield, he wrote.

“In comparing high-quality muni vs. corporate bonds: excluding the short end of the curve, yields of AA and higher munis are still attractive for higher tax bracket market participants,” he said.

He cited yield curve shifts in October so far:

- 10-year AAA municipal bonds +06 basis points;

- 10-year Treasury bonds +17 basis points; and

- 10-year Apple Inc. bonds +13 basis points.

Back to work

Municipal bond traders returned to work on Tuesday after a three-day holiday weekend only to see action pick up where it left off last week — with yields heading higher.

The continued weakness in the municipal market has spooked retail investors and provoked institutional investors to sell as Tuesday’s trading activity centered on a slew of bid-wanted lists, according to a New York trader.

“It seems like its getting weaker and weaker,” he said, noting that the 10-year Treasury was at 3.25% Tuesday. “It seems like not too long ago that was a 2.25%.”

“Retail has definitely shut down for a little bit and institutions are definitely selling, especially the front end of the curve,” he continued.

The trader said retail investors are squeamish about the Treasury weakness spilling into the municipal market — and nervous about stock market volatility.

“Retail looks at the equity market bouncing all over the place and that has put the fear of God in them,” he said.

He expects the retail market to remain quiet until retail investors get used to the new levels.

Meanwhile, he predicted institutions are trying to acquire some cash on hand as yields rise ahead of the expected swell in volume next week. “There are a lot of bonds out for the bid to raise some cash and maybe take some tax loss swaps — or replace bonds with new issues,” he said.

“It’s painful for what you own, but at least it’s changing the dynamics of the market and people are willing to sell some of their items at adjusted prices,” the trader said.

Primary market

This week’s supply is estimated at $4.4 billion, consisting of $3.6 billion of negotiated deals and $815.3 million of competitive sales.

In the short-term competitive sector, the Louisville and Jefferson County Metropolitan Sewer District, Ky., sold $226.34 million of Series 2018 sewer and drainage system subordinated bond anticipation notes on Tuesday.

JPMorgan Securities won the BANs with a true interest cost of 2.0818%. The financial advisor was J.J.B. Hilliard, W.L. Lyons; bond counsel was Wyatt Tarrant.

Suffolk County sold $100 million of Series 2018I tax anticipation notes.

The TANs were won by JPMorgan and Bank of America Merrill Lynch. The financial advisor was Capital Markets Advisors; the bond counsel was Harris Beach.

In the competitive arena on Wednesday, the Fremont Unified School District, Calif., is selling $127 million of Series C Election of 2014 GOs.

Proceeds are being issued to acquire, repair and build equipment, sites and facilities. The financial advisor is Keygent; bond counsel is Stradling Yocca.

Topping the week’s negotiated sector, JPMorgan Securities is set to price the Maricopa County Special Health Care District, Ariz.’s $400 million of Series 2018C general obligation bonds on Thursday.

Proceeds of the sale will be used for capital improvements or renovations to the district’s hospitals and ambulatory and outpatient facilities. Stifel is the financial advisor while Ballard Spahr is the bond counsel.

Siebert Cisneros Shank & Co. is expected to price the North Texas Tollway Authority’s $347 million of Series 2018 second tier revenue refunding bonds on Thursday.

Co-managers are Citigroup, FTN Financial Capital Markets, Jefferies and JPMorgan. The financial advisors are Hilltop Securities, Estrada Hinojosa and the RSI Group. Bond counsel are McCall Parkhurst & Horton and Mahomes Bolden.

Prior week's top underwriters

The top municipal bond underwriters of last week included Citigroup, Bank of America Merrill Lynch, JPMorgan Securities, Morgan Stanley and Raymond James & Associates, according to Thomson Reuters data.

In the week of Sept. 30 to Oct. 6, Citi underwrote $2.47 billion, BAML $1.56 billion, JPMorgan $1.39 billion, Morgan Stanley $914.5 million and Raymond James $545.4 million.

Bond Buyer 30-day visible supply at $9.32B

The Bond Buyer's 30-day visible supply calendar increased $1.68 billion to $9.32 billion for Tuesday. The total is comprised of $3.78 billion of competitive sales and $5.54 billion of negotiated deals.

Secondary market

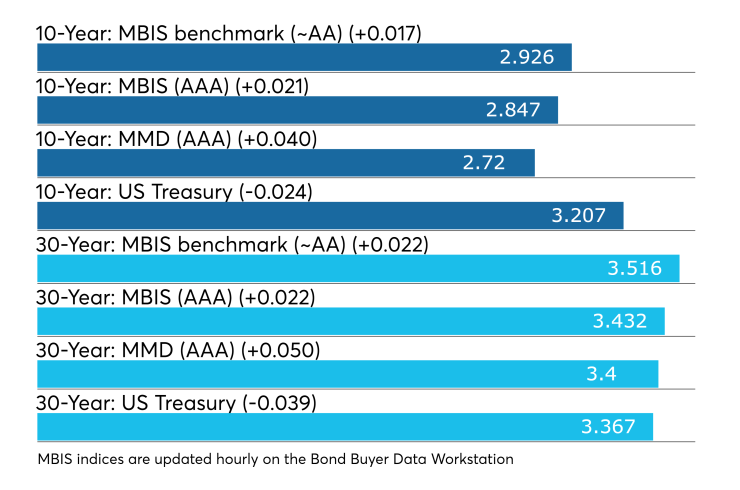

Municipal bonds were weaker on Tuesday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields rose as much as one basis point in the one- to 30-year maturities.

High-grade munis were also weaker, with yields calculated on MBIS' AAA scale rising as much as one basis point all across the curve.

Municipals were weaker on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation rising four basis points while the yield on 30-year muni maturity gained five basis points.

Treasury bonds were a little stronger stock prices traded a little higher.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 84.8% while the 30-year muni-to-Treasury ratio stood at 100.9%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Prior week's actively traded issues

Revenue bonds comprised 57.13% of total new issuance in the week ended Oct. 5, up from 56.66% in the prior week, according to

Some of the most actively traded munis by type in the week were from New York, New Jersey and Puerto Rico issuers.

In the GO bond sector, the New York City zeros of 2038 traded 31 times. In the revenue bond sector, the New Jersey Transportation Trust Fund Authority 4s of 2037 traded 128 times. And in the taxable bond sector, the Puerto Rico Government Development Bank 5.5s of 2020 traded 15 times.

Previous session's activity

The Municipal Securities Rulemaking Board reported 34,573 trades on Friday on volume of $9.97 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 15.369% of the market, the Empire State taking 11.717%, and the Lone Star State taking 10.06%.

Week's actively quoted issues

Puerto Rico, Virginia and California names were among the most actively quoted bonds in the week ended Oct. 5, according to Markit.

On the bid side, the Puerto Rico Public Buildings Authority revenue 5.25s of 2042 were quoted by 42 unique dealers. On the ask side, the Front Royal and Warren County Industrial Development Authority, Va., revenue 4s of 2050 were quoted by 175 dealers. And among two-sided quotes, the California taxable 7.3s of 2039 were quoted by 17 dealers.

Prior week's top FAs

The top municipal financial advisors of last week included Public Resources Advisory Group, Backstrom McCarley Berry, PFM Financial Advisors, Kaufman Hall & Associates and Ponder & Co., according to Thomson Reuters data.

In the week of Sept. 30 to Oct. 6, PRAG advised on $1.4 billion, Backstrom $1.3 billion, PFM $891.8 million, Kaufman $424.6 million, and Ponder $250.8 million.

Treasury auctions discount rate bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were higher, as the $48 billion of three-months incurred a 2.220% high rate, up from 2.175% the prior week, and the $42 billion of six-months incurred a 2.380% high rate, up from 2.335% the week before.

Coupon equivalents were 2.264% and 2.442%, respectively. The price for the 91s was 99.438833 and that for the 182s was 98.796778.

The median bid on the 91s was 2.190%. The low bid was 2.130%. Tenders at the high rate were allotted 57.07%. The bid-to-cover ratio was 2.72.

The median bid for the 182s was 2.350%. The low bid was 2.320%. Tenders at the high rate were allotted 50.26%. The bid-to-cover ratio was 2.79.

Treasury also auctioned $26 billion of 364-day bills at a 2.580% high yield, a price of 97.391333. The coupon equivalent was 2.668%. The bid-to-cover ratio was 3.48.

Tenders at the high rate were allotted 4.59%. The median yield was 2.560%. The low yield was 2.530%.

Additionally, Treasury auctioned $40 billion of four-week bills at a 2.135% high yield, a price of 99.833944. The coupon equivalent was 2.168%. The bid-to-cover ratio was 3.17.

Tenders at the high rate were allotted 70.69%. The median rate was 2.110%. The low rate was 2.085%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.