Municipal bond supply jumps next week as the last quarter of the year opens with a market that has seen a drop in issuance of about $45 billion from the same three quarter period in 2017.

Ipreo forecasts weekly bond volume will increase to $7.5 billion from a revised total of $3.3 billion in the prior week, according to updated data from Thomson Reuters. The calendar is composed of $5.0 billion of negotiated deals and $2.5 billion of competitive sales.

Primary market

Topping the negotiated slate is a $1.56 billion deal from the New Jersey Transportation Trust Fund Authority.

Citigroup is slated to price the Series 2018A transportation system bonds on Wednesday. Proceeds of the sale will refund outstanding bonds.

The deal is rated Baa1 by Moody’s Investors Service, BBB-plus by S&P Global Ratings and A-minus by Fitch Ratings.

In the competitive arena, the Dormitory Authority of the State of New York is selling over $1.7 billion of tax-exempts and taxables in six separate offerings. Proceeds will be used for various state programs.

Public Resources Advisory Group and Backstrom McCarley Berry are the financial advisors; Hawkins Delafield and Golden Holley James are the bond counsel.

The bonds will be going up for grabs on Tuesday.

In the short-term competitive sector, the N.Y. Metropolitan Transportation Authority is coming to market with two competitive note sales totaling $900 million on Wednesday.

Public Resources Advisory Group and Backstrom McCarley Berry are the financial advisors; Nixon Peabody and D. Seaton and Associates, P.A,, are the bound counsel.

Bond Buyer 30-day visible supply at $9.78B

The Bond Buyer's 30-day visible supply calendar increased $5.36 billion to $9.78 billion for Friday. The total is comprised of $3.29 billion of competitive sales and $6.49 billion of negotiated deals.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended Sept. 28 were from Puerto Rico, Minnesota and Pennsylvania issuers, according to

In the GO bond sector, the Puerto Rico Commonwealth 8s of 2053 traded 23 times. In the revenue bond sector, the Minneapolis Health Care System 4s of 2048 traded 59 times. And in the taxable bond sector, the Pocono Mountains Industrial Park Authority, Pa., 5.05s of 2049 traded 24 times.

Secondary market

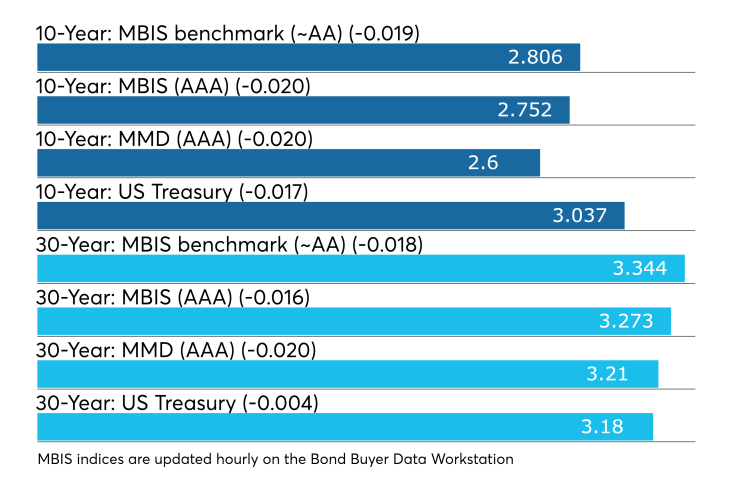

Municipal bonds were stronger on Friday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell as much as two basis points in the one- to 30-year maturities.

High-grade munis were also stronger, with yields calculated on MBIS' AAA scale falling as much as two basis points all across the curve.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation declining two basis points while the yield on 30-year muni maturity also dropped two basis points.

Treasury bonds were stronger as stock prices traded higher.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 85.2% while the 30-year muni-to-Treasury ratio stood at 100.9%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 39,299 trades on Thursday on volume of $13.85 billion.

New York, California and Texas were the municipalities with the most trades, with the Empire State taking 14.926% of the market, the Golden State taking 13.72% and the Lone Star State taking 9.59%.

Week's actively quoted issues

Puerto Rico, New York and Illinois names were among the most actively quoted bonds in the week ended Sept. 28, according to Markit.

On the bid side, the Puerto Rico GO 5s of 2035 were quoted by 30 unique dealers. On the ask side, the New York Sales Tax Receivable Corp. revenue 5s of 2031 were quoted by 191 dealers. And among two-sided quotes, the Illinois taxable 5.1s of 2033 were quoted by 20 dealers.

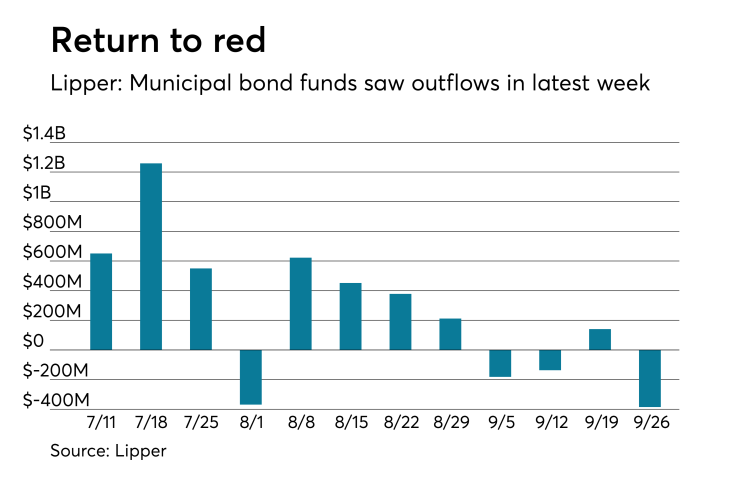

Lipper: Muni bond funds saw outflows

Investors in municipal bond funds again reversed course and pulled cash out of the funds during the latest reporting week, according to Lipper data released on Thursday.

The weekly reporters saw $384.796 million of outflows in the week ended Sept. 26 after inflows of $140.850 million in the previous week.

Exchange traded funds reported outflows of $152.012 million, after inflows of $35.766 million in the previous week. Ex-ETFs, muni funds saw $232.784 million of outflows, after inflows of $105.085 million in the previous week.

The four-week moving average turned negative at -$140.470 million, after being in the green at $8.742 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had outflows of $371.535 million in the latest week after inflows of $134.403 million in the previous week. Intermediate-term funds had inflows of $131.732 million after outflows of $80.745 million in the prior week.

National funds had outflows of $346.384 million after inflows of $158.227 million in the previous week. High-yield muni funds reported outflows of $129.551 million in the latest week, after inflows of $156.236 million the previous week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.