Municipal investors saw a wave of supply come to market on Tuesday as New York and California issuers sold debt in the competitive arena.

Primary market

In the competitive arena on Tuesday, the Dormitory Authority of the State of New York sold over $1.7 billion of tax-exempt and taxable state sales tax revenue bonds in six separate offerings. Proceeds will be used for various state programs.

Citigroup won the $443.115 million of Series 2018E tax-exempt Bidding Group 2 bonds with a true interest cost of 3.5228%.

JPMorgan Securities won the $396.96 million of Series 2018E tax-exempt Bidding Group 1 bonds with a TIC of 2.4456%.

Bank of America Merrill Lynch won the $390.205 million of Series 2018E tax-exempt Bidding Group 3 bonds with a TIC of 4.0608%.

The bonds are rated Aa1 by Moody’s Investors Service and AAA by S&P Global Ratings.

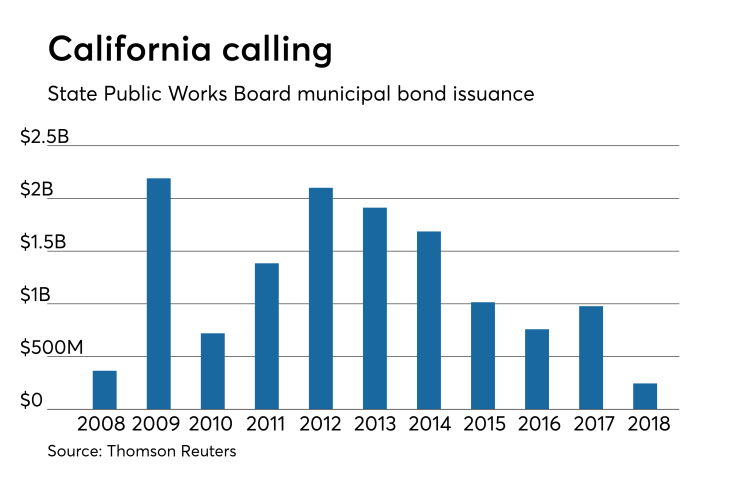

Additionally, the California Public Works Board competitively sold $104.235 million of Series 2018C lease revenue bonds on Tuesday. Proceeds will be used to finance and refinance a portion of the costs of the design and construction associated with various correctional facilities projects. Wells Fargo Securities won the bonds.

The deal is rated A1 by Moody’s and A-plus by S&P and Fitch Ratings.

Since 2008, the board has sold about $13.5 billion of debt with the most issuance occurring in 2009 when it offered $2.2 billion. It sold the last amount of bonds in 2008 when it issued $365.5 million.

In the negotiated sector, Raymond James & Associates priced the Texas Public Finance Authority’s $164.915 million of general obligation refunding bonds.

JPMorgan Securities is expected to price on Tuesday the Indiana Finance Authority’s $162.075 million of hospital revenue bonds for Parkview Health consisting of Series 2018A and Series 2018C tax-exempts, Series 2018B taxables and Series 2019A forward delivery bonds.

Bank of America Merrill Lynch is set to price the Maine Municipal Bond Bank’s $129 million of Series 2018B bonds on Tuesday. BAML is also expected to price the Kentucky Bond Development Corp.’s $101 million of convention facilities revenue bonds for the Lexington Center Corp.

On Wednesday, Citigroup is slated to price the New Jersey. Transportation Trust Fund Authority’s $1.56 billion of Series 2018A transportation system bonds on Wednesday. Proceeds will refund outstanding bonds.

Tuesday’s bond sales

Texas

Bond Buyer 30-day visible supply at $11.53B

The Bond Buyer's 30-day visible supply calendar decreased $50.5 million to $11.53 billion for Tuesday. The total is comprised of $4.61 billion of competitive sales and $6.92 billion of negotiated deals.

Secondary market

Municipal bonds were mixed on Tuesday, according to a midday read of the MBIS benchmark scale. High-grade munis were also mixed, according to yields calculated on MBIS' AAA scale.

Municipals were steady on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the yield on 30-year muni maturity remaining unchanged.

Treasury bonds were stronger as stock prices traded higher.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 83.7% while the 30-year muni-to-Treasury ratio stood at 99.3%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 39,620 trades on Monday on volume of $12.22 billion.

California, New York and Texas were the municipalities with the most trades, with the he Golden State taking 17.381% of the market, the Empire State taking 11.245%, and the Lone Star State taking 9.438%.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.