-

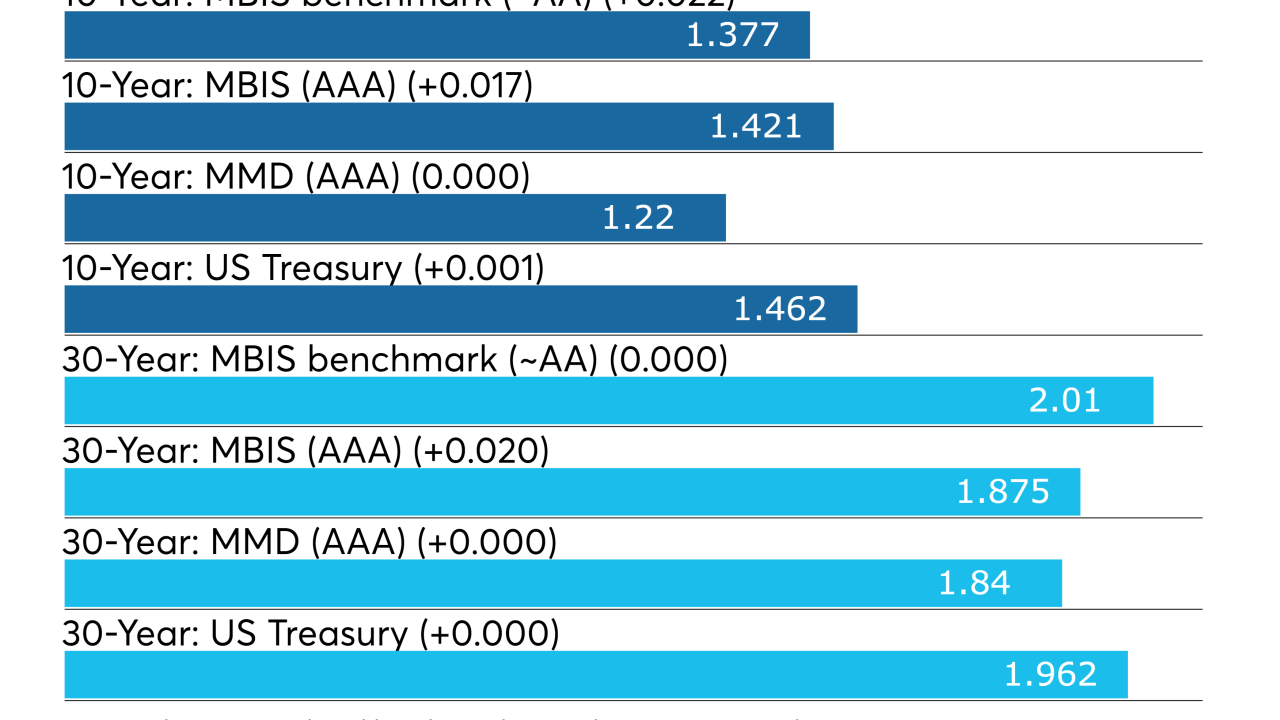

Municipal yields and issuance plans both rose, showing market participants aren't uncertain about the meeting, with a quarter point cut in interest rates baked in.

September 13 -

Lawmakers sent Gov. Gavin Newsom a bill that would set up a commission to study if the state should require the machine-readable accounting program.

September 13 -

Municipal traders and managers said the tax-exempt market’s early strength translated into weakness before the end of trading — due to taxable and overseas influences.

September 12 -

Los Angeles and Broward County deals were offered while some say the municipal market feels "heavy" and in retreat.

September 11 -

It was a big day for the municipal bond market as billions of dollars of new deals hit the screens.

September 10 -

Issuers jump into the market as yields remain near record low levels.

September 9 -

With supply looking up, traders and analysts expect new issues to be well absorbed even if Treasuries correct futher.

September 6 -

The Chicago Public Schools also came to market with a $349 million GO deal.

September 5 -

California's $2.4 billion GO deal was priced for retail investors on Wednesday.

September 4 -

California's Legislative Analyst's Office wants state lawmakers to have a framework to evaluate cash borrowing proposals.

September 3 -

A pre-marketing scale was released on California's $2.3 billion GO deal.

September 3 -

It's the first week after Labor Day and investors are facing a hefty calendar with some big names.

September 3 -

The market will see $7.6 billion of bonds plus a $1 billion note sale coming up in a holiday-shortened week.

August 30 -

Volume bounced back from second lowest monthly total of the year in July as yields plunged to historic lows and issuers came out in droves.

August 30 -

Many market participants were already planning their getaways before the unofficial end of summer hits next Monday.

August 29 -

NYC to continue Wells' muni underwriting ban as Fed's Powell opines on the firm's woes.

August 28 -

Deals from Atlanta, Massachusetts, Ohio and Miami-Dade County led Tuesday's primary activity.

August 27 -

Massachusetts taxable deal hits $858 million.

August 26 -

The last full trading week ahead of the Labor Day holiday will see a variety of credits come to market.

August 23 -

Houston issued bonds in the negotiated sector, while Long Beach competitively sold two issues.

August 22