-

Municipal bond volume continues to accelerate, closing out the month of September 39.1% higher and the quarter 17.8% higher than a year earlier, as issuers flocked to market with taxable deals.

September 30 -

As we enter the fourth quarter, municipals continue their remarkable performance with the market continuing to follow trends of demand outstripping supply and inflows into the asset class.

September 27 -

Most of this week’s municipal bond deals were well received, according to Peter Delahunt of Raymond James.

September 26 -

Munis strengthened Wednesday, the day after about 80% of the week's new issue calendar came and went.

September 25 -

The market had no trouble absorbing Texas Water's $877 million and a $1 billion deal from New Jersey Transportation Trust.

September 24 -

Municipal bond supply will keep on keeping on this week, continuing a boom that started August.

September 23 -

The primary market was somewhat stagnant after the FOMC but things should revert back how they were before — with most deals getting put away quickly.

September 20 -

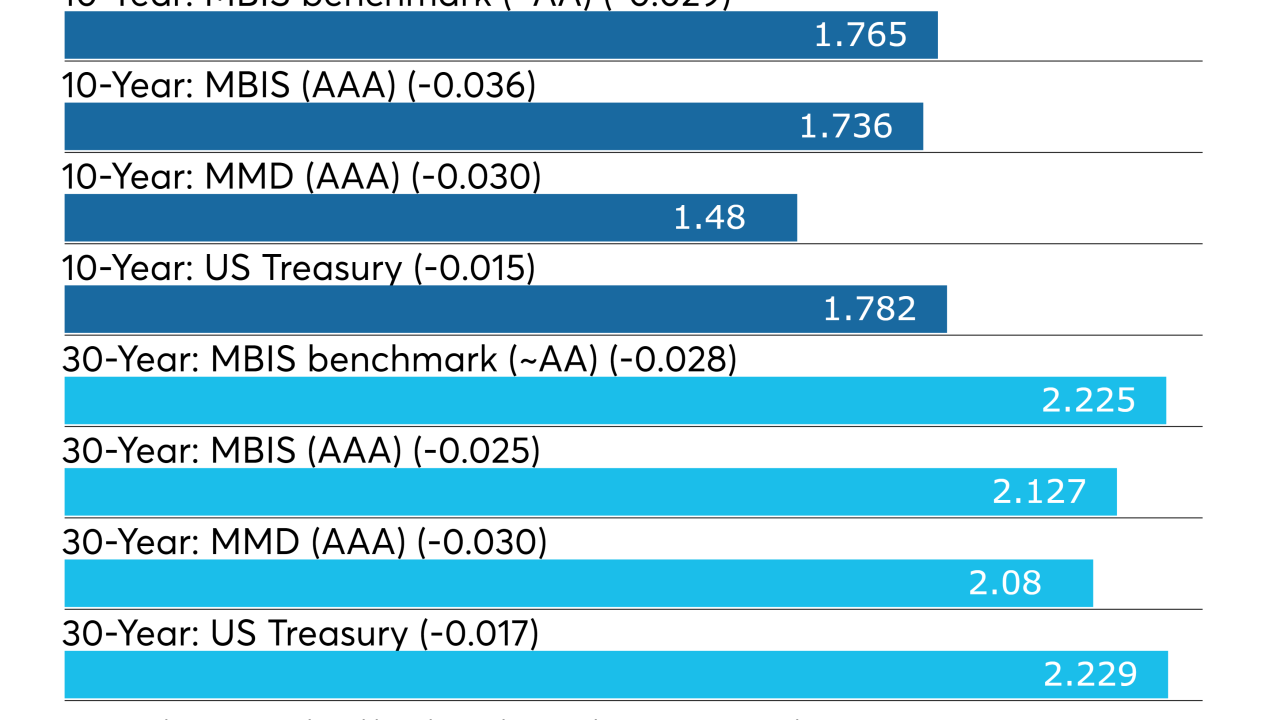

Municipal bond yields moved lower in secondary trading as some big deals were sold.

September 19 -

The market got what it expected and can now shift attention to the week's remaining deals after Fed policy makers cut interest rates by a quarter point.

September 18 -

The cloud-based debt management and reporting service hired Mark Campbell as head of western region client management.

September 17