-

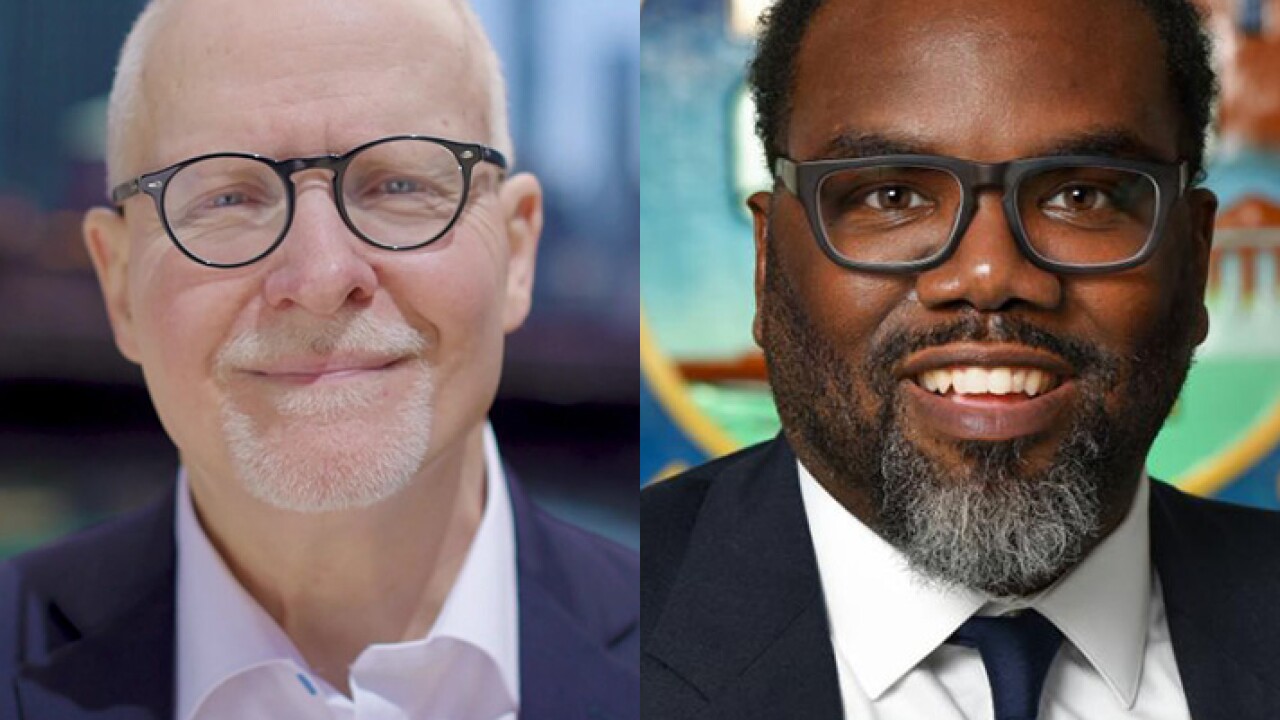

Paul Vallas, a former city budget director and public schools chief, and Brandon Johnson, a Cook County commissioner and teachers' union organizer were the two top vote-getters in Tuesday's election sending them to an April runoff.

March 1 -

The bond markets are witnessing a rare situation that could hinder spending on infrastructure projects around the country, said Amanda Hindlian, president of fixed income and data services at ICE.

February 28 -

Midwest borrowing last year went from 11% year-over-year growth in the first quarter to a 48% plunge in the fourth quarter.

February 14 -

"I think ESG is here to stay in our market. I think it's a natural fit with the types of infrastructure that our market finances," said MSRB CEO Mark Kim.

February 9 -

Mayor Lori Lightfoot, in a reelection fight, highlights first-term progress including lifting the city's bond ratings and bringing new investors to debt sales.

January 30 -

Small businesses that are certified to work for either Chicago or Philadelphia's transit agency will now be able to work for the partner agency as well.

January 9 -

The $242 million payment that's being made in addition to regularly scheduled contributions launches the city's policy aimed at staving off growth in its unfunded liabilities, a goal made all the more urgent by the beating pension funds are taking on their investments.

January 6 -

The Greater Chicagoland Economic Partnership said it will leverage the region's first-rate freight infrastructure, talent, industries and institutions.

January 4 -

The administration gave priority to large bridge projects that are ready to proceed with construction.

January 4 -

A final state regulatory hurdle remains for the casino proposal and the rail transit extension relies on federal funds not yet in hand.

December 15