The advance refunding of tax-exempt bonds with taxable bonds is the dominant activity in the municipal markets. This is the major driver of the increase in taxable volume. According to a recent report in The Bond Buyer, taxable munis are now a “

How does the call provision affect the value of a taxable muni? Normally the value is determined with an OAS calculator, based on issuer-specific credit and interest rate volatility. This approach can also determine the fair coupon of a new callable bond, such as a 30‑year NC‑10. For example, when the 30-year AAA optionless taxable muni rate is 2.80% (as it was in late February), the fair coupon of a par 30 NC-10 bond at a 15% interest rate volatility turns out to be 3.05%, or 25 basis points above the optionless rate. The 25 basis point spread is actually in line with current pricing. Similarly, the coupon of a 20 NC-10 is roughly 2.75%, or 13 basis points over the prevailing 20-year optionless rate of 2.62.

As we can see above, the “tax-exempt” refunding feature does not affect the market’s perception of the value of callable taxable bonds. But in fact, it can generate a windfall for investors.

Standard analysis assumes the issuer of a taxable bond will exercise the call option optimally, based on taxable refunding rates. And the best time for the issuer happens to be the worst for investors. But in the case of callable taxables, the issuer can dip into the tax-exempt market to refund. Obviously, tax-exempt rates are always lower than like taxable rates. For example, in late February, when the long AAA optionless taxable rate was 2.80%, the like tax-exempt rate was about 2.30%, i.e. 50 basis points lower. Due to this spread between tax-exempt and taxable rates, a taxable bond may be called when it is selling at a discount, as shown below. Needless to say, investors would more than welcome such calls.

To see this, let’s fast forward to the initial call date of our 3.05% 30 NC-10 bond, with 20 years left to maturity. Suppose that the 20-year tax-exempt rate has increased to 2.70%. The issuer is likely to call its 3.05% taxable bond and replace it with a tax-exempt bond. How would this look to the holder of the 3.05% callable taxable bond? Assuming that the 20-year taxable rate also increased, going from 2.62 to 3.00%, the price of the 3.05% callable bond is about 96.4, i.e. 3.6 points below par. A discount bond called at par is a bonanza for the investor!

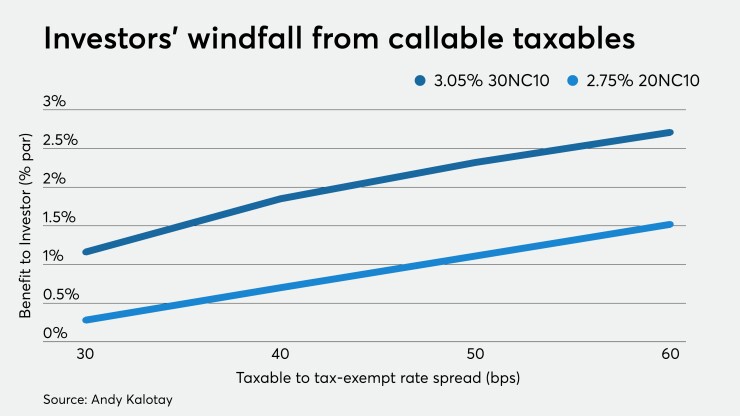

There are many scenarios of tax-exempt and taxable rates where it makes sense for the issuer to call a taxable bond selling below par. The potential windfall to investors can be quantified by option-based analytics. Results for a 30 NC-10 and a 20 NC-10 taxable bond are displayed in the figure below. The expected benefit to investors depends on the spread between the issuer’s tax-exempt and taxable rates — the wider the spread, the larger the probability of ”inefficient” calls, and the greater the windfall to the investor. At a 30 basis point spread the windfall on a 30 NC-10 is roughly 1.2 points, at 50 basis points it is about 2.3 points. In the case of a 20 NC-10 the windfall is smaller, but still significant. At 30 and 50 basis points, the respective benefits are 0.3 and 1.1 points.

In summary, callable taxable munis provide hidden value to investors. We have quantified this value for newly issued bonds, callable in 10 years. But what about seasoned bonds, or bonds with, say, a five-year call? The call decision depends on the issuer’s tax-exempt rates, while the bond’s value to the investor depends on taxable rates. Identifying the hidden value requires complex option-based analytics — a challenge for buy-side.