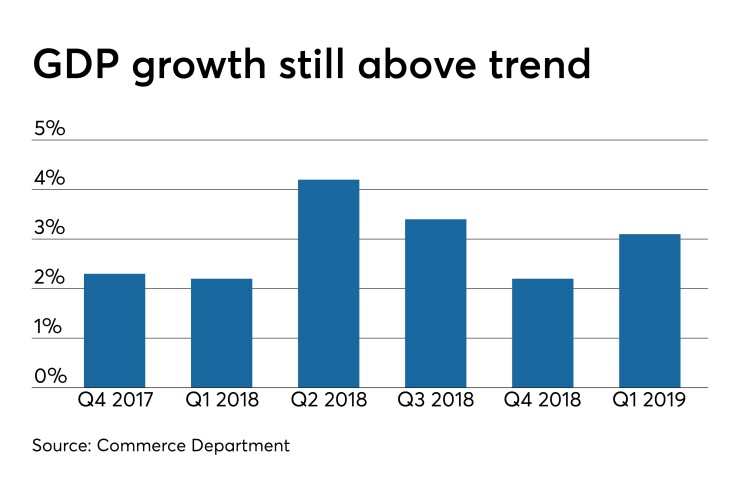

Despite “solid” growth in gross domestic product in the past year, it will be difficult for GDP to rise more than 1.5% to 1.75% on a longer run basis, Federal Reserve Bank of San Francisco researchers said in an

“This slow pace relative to history reflects two factors,” wrote John Fernald, a senior research adviser at the Bank, and Huiyu Li, a senior economist. Slow growth in the labor force and productivity will prevent stronger growth.

“Most importantly, demographic trends leave little doubt that the labor force will grow slowly at best over the next decade,” they wrote. Although productivity growth is less certain, they estimated productivity would rise at the pace it’s been hitting in “recent decades,” short of what would be needed to boost GDP.

Despite a good year for GDP in 2018, “it is far too early to declare that trend growth is higher than current estimates of 1.6-1.7%.”

Economic data

The most recent manufacturing report was not as dire as last week’s, showing “moderate expansion,” while another read of the economy suggested a “pickup” in growth.

The Texas Manufacturing Outlook Survey production index climbed to 8.9 in June from 6.3 in May.

“The June report reflects continued moderate expansion in Texas manufacturing, with growth this year remaining below the more robust pace seen throughout most of 2017 and 2018,” said Emily Kerr, Dallas Fed senior business economist.

Perceptions of business conditions fell to three-year lows in the survey, while uncertainty rose.

“Some signs of weakness continue to materialize, with demand growth slowing and outlooks worsening,” Kerr said. “Uncertainty increased again this month, with about 40% of manufacturers noting that tariffs and other potential changes to trade policy have increased uncertainty regarding their outlook and business decisions.”

Most of the respondents said tariffs raised input costs, and more than one in four said they’ve reduced capital spending plans.

This follows last week’s Empire State Manufacturing Survey — in which the general business conditions index plunged 26 points to negative 8.6, the first time in more than two years the index showed contraction — and the Federal Reserve Bank of Philadelphia’s manufacturing index’s decline to a barely expansionary 0.3 in June from 16.6 in May.

The Chicago Fed National Activity rebounded to negative 0.05 in May from negative 0.48 in April, suggesting below-average economic growth.

While three of the four broad categories of indicators that make up the index rose in the month, only one made a positive contribution. The index’s three-month moving average, CFNAI-MA3, narrowed to negative 0.17 in May from negative 0.37 in April. The CFNAI Diffusion Index also improved, climbing to negative 0.12 in May from negative 0.26 in April.

“Periods of economic expansion have historically been associated with values of the CFNAI-MA3 above negative 0.70 and the CFNAI Diffusion Index above negative 0.35,” the Chicago Fed said.