Fiscally distressed Harvey, Illinois, and holders of its defaulted 2007 general obligation bonds are trying to hammer out a settlement that provides investors with a piece of the city’s battered tax base while allowing the city government to function.

Several lead holders of the $32 million issue, who sued the Chicago suburb in 2018 after their patience with ongoing defaults wore out, agreed to put off until Feb. 28 enforcement of a December court order, to allow talks to continue as Harvey also seeks to restructure other debts.

The

Enforcement of the December 23 order partially granting bondholders summary judgment was initially stayed until Jan. 31 but at a hearing Monday Mullen agreed to the Feb. 28 extension requested by both sides.

“It’s apparent as ever that there are limited to funds to go around,” said Harvey attorney Edward Campbell, of Roth Fioretti LLC. Campbell and Robert Fioretti are representing the city. “Harvey is attempting to work within its means in good faith to pay its bondholders, and do what it needs to do to also make ends meet. We are going to do right by all the stakeholders in Harvey.”

Harvey warns of its dire condition in

“Any diversion of Harvey’s general corporate tax revenues for any use other than those that Harvey has already lawfully budgeted, appropriated and levied taxes for, as set forth…would be financially catastrophic for Harvey,” reads the motion. “Harvey is already in a very precarious position and scarcely able to meet its current obligations for payroll and other basic expenditures necessary to run the city and to provide its citizens with essential services.”

Harvey, which has about 25,000 residents, has experienced multimillion-dollar operating losses dating back well over 10 years with operating deficits ranging from $1.7 million to $3.1 million over the last three fiscal years and has no reserves, according to the filing.

A new wrinkle in the case surfaced in recent days. Assured Guaranty Municipal Corp., which insures a 2002 Harvey issue, entered the fray. Assured filed a petition to intervene to make the court aware that other bonds are outstanding that have not been paid, said Assured’s attorney, Michael Kasper.

Assured, formerly Financial Security Assurance Inc., reports being the owner of $1.16 million in principal and insurer of $565,000 bonds maturing February 2020. The filing argues that the 2002 bonds also benefit from the same tax escrow agreement as the 2007 bonds.

Assured wants the December order “modified to recognize the pre-existing obligation to the 2002 bondholders,” reads the filing.

The 2007 bondholders are trying to work with Harvey to reach an agreement that would allow them to recoup their investment while also allowing the city to operate successfully, said one attorney familiar with the bondholders’ position.

The 2007 bondholders who filed the 2018 lawsuit, led by Invesco Oppenheimer Rochester High Yield Municipal Fund and Susquehanna Government Products LLP, are willing to give Harvey some time in part because the city is working to regain some control over its water operations and dealing with Chicago.

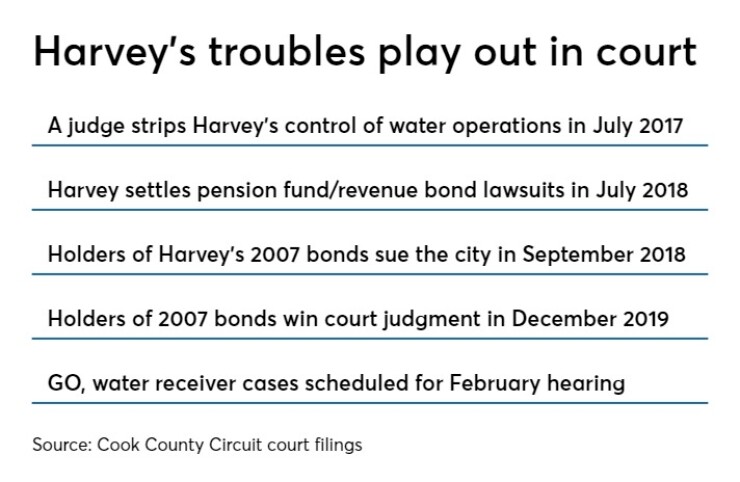

Chicago took Harvey to court after Harvey fell in the arrears on payments for Chicago-treated water from Lake Michigan. The two cities agreed to a consent decree in 2015 but Harvey violated it and the court stripped Harvey of control over its water operations in 2017.

The 2007 bondholders intervened in the Chicago case at the same time they filed the 2018 litigation against Harvey and county officials. Bondholders and Harvey believe revenue being diverted by a receiver appointed in the ongoing litigation can be freed up for other use.

Harvey, now led by a new mayor, Christopher Clark, is seeking to regain control. Harvey has argued the receivership has failed to accomplish the goal of bringing Harvey up-to-date on water payments while extracting fees for its services and withholding needed revenues while also overstepping its management powers. The receiver has countered that it’s lived up to its duties.

The court last month sided with Harvey on some of its grievances. Discussions are underway on the role of the receivership going forward and a status hearing is set for late next month in that case.

Harvey has been mired in litigation with various creditors.

In 2018, the city and its public safety pension funds and revenue bondholders settled a dispute that threatened the city’s ability to make payroll. The city’s police and firefighter pension funds were the first to act on a state law that allowed local public safety funds to garnish a municipality’s share of state collected tax funds to make up for overdue actuarially based pension contributions by filing a claim with the state comptroller.

The settlement allowed the Chicago suburb to keep a chunk of its state collected funds and protected revenues pledged to bondholders. The settlement saved Harvey from “a de facto bankruptcy that threatened critical services and could have put citizens in jeopardy,” Fioretti said at the time.

Harvey’s fiscal woes run deep due to a dwindling tax base, population and job losses, and past fiscal mismanagement that led to

Illinois lacks a general Chapter 9 statute to allow municipalities to file for bankruptcy. Former Gov. Bruce Rauner, a Republican, had pressed for such a statute, but the Democratic-led General Assembly opposed it. Rauner lost to his Democratic challenger J.B. Pritzker in 2018. Harvey does not currently qualify for existing local government fiscal intervention rules in state law.

The 2007 bondholders accuse Harvey in their lawsuit of breach of contract on debt service defaults now totaling about $4 million in principal and interest.

County officials were also named as defendants for failing to send tax dollars directly into the escrow. Under the ordinance authorizing the 2007 bonds, the city directed Cook County to deposit 100% of collections of all legally available ad valorem property taxes into a designated escrow account in addition to special levy funds, with the city receiving only excess revenues after debt service is paid.

At the time of the lawsuit’s filing, OppenheimerFunds held $11 million of the bonds and Susquehanna held $5.8 million. Bondholders are represented by Bryan Cave LLP partner Brent Vincent.

County officials responded to bondholder demands by saying they can’t honor the request until instructed by Harvey, according to the complaint. At the time of the lawsuit’s filing, bondholders moved in tandem to intervene Chicago’s water lawsuit against Harvey.

The holders argue they are entitled to a portion of water rents and rates because about $5 million of the 2007 bonds financed water system improvements. They also want to prevent the court receiver from siphoning off to the water fund general funds the bondholders believe should go to repay their holdings.

While the bonds carried a general obligation pledge with a tax levy as the primary source of funds, if that levy fell short principal and interest was to be paid from “any other moneys, revenues, receipts, income, assets or fund of Harvey that are legally available for that purpose,” according to the lawsuit, which cites bond documents. Harvey’s tax collections have long fallen far short of levy amounts.

The 2007 issue, which carried a BBB-minus rating from Fitch Ratings when it was issued, included $9 million of B series taxable bonds with a $3.2 million 2017 maturity paying a yield of 7.25% and a $5.8 million 2024 maturity yielding 7.75%.

The $22 million tax-exempt A piece included a 2027 maturity for $9 million that paid a yield of 5.14% and a 2032 maturity for $12.8 million that paid a yield of 5.22%.

The city bears responsibility for investor disclosure. U.S. Bank NA serves as the paying agent, but there is no trustee.

Federal law requires only corporations to follow trust guidelines on the issuance of securities, and many GO issuers forgo the use of a trustee though use is common, and investor-driven, on revenue bond deals.

Fitch Ratings later dropped its ratings on the 2007 bonds to a low of B but withdrew its rating in 2010 "due to insufficient information."