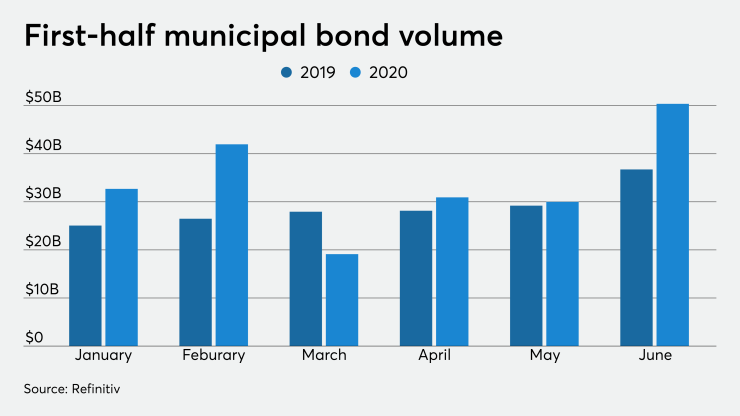

Long-term municipal bond sales were up 18.2% year-over-year during the first half of the year to $205.14 billion from $173.62 billion, according to data from Refinitiv.

2020 has more bond sales through the first half than a year earlier, despite the fact that COVID-19 temporarily shut down the primary market for nearly two weeks at the beginning of March. The third month of the year only produced $19.12 billion, 31.6% lower than March of 2019.

Other than the muted month of March, muni issuance has been heavy and it looks as though 2020 will surpass 2019 in terms of sheer volume, if it stays on this current pace.

“We think it is likely that there will be more primary muni issuance in 2020 versus 2019,” said David Hammer, executive vice president and head of municipal bond portfolio management at Pacific Investment Management Company. “The magnitude of that differential will be influenced by the size of the aid package that comes out of Washington. Some issuers with legal capacity will likely have to do deficit financings if additional Federal aid is not forthcoming.”

Muni volume really picked up in May and June, as those two months accounted for $80.40 billion of volume.

“Most of the surge in volume to close out the first half was because of refundings, not because of an enthusiasm for selling more new money debt,” said Tom Kozlik, head of municipal strategy and credit at Hilltop Securities.

For the first quarter, issuance was up 18% to $93.80 billion from $79.51 billion, while the second quarter rose 18.3% to $111.34 billion from $94.11 billion.

Throughout the first six months of 2020, the market has seen five months where issuance has been greater than $30 billion, while a year ago, there was only one such occurrence.

The big story issuance wise is taxable muni issuance, which was up 249% year-over-year in the first six months of 2020 to $55.63 billion from $15.94 billion.

“As long as rates stay low and muni issuers do not have the ability to advance refund with tax-exempt debt, we expect taxable issuance to remain elevated against historical averages,” Hammer said. “Taxable issuance has historically been 10% of the muni market — we are on pace for that percentage to be between 25% to 30%, above 30% if you include corporate bonds backed by municipal issuers.”

Kozlik agreed that taxable issuance could be here to stay.

“If their market appeal continues, and if interest rates offer a compelling argument to consider them,” Kozlik said. “The pace of taxable issuance is sustainable as long as there is not a tax-exempt option, and interest rates remain low taxable issuance could continue.”

Hammer added that with the backdrop of low rates, we think that percentage of issuance is sustainable over the next few years.

“Longer term, we expect the majority of issuance will return to the tax-exempt market. Overall volumes are unlikely to increase without direct federal infrastructure investment,” Hammer said.

New-money deals were down 6.3% in the first half, while refundings were 117% higher.

“State and local governments, and other municipal sectors, including transit districts, hospitals, and airports, are suspending some infrastructure spending as they contend with the declining revenue outlook,” Hammer said. “We would expect to see a decline in new-money issuance related to those deferred projects. However, the decline may be short-lived because maintenance and strategic infrastructure spending, especially across transportation and healthcare sectors, can only be deferred for so long, and it is possible states in a stronger financial position may pull forward critical projects and bond issuance as a form of economic stimulus.”

Kozlik thinks that refunding issuance will continue to outpace their initial 2020 expectations almost “no matter what happens.”

“We are being assured that low rates are here to stay for the near term,” Kozlik said. “New-money municipal issuance will likely fall if there is not meaningful federal fiscal relief. Issuer will be less inclined to add debt to their balance sheets because of the uncertainty.”

Kozlik also noted there is a lack of enthusiasm to add more debt service expense in the current environment.

“We think new money issuance could fall further if there is no meaningful federal government relief,” Kozlik said.