Illinois could counter the COVID-19 pandemic’s toll on motor fuel tax revenue by funneling some of its incoming federal relief funds to infrastructure projects, a policy group recommends

The state lost about $308 million in motor fuel tax revenue between April 2020 and February, potentially knocking off track local government and state projects under the multi-year, $45 billion Rebuild Illinois program passed in 2019.

The pandemic stripped the state's transit agencies of an additional $700 million of sales tax and farebox revenues, putting the overall toll at $1 billion.

“While annual MFT revenues will exceed those collected prior to the passage of the capital bill, this revenue source did not reach its full potential for 2020 and likely will not for 2021,” Mary Tyler, transportation policy analyst at the Illinois Economic Policy Institute, writes in the report, published Thursday.

“By devoting portions of the American Rescue Plan funding to replace MFT revenue lost during the pandemic, Illinois could take steps to prevent longer term pandemic impacts on the quality of highway, street, and bridge infrastructure and the state’s broader economic recovery,” Tyler wrote.

Gov. J.B. Pritzker and lawmakers will likely settle on a plan for the relief funds during the current legislative session underway as part of the fiscal 2022 budget process. Pritzker has said the state would first pay off nearly $3 billion still owed to the Federal Reserve from $3.2 billion of borrowing through the Municipal Liquidity Facility and then would pay down a portion of an unpaid bill backlog that this week stood at $4.8 billion.

Some funds would likely be left over and lawmakers have their own ideas. Rating agencies have warned the state against adding to its structural gap with recurring spending commitments. Replacing lost MFT revenue would mark just a one- or two-year commitment.

The state and local governments expect to receive about $13 billion in two installments over the next year from the American Rescue Plan recently signed by President Biden. The state’s direct share is $7.5 billion.

State lawmakers doubled the motor fuel tax to help raise $1.3 billion annually to fund infrastructure projects authorized under the

Rebuild Illinois relies on about $23 billion of borrowing and if tax and fee revenues earmarked for capital fall short, the general fund is tapped to make up the difference.

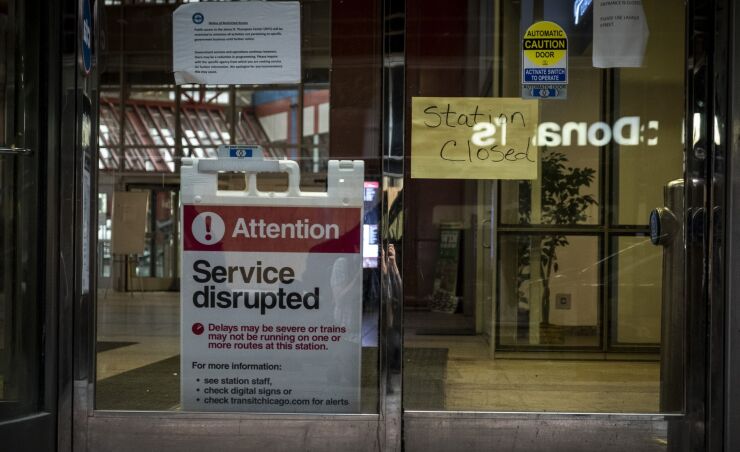

Vehicular and transit system travel plummeted dramatically and remains depressed. Following Illinois’ stay-at-home order in March 2020, the state saw a 40% in total vehicle travel compared to the same month in 2019. A 15% year-over-year reduction in travel was recorded for 2020.

Of the $308 million in lost MFT collections — about 12% of expected revenues — $151 million would have gone to the state, $30 million to transit agencies, and $126 million to local governments. The tax is collected on a per-gallon basis, with rates currently at $0.387 for gasoline and $0.462 for special fuels. Rebuild Illinois raised rates by $0.19 per gallon for gasoline and $0.24 per gallon for special fuels and then indexed future increased to inflation.

Transit took dual hits as fare-paying riders stayed home and sales tax revenue fell, although the Regional Transportation Authority, which provides fiscal oversight of three Chicago area transit boards, recently laid out a rosier sales tax picture.

Local sales taxes generated $96 million less for the RTA between March and November 2020 compared with the year prior.

Transit ridership was off 68% at the Chicago Transit Authority buses and almost 100% for Metra suburban commuter rail last April and May. For June through December 2020, year-over-year ridership declines remained at 50%-60% for bus services, 77% for CTA rail transit service, and 89% for Metra. Collective fare box revenue from the CTA, Pace suburban bus service, and Metra generated $645 million less in 2020 compared to 2019; 69% less for Metra, 62% less for CTA, and 50% less for Pace.

The RTA is still awaiting additional apportionment details from the Federal Transit Administration on distribution of the roughly $30.5 billion of transit relief in the American Rescue Plan but the authority expects to receive at least

Still to be determined: what happens to traffic and ridership after the pandemic.

“While traffic volumes showed signs of rebound in 2020, certain trends that became commonplace during the COVID-19 pandemic may ultimately persist for years to come,” the report warned.

A U.S. Census Bureau survey indicates that 35% of Illinois workers who were working at an employment site prior to COVID-19 are now working from home.

“Rebuild Illinois was a historic plan to address long-term transportation funding shortages, but it is now important to continue tracking travel trends and emerging infrastructure needs as telework becomes more common post-pandemic,” the report recommended. “Only time will allow for a full understanding of Illinois’ altered travel habits, demographic shifts, and overall post-pandemic economy.”

The MFT and transportation-related spending is currently the subject of legislative and legal action.

Transportation-related tax uses are guarded by a lockbox put in place when voters approved a

A state House committee recently advanced to a floor vote legislation in

Cook County, which includes Chicago, recently prevailed at the appellate court level in a challenge to its powers over the use of other transportation-related taxes it levies.

The appellate court in a March 4 opinion agreed with the lower court which in 2019 dismissed the case and concluded that home rule units of governments retain autonomy to use funds from taxes they impost at their discretion with the lockbox applying only to state imposed taxes.

“The taxes imposed by the County that are the subject of the complaint are six different taxes. The County spends the revenue from each of these taxes pursuant to its home-rule spending power, not in accordance with a statute,” reads the March 4 decision. “The amendment thus does not restrict, or govern in any way, the spending of these tax revenues. We agree with the County that the complaint fails to state a claim for a constitutional violation and was properly dismissed.”

The litigation posed the first major legal challenge to the lockbox structure and dates back to 2018 when a group of road construction firms and trade associations sued the county in Cook County Circuit Court alleging that the county’s use of about $250 million in transportation related revenue for public safety violated the amendment.

“The appellate court’s decision along with the trial court recognizes the county’s Home Rule power and taxing authority. While we are pleased with this outcome, Cook County and its Department of Transportation and Highways will continue its work to foster strategic investments and improvements in the transportation system,” said Cook County finance department spokesman Edward Nelson.

Plaintiffs’ attorney John Fitzgerald, a partner at Tabet DiVito & Rothstein LLC, said they will file a petition for leave to appeal to the Illinois Supreme Court.