Illinois lawmakers ended a marathon overtime session after sending Gov. J.B. Pritzker a $40 billion operating budget, a six-year $45 billion capital plan, a sweeping expansion of gambling, and a plan to legalize adult recreational use of cannabis.

The passage of key budget bills, a

“Illinois is back. Illinois is back in business,” said Pritzker, a Democrat who took office early this year after four years under Republican Gov. Bruce Rauner, whose feud with the legislature's majority Democrats led to two years without an enacted state budget.

Democratic leaders called the session “historic” for the list of work completed and Republicans — who oppose progressive income tax rates but put up votes for key budget, capital and gambling bills — stood by Pritzker as he took questions on the session.

The market will have plenty to digest in the coming days and investors will make their own decision about whether the

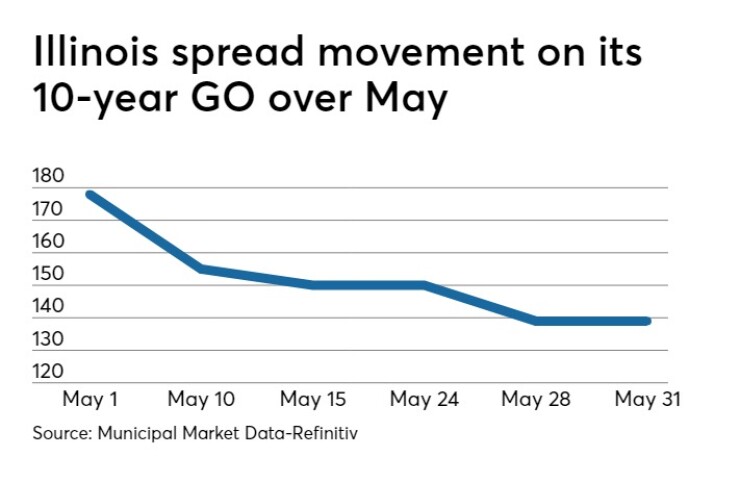

As the graduated tax measure made headway and thanks to a hunger for high yielding paper and a dearth of supply, the state closed May with its 10-year at a 139 basis point spread to Municipal Market Data’s top benchmark, down materially from 178 bps where it opened the month and a low since mid-2014.

Pritzker previously acknowledged the “bridge” status for 2020 budget as it relies on some one-shots. To erase a structural deficit he’s relying on the projected $3.4 billion in new revenue that would be raised from a progressive rate structure if voters approve in November 2020.

Rating agencies and investors have offered positive comments about the potential for a

The budget package does little to stabilize a $133.7 billion and growing pension liability for a system just 40% funded. If the income tax change is adopted, $200 million more would go toward pensions annually and the state is exploring asset sales and transfers to bolster funding.

“It took a lot of years for Illinois to get into the situation that we are in today where the rating agencies have put us. It’s going to take years for us to get out of it, but this is an enormous step forward,” Pritzker said after the session’s end Sunday. “We are beginning to address our pensions. We are doing things that I think move us in the right direction from a financial perspective, a fiscal perspective, and I think the rating agencies will recognize that.”

The Senate adjourned Sunday wrapping up measures sent over from the House on Saturday after it adjourned until the fall veto session. The weekend action was an extension of the regular session that formally ended Friday.

DEBT

HB0142 adds more than $23 billion in

The bill also authorizes $1.2 billion of borrowing to pay down the state's $6.6 billion unpaid bill backlog. It authorizes the use of a new credit in the form of "income tax proceeds bonds" for the backlog borrowing if the state prefers.

It also limits the backlog bonds’ maturity to 12 years similar to what was authorized for the state’s $6 billion backlog issuance in late 2017. An additional $200 million in cash will also go to pay down the backlog, according to the budget’s authors. A portion of future revenue from the legalization of adult use of recreational marijuana will also go toward the backlog.

OPERATING BUDGET

Pritzker and lawmakers described the $40 billion budget — a 2% increase over the fiscal 2019 plan — as balanced but a detailed analysis was not available to assess that assertion.

Pritzker originally was banking on $200 million from sports betting licenses, but those funds now go to the capital bill and marijuana licenses were reduced to $57 million in expected revenue from $170 million.

The plan provides an additional $375 million for public school education, $25 million more than what’s required under the 2017 overhaul of school aid formulas while state universities will see their aid levels rise by 5% to nearly $2 billion. Funding for early childhood education would increase by $50 million, up to $544 million.

The budget includes Pritzker’s proposal to impose a Medicaid provider tax that will go to leverage federal funds resulting in at least a $1.2 billion gain for the budget.

The state’s scheduled $9 billion payment to the pension system is funded. Pritzker had initially sought to cut it by more than $1 billion but backed off after the state saw a $1.5 billion April tax windfall that wiped out most of the current year deficit and prompted an upward revision of fiscal 2020 collections.

Some Republicans voted for the budget after they successfully negotiated the inclusion of business tax credits that phase out a franchise tax paid by corporations and creation of a tax credit for various items.

CAPITAL BUDGET

The partially-bond financed capital program spends a record $45 billion on roads, bridges, transit, schools and state facilities, ending a long drought in any new substantial funding in a decade in a $31 billion program. The package did get some GOP votes after Democrats agreed to concessions including some changes in the taxes and fees supporting the infrastructure program.

The plan relies on nearly $21 billion in borrowing, $10 billion in federal funds, $11 billion in pay-as-you-go financings, and $2.6 billion in local matching funds.

Transportation-related projects receive $33 billion of funding, state buildings get $4 billion, educational facilities get $3.5 billion, and healthcare, broadband and environmental projects get the remainder.

Transportation, or so-called

Additionally, $475 million will come from an increase in vehicle registration fees, $78 million from a five-cent-per-gallon increase in diesel fuel tax, $4 million from an increase in registration fees for electric vehicles, $50 million from an increase in truck registration fees, and the state’s sales tax revenues on gasoline will move to the road fund beginning in fiscal 2022.

So-called

It also relies on $68 million from an increase in the real estate transfer tax on commercial property sales, $45 million from the removal of the sales tax exemption on some traded-in property, and $156 million from a $1 per pack increase in the state’s cigarette tax.

CHICAGO

Chicago succeeded in getting approval for a casino license in the city. Chicago will get a one-third cut of any profits from the casino. The city’s existing police and firefighter pension statutes require that any profits from an eventual city-owned casino go to improve their funded status. The city’s four funds are carrying $28 billion of net pension liabilities and are just collectively 26.5% funded.

If voters adopt the progressive income tax amendment, Chicago would gain a big piece of the estimated $100 million of income taxes shared with local governments under a proposed rate structure lawmakers approved.

The capital package also allows local governments to layer over the state motor fuel tax a three-cent-per-gallon increase for local use. Chicago also stands to gain revenue through implementation of sports betting and legalized cannabis.

VICE TAXES

The gambling expansion allows for six additional licenses for privately owned casinos although the state gaming commission will have oversight. The Chicago-based casino is authorized to be one of the largest in the nation with up to 4,000 slot and table positions. Current casinos can expand and slots will be allowed at Chicago's airports.

Lawmakers also voted to allow Illinois to join the dozen states that have implemented or voted to implement sports betting in the wake of a U.S. Supreme Court ruling. The legislation allows betting at professional sports stadiums and existing gambling venues.

The state will become the 11th to legalize recreational cannabis. While little revenue is expected next year, future annual tax revenue is estimated at $170 million of which 35% would go to the state’s general fund, 20% for substance abuse and mental health services, 10% to reduce the state’s bill backlog, and 8% to local governments for law enforcement, with the rest earmarked for various programs.

The budget also includes language to support a public-private partnership to spur a

Left out was proposal to expand the Metropolitan Pier and Exposition Authority’s tourism tax boundaries to support $600 million in bonding authority for expansion projects. Chicago Mayor Lori Lightfoot opposed the extension, which would have added the tax to Chicago restaurants farther from the convention center than the ones paying it now.