CHICAGO –The Regional Transportation Authority of Illinois has qualified 10 financial advisory firms to assist the agency on bond deals and other fiscal transactions over the next five years.

The board approved an ordinance giving executive director Joe Costello authority to negotiate contracts with the firms.

The list includes Acacia Financial Group Inc., A.C. Advisory Inc., Robert W. Baird & Co. Inc., Backstrom McCarley Berry & Co., a partnership between Columbia Capital Management LLC and Kensington Capital, Peralta Garcia Solutions, Public Financial Management Inc., Public Sector Group Inc., Siebert Brandford Shank & Co. LLC, and Sycamore Advisors.

“For the upcoming years, the RTA anticipates financial activity that includes bond issuance, investment of bond proceeds, financial restructuring opportunities, short-term borrowings, and other funding and financing vehicles such as government loans,” Costello said in a memorandum to the board. “The proposed financial advisors will support RTA staff on these transactions. The RTA will assign work based on its needs for specific services.”

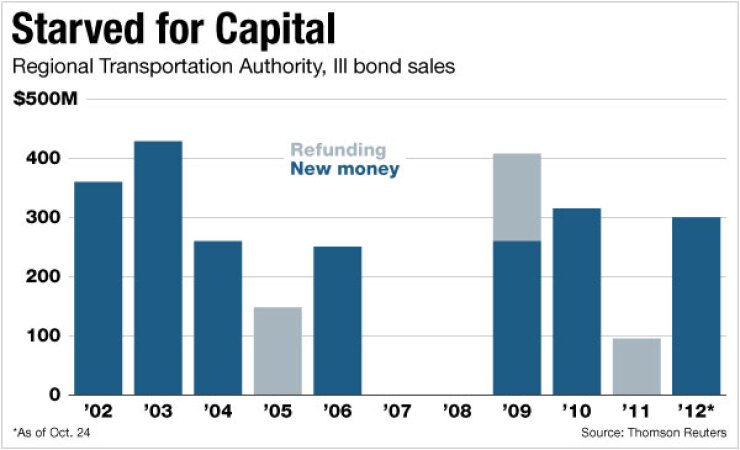

Starved for capital funding, the RTA last month floated a $2.5 billion borrowing proposal that relies on projected growth in existing revenue streams and maintenance savings for repayment.

The agency — which provides fiscal oversight of the Chicago Transit Authority, Metra commuter rail system, and Pace suburban bus service — expects to submit formal legislation to the General Assembly during its next regular session that begins in early 2013.

With federal funding lacking and the state struggling with its own pension costs, budget problems and liquidity woes, board chairman John S. Gates Jr. said: “We are going to have to solve this problem at home.”

The plan calls for $500 million bond issues to be sold annually over a five-year period. Growth in the RTA’s share of sales taxes, debt service available from retired bonds, and $3 million in annual interest rate savings on short-term borrowing would go to repay the debt.

Additional savings from a reduction in the costs to maintain aging equipment would also help provide the revenues needed to repay the debt and maintain at least three times debt service coverage.

The agency would not require increases in any of its tax rates and the plan does not rely on the state subsidizing debt service costs as much of the RTA’s past state-approved borrowing did, Costello added.

The RTA has exhausted its state-authorized borrowing, but the state’s ongoing $31 billion capital program approved in 2010 earmarks $2.7 billion for public transportation. The figure falls far short of what the RTA and its service boards estimate is needed simply to keep the system in a state of good repair.

The RTA’s service boards have total capital needs of $24.6 billion including the CTA with $15 billion, Pace with $7.3 billion, and Metra with $2.3 billion. Projects include new buses, locomotives, paratransit vehicles, the rebuilding or modernization of several CTA light-rail lines, rail grade upgrades, and improvements to meet the needs of the disabled.

Fitch Ratings earlier this year upgraded the credit to AA as part of revised criteria on tax-supported credits, but assigned a negative outlook due to operating and capital pressures posed by the state payment delays. Moody’s Investors Service rates the RTA Aa3 with a stable outlook. Standard & Poor’s assigns a AA rating and a stable outlook. The authority has about $2 billion of long-term general obligation bonds.