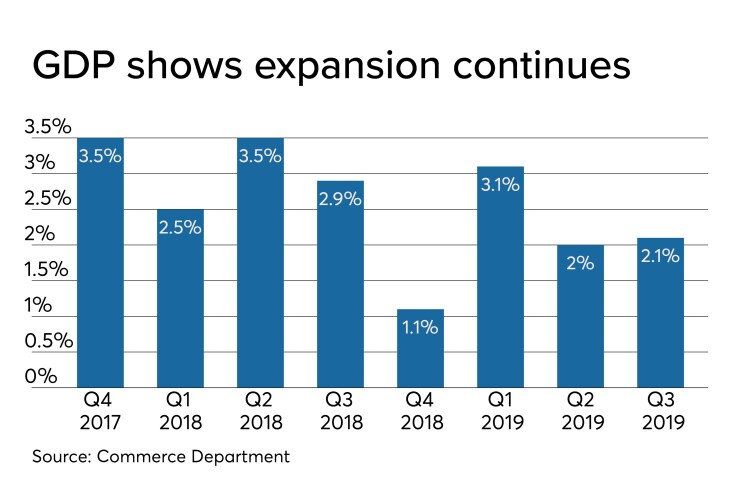

Gross domestic product grew at the expected 2.1% annualized pace in the third quarter, as economists wondered how long consumers will stay strong and offset soft business investment.

“It is very likely that the Fed is making a material mis-assessment of the ‘strength’ in the economy, particularly on the part of the consumer, which, once realized, will result in reigniting the easing train,” according to Stifel Chief Economist Lindsey Piegza.

Mark Hamrick, senior economic analyst and Washington bureau chief at Bankrate.com, agreed, “Anemic business investment is one of the most troubling aspects of the economy at the moment. Consumers won't shoulder all of the economy on their backs alone. One reason why Q4 2019 and Q1 2020 GDP outlooks don't go as high as 2%.”

But, he added, “the economy has weathered a lot in the past year or so. Fortunately, some veils of uncertainty have lifted with the apparent agreement between the U.S. and China on the so-called Phase One deal along with the House passage of USMCA, the successor to NAFTA.”

While the 2.1% growth exceeds the 2.0% gain in the prior quarter and is higher than was expected before the first estimate was released, it “is significantly below the strong growth (3.1%) that set off the year in the first quarter,” said Beth Akers, Manhattan Institute senior fellow and a former Council of Economic Advisors economist.

The report’s (the third and final read for the quarter) “only surprises were the sources of growth,” she added. Consumers outdid themselves while “investment in inventories lagged below the earlier estimate. These offset one another, leaving the final figure the same as previously estimated.”

Also supporting the “moderate expansion,” Akers said, are low interest rates and a strong labor market. “With most forecasts predicting moderately slower growth in 2020, I anticipate a series of less encouraging GDP reports in the coming months.”

A separate report from the Commerce Department showed consumer spending rose 0.4% in November, as expected, after an unrevised 0.3% gain in October, while personal income grew 0.5%.

The report also show inflation in check during the month, with the personal consumption expenditures index up 0.2% in the month, the same gain as in October. For the year ended in November, PCE rose 1.5%, compared with a 1.4% gain for the year ended October.

Excluding food and energy, PCE rose 0.1% in November, the same as in October, while advancing 1.6% for the year, following a 1.7% gain for the year ended in October.

Consumer sentiment

The University of Michigan consumer sentiment index ticked up to 99.3 in the final December read from 99.2 at mid-month and 96.8 in November, while the current conditions index grew to 115.5 from 115.2 mid-month and 111.6 last month, and the expectations index held at 88.9, unchanged from the mid-month read and up from 87.3 last month.

The inflation reads were lower, with the one-year at 2.3% and the five-year at 2.2%.

“The fourth straight monthly rise in consumer sentiment seen in the University of Michigan reading, including companion gains for assessments of current conditions and expectations, is a welcome sign,” Hamrick said. “Consumers appear to have been cheered by both wage gains and the positive performance of the stock market, even if they aren’t directly personally invested. It might be said that they’re somewhat emotionally invested, if not more, to the extent that the market’s performance tends to be correlated to economic performance, most dramatically when recessions are looming.”

K.C. Fed

“Regional factory activity declined for the sixth straight month in December, driven again by weaker activity in durable goods manufacturing,” according to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City. “About half of District firms said weakening in other goods-producing sectors (such as energy and agriculture) has negatively affected business in their area.”

The composite index declined to negative 8 in December from negative 3 in November. After a zero reading in June, the index has remained negative.