Want unlimited access to top ideas and insights?

While the economy continues to expand “at a slight to modest pace,” those surveyed lowered their outlooks for growth over the coming year, according to the Beige Book report, released by the Fed Wednesday.

Contacts in states in the South and West “generally were more upbeat” than those in the Midwest and Great Plains, according to the Fed. “Household spending was solid on balance: non-auto retail sales increased modestly, while light vehicle sales were generally robust,” the report added.

But business spending continued to slow, with nonresidential construction growing “at a slightly slower yet still modest pace, while leasing activity advanced at a slow but steady rate. Manufacturing activity continued to edge lower.”

Some respondents pointed to trade issues and global growth as a hindrance.

In addition to the Beige Book, several reads of the economy offered documentation of slowing, although a housing indicator offered promise.

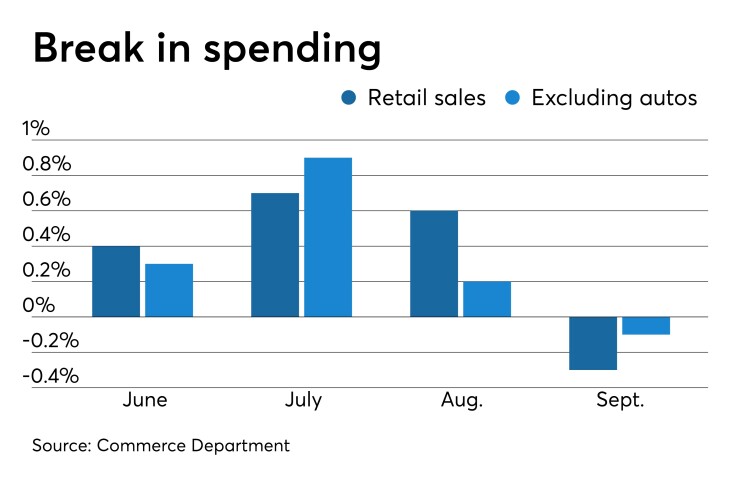

September retail sales declined 0.3%, the first decline since sales fell 0.5% in February, the Commerce Department said Wednesday. Sales were up 0.6% in August.

Excluding autos, sales were down 0.1%, after a 0.2% gain the month before.

Economists polled by IFR Markets expected sales to gain 0.3% and 0.2% excluding autos.

“If consumers fold their cards, we'll have reason to be truly concerned,” said Mark Hamrick, senior economic analyst, Bankrate.com, in a Tweet. Consumers have fueled the recent expansion. “One month does not a trend make, but [is] worth watching.”

“This morning’s slower-than-expected retail spending report solidifies concerns of the consumer’s inability to perpetually support the economy alone,” said Lindsey M. Piegza, Stifel chief economist. “With business investment declining, manufacturing activity deteriorating and other key sectors of the economy slowing, many investors brushed off fears of a slowdown because the consumer was still spending. This morning’s report forces eternal optimists to face the possibility household spending may be moderating along with a decline in fundamentals.”

Separately, the Federal Reserve Bank of New York’s Business Leaders Survey showed weakness in the region’s service sector, as the business activity index was negative for the first time in two years, dropping to negative 4.3 from positive 4.9. The business climate index narrowed to negative 14.8 from negative 15.6, meaning firms general see “the business climate as worse than normal,” the Fed said.

Business inventories were flat in August after a 0.3% rise in July, the Commerce Department reported Wednesday. Sales rose 0.2% in the month, the same percentage increase as in July.

Economists expected a 0.2% gain.

Home builders showed increased confidence in the market for newly-built single-family homes, as the National Association of Home Builders/Wells Fargo Housing Market Index jumped 71 in October from 68 in September.

The index hadn’t been this high since February 2018.

“Builders have good reason to feel emboldened, with spirits lifted by the decline in mortgage interest rates,” Bankrate’s Hamrick said. “While the housing market is interest rate sensitive, it would not be immune from friction caused by an actual economic downturn. But, in the meantime, the job market continues to perform well, and steam has been coming out of the year-over-year increases in home prices, also taking some of the pressure out of the affordability squeeze.”

Federal Reserve Bank of Chicago President Charles Evans said the economy is in “a good place,” but more accommodation may be needed to offset uncertainties.

“I now think a more accommodative stance is needed to support a roughly similar growth outlook and, importantly, to support moving inflation and inflation expectations up with greater assurance to achieve our symmetric 2% goal sustainably and within a reasonable time,” he said in prepared remarks released by the Fed.

But, he added, “there is some risk that the economy will have more difficulty navigating all the uncertainties out there or that unexpected downside shocks might hit. So there is an argument for more accommodation now to provide some further risk-management buffer against these potential events.”

And, while he’s “keeping an open mind,” should an “imminent downturn” arise, “we obviously would act aggressively.”