Want unlimited access to top ideas and insights?

The softness in consumer spending may be ending, which would increase gross domestic product.

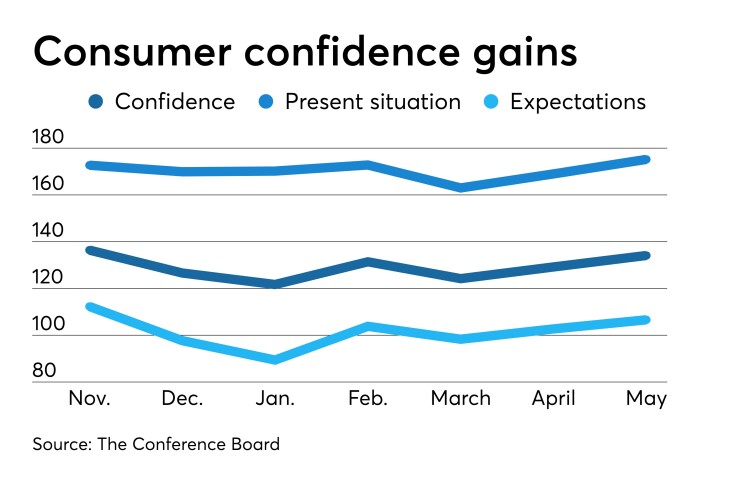

Consumer confidence rose in May to its levels of last fall, which hadn’t been seen in nearly two decades prior to that. This bodes well for spending, which has been weak this year.

The consumer confidence index grew to 134.1 in May from 129.2 in April, the Conference Board reported Tuesday. Economists polled by IFR Markets expected a 130.0 reading. The present situation index rose to 175.2 from 169.0, while the expectations index climbed to 106.6 from 102.7.

"Consumers expect the economy to continue growing at a solid pace in the short-term, and despite weak retail sales in April," said Lynn Franco, senior director of economic indicators at the Conference Board, "these high levels of confidence suggest no significant pullback in consumer spending in the months ahead."

The stock market drop late last year and the partial government shutdown made consumers anxious, and consumer confidence took a hit. Now confidence is returning, said Robert Frick, corporate economist at Navy Federal Credit Union, and “It appears the ratcheting up of tariff tensions have not, or at least not yet, outweighed consumers’ positive feelings about the jobs market or the expansion. Together with May’s consumer sentiment index, we should see consumer spending resume to normal gains this summer."

Earlier this month, the University of Michigan’s preliminary May consumer sentiment index hit a 15-year high of 102.4, while the expectations index was at its highest level since 2004.

Factory activity

Texas factory activity expanded in May at a slower pace, according to the Texas Manufacturing Outlook Survey. The production index dropped to 6.3 from 12.4.

The general business activity index fell to negative 5.3 from positive 2.0, while the company outlook index dropped to negative 1.7 from positive 6.3.

Readings below zero usually indicate contraction, according to the Federal Reserve Bank of Dallas, which conducts the survey.

“The index measuring uncertainty about companies' outlooks jumped nine points to 16.1, its highest reading since last September,” the Fed said. “More than a quarter of firms said uncertainty increased this month.”

"Firms' outlooks deteriorated, with the index turning slightly negative for the first time this year and uncertainty surrounding those outlooks spiking,” said Emily Kerr, Dallas Fed senior business economist. “Several businesses pointed to tariffs, and specifically trade talks with China, as a contributing factor to the increased uncertainty."

Housing

Home prices slowed in March, rising 3.7% on an annual basis, down from 3.9% the month before, according to the S&P CoreLogic Case-Shiller Indices.

“The patterns seen in the last year or more continue: year-over-year price gains in most cities are consistently shrinking,” said David M. Blitzer, managing director and chairman of the S&P index committee. “Other housing statistics tell a similar story. Existing single family home sales are flat. Since 2017, peak sales were in February 2018 at 5.1 million at annual rates; the weakest were 4.36 million in January 2019. The range was 650,000.”

And with the economy doing well, he said, “housing should be doing better.” Low mortgage rates, low inflation and rising wages should translate into a stronger market. “Measures of household debt service do not reveal any problems and consumer sentiment surveys are upbeat,” Blitzer said. “The difficulty facing housing may be too-high price increases,” as home prices are rising at a pace nearly twice the inflation rate.