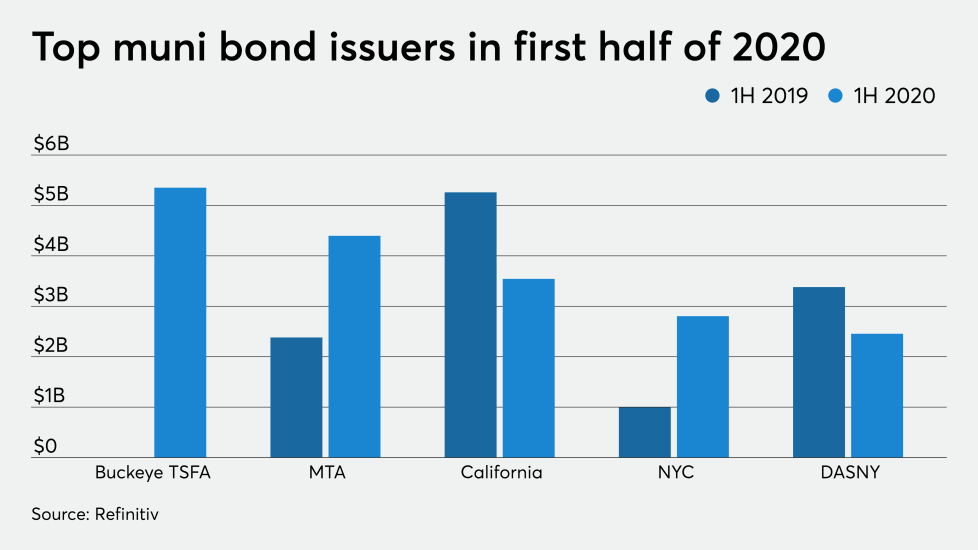

Municipal bond issuers are selling debt at a faster pace than they were at this time last year, even though COVID-19 is still hampering state and local governments. At the halfway point of 2020, the top muni issuers have accounted for $`188.58 billion in 5,105 transactions, compared to the $165.18 billion over 4,654 deals in the same time period of 2019.

Four of the top 10 issuers did not sell any bonds in the second quarter, including two of the top four.