Lynne Funk is Senior Director, Strategy and Content, Live Media - Municipal Finance. She leads and shapes The Bond Buyer's six major events, serving as host, moderator, thought leader and brand ambassador. Lynne also is charged with creating innovative live media formats, including new conferences, virtual summits and podcasts to help serve our municipal finance community. Lynne has nearly two decades of experience in the public finance industry. She was most recently Executive Editor of The Bond Buyer. Previously, she was a director at Municipal Market Analytics, Inc., and in the Policy and Public Advocacy for the Municipal Securities Division at the Securities Industry and Financial Markets Association.

-

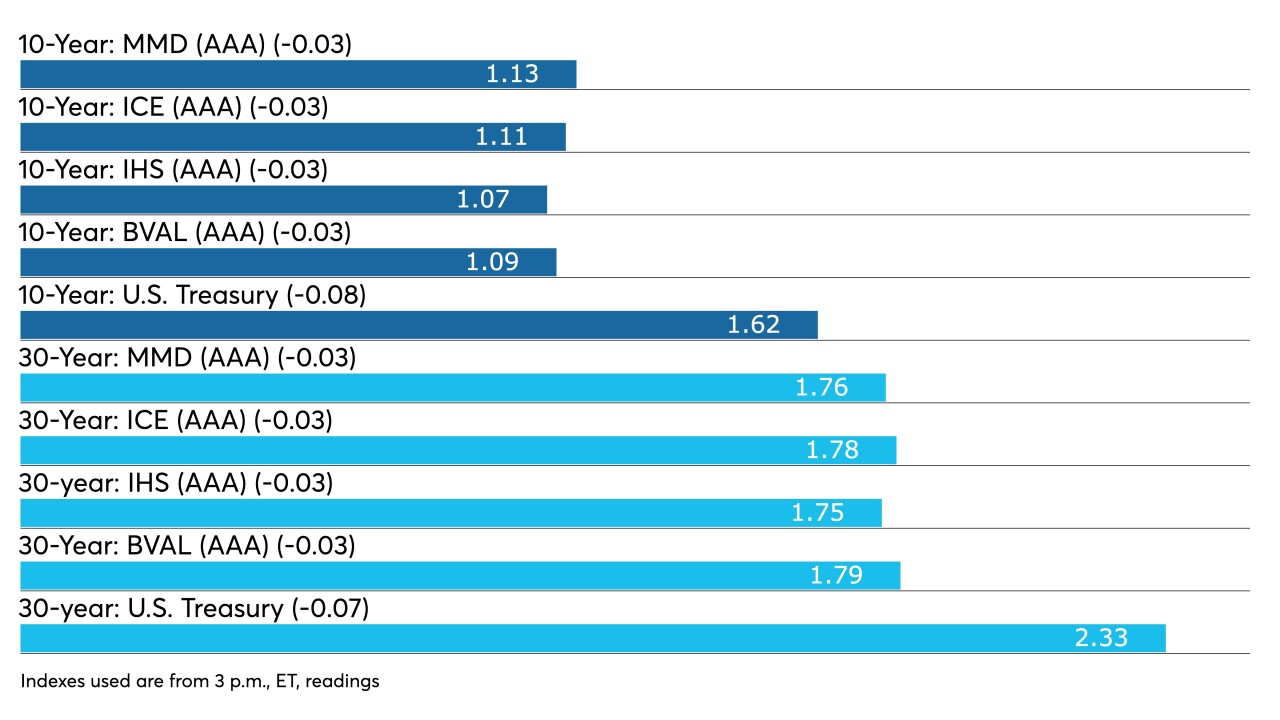

The primary led the secondary to lower yields as UST 10-year fell to lows last seen a week ago. Regional service sector surveys released Tuesday showed improvement, which feeds into the belief that inflation will rise in the near term.

By Lynne FunkMarch 23 -

How the industry weathered the worst public health crisis in over 100 years to bring to market the amount of bonds it did, and to recover as it did, is a testament to its resiliency and its necessity for the state and local governments it serves. Join us for perspectives from industry experts on March 31.

By Lynne FunkMarch 22 -

Exactly one year after record billions were pulled from municipal bond mutual funds and the market was in free fall, municipals followed U.S. Treasuries this week as the markets continued to dismiss the Fed's outlook on inflation and rates.

By Lynne FunkMarch 19 -

Yields jumped as much as 10 basis points as new deals saw some concessions as munis played catch up to the run-up in U.S. Treasury rates after the 10-year hit 1.75% mid-session. Refinitiv Lipper reports nearly $1.3 billion of inflows.

By Lynne FunkMarch 18 -

The rise of machine learning. Continued growth of electronic trading. Intensifying automation. Stephanie Sparvero, Global Head of BVAL Evaluated Pricing at Bloomberg, talks about these issues and more in how the muni market is charting a changing muni landscape. Lynne Funk hosts. (30 minutes)

By Lynne FunkMarch 18 -

The Fed remains dovish, although it raised inflation projections and lowered expected unemployment rates, but most participants still see rates at the zero lower bound in 2023.

By Lynne FunkMarch 17 -

A repricing of Illinois GOs saw the bonds bumped by 12 to 20 basis points from Tuesday's preliminary pricing wires and 17 to 25 basis points from Monday's price talk.

By Lynne FunkMarch 16 -

Municipals largely ignored the moves to higher yields in U.S. Treasuries as participants await the largest new-issue calendar of 2021 and big-name deals out of New York and Illinois.

March 12 -

Inflows return, stimulus set, new deals on fire — the municipal market reaped all the benefits. Initial jobless claims dropped more than expected in the week, as reopening continued slowly, but the total remains higher than any week before the COVID crisis hit.

By Lynne FunkMarch 11 -

Munis were stronger across the curve as secondary trading was constructive and bellwether credits moved yields lower.

March 9 -

Refinitiv Lipper reported $600 million of outflows from municipal bond mutual funds as the market correction caught up. High-yield funds lost a massive $722 million after $330 million a week prior.

By Lynne FunkMarch 4 -

A year after COVID disrupted the markets, Sylvia Yeh and Scott Diamond, co-heads of fixed income at Goldman Sachs Asset Management discuss their strategies for 2021 and the important role of retail, consider the new regime in Washington, and contemplate where ESG fits into their portfolio as the muni market incorporates the burgeoning investor interest in it. Lynne Funk hosts (35 minutes)

By Lynne FunkMarch 4 -

The Beige Book suggests the economy is recovering, with optimism for 6-12 months ahead, while economists don't envision inflation rising enough for the Fed to take action any time soon.

By Lynne FunkMarch 3 -

Institutional pricing of New York City and competitive deals from Baltimore and Cambridge, Mass., should help give a sense of where yields are heading, while Ohio offers up GOs for a market that's been little changed for three days after a large sell-off.

By Lynne FunkMarch 2 -

The sell-off in the back half of February brought negative 1.59% returns for the month and a negative 0.96% return for the year so far. Taxables and high-yields fared slightly better.

By Lynne FunkMarch 1 -

The prominent private university will add $600 million to corporate CUSIP deal numbers that recorded a more than 200% increase last year.

March 1 -

The market took a much-needed breather Friday and U.S. Treasuries pared Thursday's losses to see the 10-year fall 12 basis points to 1.42% and the 30-year 17 basis points to 2.11%. Municipals were steady at 1.14% in 10 years and 1.82% in 30.

By Lynne FunkFebruary 26 -

While issuance fell significantly from 2020, it was higher than January's and only the fifth time in 35 years that volume exceeded $30 billion in February.

By Lynne FunkFebruary 26 -

Municipal bond mutual funds took notice of rate movements with Refinitiv Lipper reporting $37 million of inflows after 15 weeks of multi-billion inflows, the lowest since Dec. 2. High-yield funds took a big hit with $330 million of outflows.

By Lynne FunkFebruary 25 -

Global bond yield move suggests financial markets are much more optimistic about the economy than the Fed.

By Lynne FunkFebruary 24