Municipal bonds traded firmer in the secondary, moving triple-A benchmark yields lower by as much as five basis points out long while new deals saw strong demand in both negotiated and competitive offerings.

Increased demand for attractive ratios and prices on new issues in a post-sell-off environment continued to drive the municipal market on Tuesday, especially with the arrival of bellwether deals from New York City Municipal Water, the Virginia Public Building Authority and the state of Wisconsin.

The higher nominal yields and relative value to Treasuries — 77% on 30-year paper — has given the municipal market a footing and avoided a prolonged selloff, noted John Bonelli, portfolio manager at Franklin Templeton Fixed Income.

Ratios were flat in 10 years while the strength out longer pushed 30-year ratios lower. The muni/UST was at 69% and the 30-year at 75%, according to Refinitiv MMD. ICE Data Services showed ratios at 68% in 10 years and 77% in 30. Bloomberg BVAL had the 10-year at 67% and the 30 at 79%.

Following the correction, Bonelli said, the market tone is positive, though somewhat subdued.

“More attractive nominal yields, ratios, moderate primary supply, and light dealer inventory are all supporting current levels,” he said. “However, continued pressure on Treasuries, and the uncertainty that creates for demand going forward, has resulted in quiet overall trading."

Since mid-February, spot yields in the municipal market 10 years and longer have risen about 45 basis points, while over the same period, Treasury yields have increased less — about 25 basis points on the 10 year and 30 year, he said.

“Coupling these new levels with resilient technical characteristics in the form of moderate supply and continued flows into the market, the overall market outlook remains constructive,” Bonelli said.

Others, like the analysts at BlackRock, are taking a cautious but constructive view on the asset class following the “healthy” market correction.

“While the month of March has been a historically weak seasonal period for muni bonds and we expect rate volatility to continue, the considerable reset of valuations has created a better backdrop for the municipal market, assuming recent performance weakness does not drive a prolonged outflow cycle,” Peter Hayes, head of the municipal bonds group, James Schwartz, head of municipal credit research and Sean Carney, head of municipal strategy, said in a monthly report Tuesday.

Their market viewpoint comes on the heels of rising interest rates that drove negative municipal bond performance in February; recalibrating rich municipal bond valuations and considerably re-setting muni-to-Treasury ratios; and a continued selloff that could create an attractive buying opportunity as markets often overcorrect.

BlackRock manages more than $164 billion of municipal assets.

Municipals in February posted their worst month of performance since the pandemic-induced selloff in March 2020, the analysts wrote. The S&P Municipal Bond Index returned negative 1.36%, driven by rising interest rates resulting from improved COVID metrics, expectations for additional fiscal stimulus, and continued easy monetary policy and optimism for the U.S. economy, the report noted.

“Municipals underperformed Treasuries as historically rich valuations recalibrated and municipal-to-Treasury ratios reset from their recent all-time tight levels,” the authors wrote.

Issuance was modestly elevated in February at $33 billion — 22% above the 5-year average, they noted.

“Initial primary market strength faded mid-month as the emergence of risk-off sentiment and elevated secondary trading weighed on new issues, causing underwriters to show more flexibility in both structure and pricing,” they wrote, noting that the average rate of oversubscriptions fell dramatically from eight times during the first half of the month to just 2.4 times in the second half.

“Retail demand waned as performance turned negative,” the analysts said. “The record muni fund inflows seen in January faded and net flows were flat by the end of February, with long-term and high-yield funds experiencing the bulk of the decline.”

Given the market’s correction and recalibration, the BlackRock team has shifted back to a neutral duration posture within a barbell yield curve strategy — after maintaining short duration for most of the month of February, according to the report.

They are adapting a preferred barbell strategy of zero to five years and 20-plus years — while maintaining an overweight position in higher quality states and essential-service bonds, school districts and local governments supported by property taxes; flagship universities and strong national and regional health systems, and select issuers in the high-yield space.

“We continue to display a preference for lower-rated credits and the more COVID-impacted sectors such as transportation, travel-related, such as hotel tax, airport credits, and health care,” they said.

At the same time, the team is underweight in speculative projects with weak sponsorship, unproven technology or unsound feasibility studies; senior living and long-term care facilities; and small colleges, student housing and single-site hospitals.

Bonelli said demand, especially for lower-rated bonds offering more spread, is strong at these new levels. Separately managed account buyers and banks have been active in the intermediate space, in particular, he noted.

“Given that a true outflow cycle did not accompany the recent volatility, traditional buyers should continue to have appetite at these more attractive levels,” Bonelli said. “The overall demand story is bolstered by tepid supply in both the primary market and in secondary offerings,” he added.

Going forward, buy side experts are optimistic about an advantageous climate for the market ahead.

“Given our view that markets tend to overcorrect, a continued sell-off could create an attractive buying opportunity,” the BlackRock analysts said.

Bonelli agreed. “Supportive technical characteristics remain intact as the fundamental credit picture has not been altered,” he said. “If demand remains strong, as it has been all this year, these higher yields and more attractive muni/Treasury ratios should actually improve the tone of the market.”

“In general, the recent correction provided a needed breather and reset to a market that had experienced an uninterrupted run to extremely low yields and historically tight ratios,” Bonelli added.

Primary market

Loop Capital Markets priced for retail investors $583 million of water and sewer system second general resolution revenue bonds for the New York City Municipal Water Finance Authority (Aa1/AA+/AA+/). Bonds in 2025 with a 5% coupon yield 0.53%, 5s of 2026 ($119 million, the largest tranche) yield 0.68%, 5s of 2031 at 1.42%, bonds in 2036 were not offered to retail, 3s of 2038 priced to yield 2.17%.

The Virginia Public Building Authority (Aa1/AA+/AA+/) sold $264.8 million serial revenue bonds to BofA Securities. Bonds in 2022 with a 5% coupon yield 0.08%, 5s of 2026 at 0.54%, 5s of 2031 at 1.21%, 5s of 2033 at 1.31%. BofA Securities also won $275 million of Series A-2. Bonds in 2034 with a 4% coupon yield 1.40%, 4s of 2036 at 1.54%, 2s of 2041 at 2.14%.

FHN Financial priced $246 million of unlimited tax school building bonds insured by the Texas Permanent School Fund for Wichita Falls, Texas, Independent School District (AAA/AA-//). Bonds in 2022 with a 3% coupon yield 0.13%, 4s of 2026 at 0.60%, 4s of 2031 at 1.30%, 3s of 2036 at 1.71%, 3s of 2041 at 1.91%, 3s of 2046 at 2.06% and 2.375s of 2051 at 2.41%.

Morgan Stanley priced $179 million of transportation revenue bonds for the state of Wisconsin (/AA+/AA+/AAA). Bonds in 2023 with a 5% coupon yield 0.11%, 5s of 2026 at 0.48%, 5s of 2031 at 1.19%, 4s of 2036 at 1.54% and 3s of 2041 at 1.96%.

Secondary market

Trading showed stronger prints along the yield curve.

Texas GO 5s of 2025, traded at 0.45%-0.43%. Virginia Public School Building Authority 5s of 2025 at 0.43%. Utah 5s of 2025 at 0.35%. Maryland 5s of 2027 at 0.64%-0.63%.

Houston Port Authority 5s of 2032 at 1.28%-1.27% versus 1.29%-1.23% Friday and 1.32% Thursday. New York City GO 5s of 2034 traded at 1.63% versus 1.70%-1.67% Monday and 1.87% original.

Portland, Oregon, 2s of 2035 at 1.78%-1.77%. Baltimore County 5s of 2036 at 1.38% versus 1.46%-1.41% Thursday.

Washington GO 5s of 2038 at 1.51%-1.44% versus 1.63%-1.61% Thursday. New York City TFA 4s of 2038 at 2.01%-1.97%. District of Columbia income tax 5s of 2040 traded at 1.53% versus 1.61% Thursday.

New York City GO 5s of 2044 at 2.16%-2.15% versus 2.18% Monday. Texas water 4s of 2045 at 1.76%-1.75% versus 1.86%-1.85% a week ago.

Washington GO 5s of 2046 at 1.82%-1.81% versus 1.88% Monday.

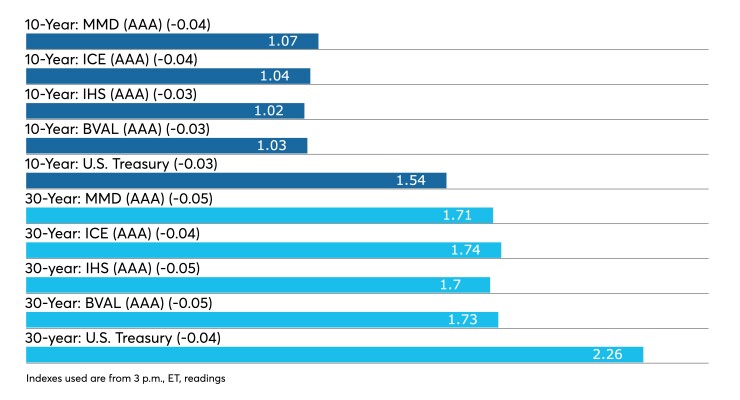

High-grade municipals were stronger across the curve, according to Refinitiv MMD. Short yields remained steady at 0.08% in 2022 but fell two basis points to 0.11% in 2023. The 10-year fell four basis points to 1.07 and the 30-year fell five basis points 1.71%, respectively.

The ICE AAA municipal yield curve showed short maturities at 0.07% in 2022 and 0.12% in 2023. The 10-year fell three basis points to 1.04% while the 30-year yield fell four to 1.74%.

The IHS Markit municipal analytics' AAA curve showed yields fall two basis points to 0.06% in 2022 and 0.11% in 2023 with the 10-year at 1.02%, and the 30-year at 1.70%, both four basis points lower.

The Bloomberg BVAL AAA curve showed yields at 0.06% in 2022 and at 0.10% in 2023, down two, while the 10-year fell three to 1.03%, and the 30-year yield fell five to 1.73%.

The 10-year Treasury ended at 1.54% and the 30-year Treasury was yielding 2.26% at the close. The Dow was up 197 points while the S&P 500 rose 1.95% and the Nasdaq rose 4.22%.

Economy

Small business optimism improved in February, but remains below its 47-year average, the National Federation of Independent Business said Tuesday.

“Small business owners worked hard in February to overcome unexpected weather conditions along with the ongoing COVID-19 pandemic,” according to NFIB Chief Economist Bill Dunkelberg. “Capital spending has been strong, but not on Main Street. The economic recovery remains uneven for small businesses, especially those still managing state and local regulations and restrictions. Congress and the Biden administration must keep small businesses a priority as they plan future policy legislation.”

“Owners expecting better business conditions over the next six months increased four points to a net negative 19%, a poor reading,” according to the report.

While most respondents said they tried to hire or hired employees in February, 40% had openings they couldn’t fill, up from the previous survey.

Separately, Fitch Ratings said the $1.9 trillion American Rescue Plan will boost the economy, but create a bigger deficit and more federal debt.

Still to come are an infrastructure plan, which Fitch believes will be paid for over the course of years, and tax hikes, which could offset some spending increases.

By fiscal 2023, Fitch estimates spending will be more typical, but by then debt will probably “exceed 130% of GDP and be on a gradual upward trajectory under relatively benign economic assumptions. However, without a fiscal anchor and in light of the ambitions of the administration, fiscal policy may be more expansionary, leading debt to rise more rapidly.”

Morgan Stanley researchers expect rising inflationary pressure, “and not all will prove transient.”

The inflation from “reopening-sensitive sectors is likely to prove transient,” but they see “more sustainable” price pressure in shelter, healthcare services, “and a multi-quarter passthrough of dollar weakness into goods” this year. “The sustainable inflation impulse intensifies in 2022 as cyclically sensitive inflation components start to dominate – based on a tightening labor market and robust levels of demand.”

Primary market

California is set to price $1.9 billion of general obligation bonds Thursday with BofA Securities running the books. Serials and term bonds structured as $881 million of Series 1 bonds and $970.9 million in a refunding series.

A $417 million Massachusetts Port Authority deal of serial and term revenue bonds scheduled for pricing by Citigroup on Wednesday.

The deal is made up of $359.1 million of Series 2021E bonds subject to the alternative minimum tax with serials in 2024 to 2041 and term bonds in 2046 and 2051. The Series 2021 D non-AMT bonds are $57.7 million of serials from 2024 to 2041 and terms in 2046 and 2051.

Wisconsin is set to price $313 million of transportation revenue and taxable refunding bonds in a serial and term structure of slated for pricing on Wednesday by Morgan Stanley & Co.

A $296 million Union County, North Carolina, serial and term revenue bond issue with serials maturing from 2023 to 2051 is slated to be priced by Baird on Wednesday.

A $254.9 million city and county of San Francisco taxable GO bonds issue is slated for pricing by Morgan Stanley on Thursday.

The California School Finance Authority will sell $237 million of state aid intercept notes in a structure that includes $79 million of Series A1 tax-exempt paper; $126.9 million of Series A2 and $37.2 million of Series B, both taxable notes. The deal will be priced by RBC Capital Market on Wednesday.

The Jackson Laboratory will sell $203 million of taxable corporate CUSIP bonds in a deal being priced by Barclays Capital Inc. on Wednesday.

The Clifton Higher Education Finance Corp. will sell $195.6 million of taxable variable rate education revenue bonds insured by the Texas Permanent School Fund Guarantee program and structured as a 2050 bullet through Baird.

The Board of Regents of the Texas A&M University System will sell $173,8 million of revenue financing system bonds in Series 2021A as serial bonds from 2022 to 2041 and term bonds in 2046 and 2051. The deal will be negotiated by RBC Capital Markets on Thursday.

The San Diego County Regional Transportation Commission, meanwhile, will sell $169.7 million of sales tax revenue bonds, limited tax bonds, in a taxable refunding Series 2021 maturing from 2025 to 2039. Wells Fargo Securities will price the offering on Wednesday.

The California Community Housing Agency is set to price $161.5 million of essential housing revenue bonds on Wednesday priced by Jefferies.

Howard University is selling $152.7 million of taxable corporate CUSIP bonds in a deal priced by Barclays.

A $148.1 million sale of taxable GO refunding bonds by the Southwestern Community College District is slated for pricing by Morgan Stanley on Wednesday.

The San Mateo-Foster School District will sell $145 million of Series A and B GO bonds priced by RBC Capital.

The Ohio Water Development Authority is set to price $100 million of drinking water assistance fund revenue bonds in Series 2021 A serials from 2030 to 2034 and terms from 2035 to 2039 priced by Huntington Securities Inc.

In the competitive market, Anne Arundel County, Maryland (Aa1/AAA//), selling GOs on Wednesday consisting of $110.1 million of consolidated general improvement Series 2021 and $47.3 million consolidated water and sewer Series 2021 at 10:15 and 10:45 a.m., respectively.

Las Vegas (Aa1/AA//) will sell $219.6 million of GO limited tax water refunding bonds, serials 2022-2034 at 11 a.m. on Wednesday.

Omaha, Nebraska, Public School District #001 (Aa2/AA//) will sell $140 million of unlimited tax GOs at 11:15 a.m. Wednesday. Serials 2025-2043.

The New York City Education Construction Fund will sell $100.9 million of revenue bonds in Series 2021 A, serials 2022-2041, at 11 a.m. on Thursday.

Arkansas (Aa1/AA//) is set to sell $268.8 million of general obligation bonds, serials 2022-2023, at 11 a.m. Thursday.

Illinois announced Monday tentative plans to sell $1 billion in new money tax-exempt general obligation bonds March 17.

Most of the borrowing would go to pay for projects under the state's multi-year Rebuild Illinois capital program approved in 2019 with a small piece also providing proceeds for an ongoing pension buyout program, said Office of Management and Budget spokeswoman Carol Knowles.

The state is watching the market and could include an additional refunding piece. Morgan Stanley has the books and Columbia Capital Management LLC is advisor. The offering statement is expected to post Tuesday.

Gary Siegel contributed to this report.