Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

California headlined the top 10 issuers in the first three quarters of 2023.

October 10 -

While the market broadly is still in the early stages of using artificial intelligence, more firms are starting to implement it, panelists said at MuniTech NYC, an event hosted by Munichain and Spline Data that brought together a gathering of technology-focused market participants.

October 6 -

All eyes will be on Friday's report, though "it seems most leading indicators suggest job growth will remain healthy, which should keep the bond market selloff going strong," said OANDA's Edward Moya.

October 5 -

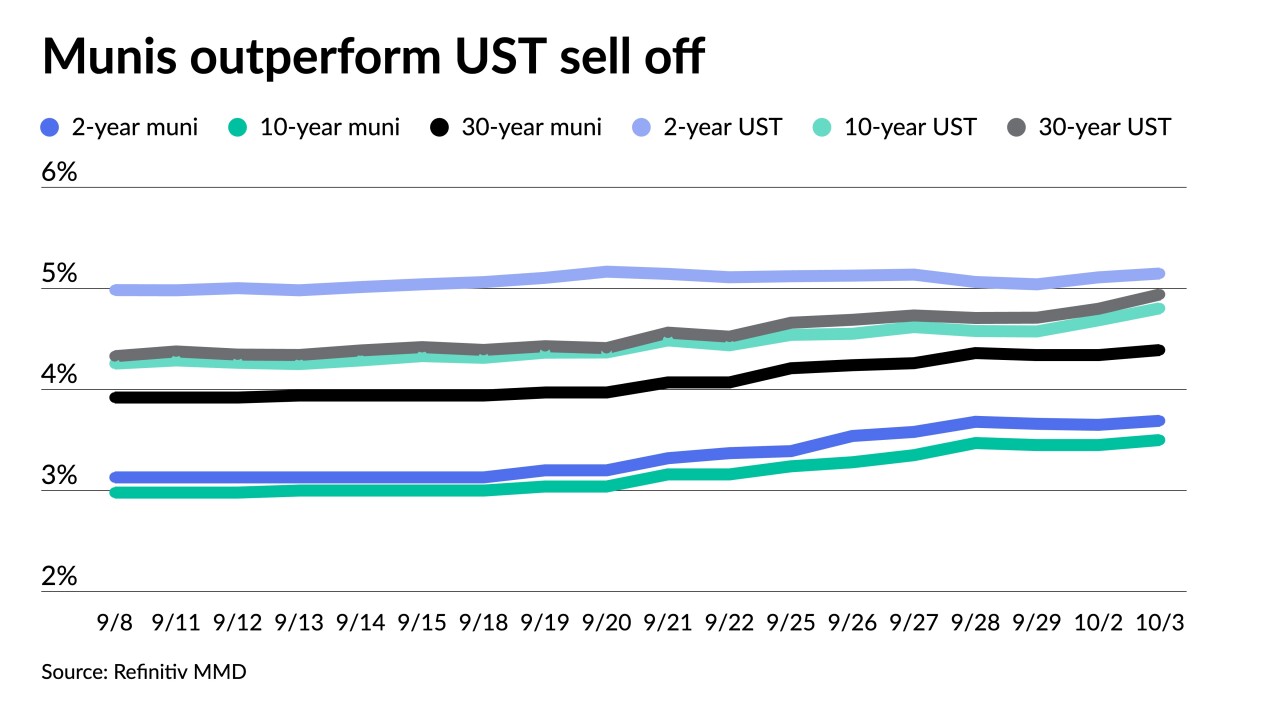

Municipal yields fell up to three basis points, depending on the scale, but underperform a better UST market.

October 4 -

UST rates are driving all things in the muni market, said Jon Mondillo, head of North American Fixed Income at abrdn.

October 3 -

This comes as the firm shores up its presence in Texas.

October 3 -

There will be "choppiness in the municipal bond market through the end of the year," said Anders S. Persson, Nuveen's chief investment officer for Global Fixed Income, and Daniel J. Close, Nuveen's head of municipals.

October 2 -

The Bloomberg Municipal Index and High-Yield Index lost 3.3% and 3.9%, respectively, in September.

September 29 -

September's total volume ticked up 1.2% to $27.585 billion in 531 issues from $27.251 billion in 592 issues a year earlier. However, the month's total is lower than the $30.652 billion 10-year average, according to Refinitiv data.

September 29 -

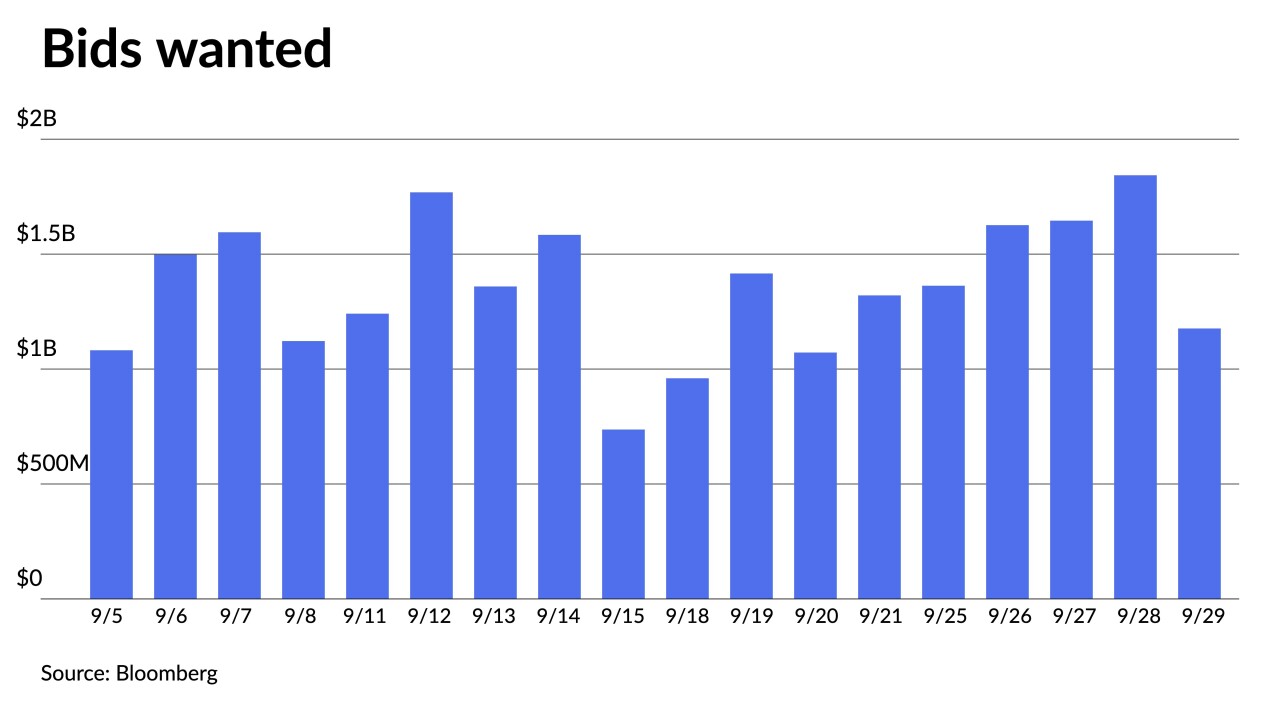

The last time muni mutual funds saw outflows top $1 billion was the week ending May 31 when they were $1.345 billion.

September 28 -

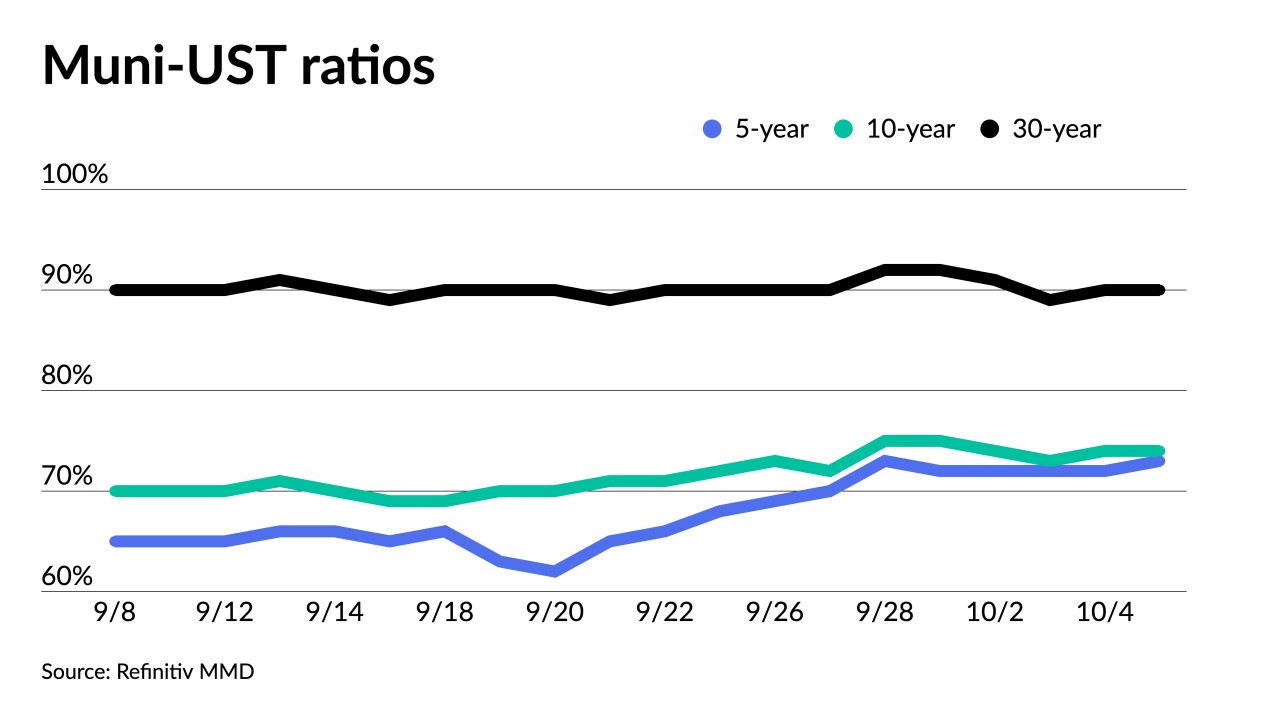

"The market has taken to heart the [Federal Open Market Committee] actions from last week," said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

September 27 -

Yields have "risen substantially over the last week as the market seeks to find at least a minor level of balance or equilibrium," said Tom Kozlik, managing director and head of public policy and municipal strategy at HilltopSecurities.

September 26 -

Data for the second quarter show the face amount of munis outstanding rose 0.4% quarter-over-quarter, or $15.5 billion, to $4.043 trillion.

September 26 -

The Texas Water Development Board leads the new-issue calendar with $1 billion of revenue bonds.

September 22 -

The general bias toward muni rates is that they would be a bit higher with technicals "being a little less supportive than they were in August, plus what we heard with from the Fed 'higher for longer,' and potentially another hike," said Jeff MacDonald, head of Fixed Income Strategies at Fiduciary Trust International.

September 21 -

As was expected, the FOMC held rates in a range between 5.25% and 5.50%, but the dot plot in the Summary of Economic Projections showed 12 of 19 members expect another 25-basis-point rate hike this year.

September 20 -

Fund flows "should be moving along a more positive trajectory, but they have yet to do so with munis unable to break free of the Treasury market's tight grip," Oppenheimer's Jeff Lipton said.

September 19 -

Refinitiv Lipper reported $116.737 million was pulled from municipal bond mutual funds for the week ending Wednesday after $798.474 million of outflows from the funds the previous week.

September 14 -

There hasn't been a huge return of capital in the muni market so far this year, with fund flows being rather anemic, said Chad Farrington, co-head of municipal bond strategy at DWS Group.

September 13 -

"One of the things that my parents said to me early on in my life is, 'If you have the will to do something, you can make it happen,'" Prachi Chandhok said.

September 13