Municipals were weaker Tuesday as triple-A yields rose in sympathy with U.S. Treasuries. Equities ended the session down ahead of the close of the Federal Open Markets Committee meeting Wednesday.

Triple-A yields were cut two to seven basis points, depending on the scale, while UST yields rose four to six basis points, pushing the two-, three-, five- and 10-year yields to multi-year highs.

The two-year muni-to-Treasury ratio Tuesday was at 63%, the three-year was at 64%, the five-year at 66%, the 10-year at 70% and the 30-year at 90%, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the two-year at 64%, the three-year at 65%, the five-year at 66%, the 10-year at 70% and the 30-year at 91% at 4 p.m.

The new-issue primary calendar is light this week, as is the usual during Federal Open Market Committee meeting weeks, and most market participants expect the Fed to hold rates this week.

"There simply is no compelling argument for the Fed to lift rates further at this time given that the current tightening cycle has already advanced the funds rate by 525 basis points throughout the past 18 months with the full effects yet to be realized, the inflationary grip is receding, and although slowing, the economy remains relatively well-anchored with a strong, albeit cooling, labor market," said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

Market stakeholders, though, are "more interested in the revised Summary of Economic Projections that will be released with the accompanying statement as well as in Chair [Jerome] Powell's performance in his post-FOMC press conference,

Despite the Fed holding rates this week, it may leave the door open for one more rate hike this year, said Cooper Howard, a fixed-income strategist at Charles Schwab.

While inflation has been trending lower, he said "the Fed will believe the fear of doing too little and reigniting inflation will outweigh the risk of doing too much and tipping the economy into a recession."

There is around a 45% probability of an additional rate hike this year, but he believes that is too low.

Elsewhere, Lipton said there is "ample deployable cash that is eager to get invested in munis."

"Investor apprehension, however, seems to reflect the ongoing uncertainty over the rate environment with muni outflows being

"While we could conveniently espouse the wisdom of making allocations into munis given the credit quality, tax-efficient, defensive, and diversification attributes of the asset class, investment timing may not always be perfect, and one must consider not only currently available absolute yield levels, but also relative value relationships," Lipton said.

With ultra-short UST yields offering 5-handle opportunities, he said "the competitive footing for tax-exempts may understandably lose some ground, particularly if taxable equivalent yield calculations fail to inspire."

Given the aforementioned investment characteristics of munis "along with compelling yield and income opportunities, fund flows should be moving along a more positive trajectory, but they have yet to do so with munis unable to break free of the Treasury market's tight grip," Lipton noted.

Investors have continued to pull money from muni mutual funds over the past several weeks, with five of the last seven weeks seeing net outflows, according to Refinitiv Lipper.

"Although the dollars involved are not overly concerning, the trend in investor dollars departing a safe and attractively priced product is," said Matt Fabian, a partner at Municipal Market Analytics.

The one exception has been MUB, which has "printed nearly $2 billion of net share creations in the last three weeks," he noted.

This exceeds the cumulative net creation total for ETFs for the prior 39 weeks, he said.

"The suggestion is that investors, satisfied with shorter-maturity or non-municipal alternatives right now, are only willing to commit to tax-exempts where costs are low and assumed liquidity (at least at the investor level) are assumed to be high," Fabian said.

Another worry is that five of the last six weeks have seen tax-exempt yields rise with the weekly total of traded par greater than $60 billion, he noted.

This, he said, further validates price discovery and/or related sector weakness.

The customer selling side of things rather than buying is driving the increased par total, according to Fabian.

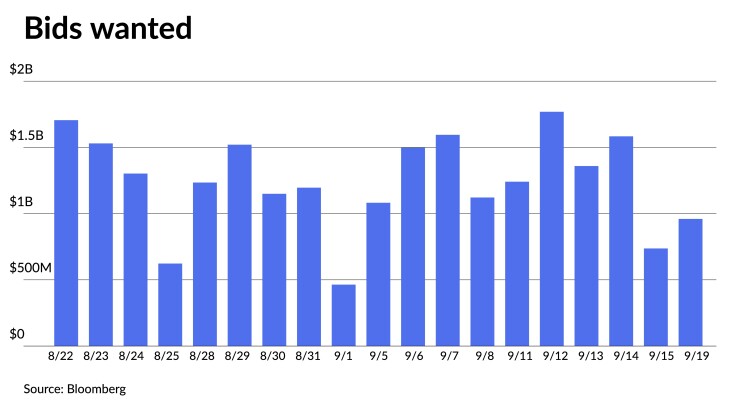

Bloomberg's daily bids wanted is averaging $1.2 billion month-to-date, 14% higher than the first half of August, he said.

Lastly, he said the "expected 30-day ahead reinvestment demand remains more comparable to last year than the much stronger episodes in 2020 or 2021 when heavy pandemic-era scoop-and-toss/call activity was pushing dollars back into investor hands."

There are some positives, including "attractive yields (in particular versus taxable alternatives and ahead of potential expiration of [Tax Cuts and Jobs Act] tax rate cuts in 2025), a prevalence of defensive coupons in the primary market, resilient (if not necessarily constructive) credit trends, and overall new issue scarcity," he said.

This suggests that if the negatives above accelerate into a correction, Fabian said "municipal value will be that much more available."

In the primary market Tuesday, Goldman Sachs priced for Philadelphia (A1/AA/A+/) $564.835 million of water and wastewater revenue bonds, Series 2023B, saw 5s of 9/2024 at 3.42%, 5s of 2028 at 3.19%, 5s of 2033 at 3.34%, 5s of 2038 at 3.89%, 5s of 2043 at 4.24%, 4.5s of 2048 at 4.65% and 5.5s of 2053 t 4.49%, callable 9/1/2033.

BofA Securities priced for Massachusetts (Aa1/AAA//AAA/) $500 million of Rail Enhancement Program Commonwealth Transportation Fund revenue bonds. The first tranche, $300 million of sustainability bonds, 2023 Series A, saw 5s of 6/2053 at 4.34%, callable 6/1/2033.

The second tranche, $200 million of bonds, 2023 Series B, saw 5s of 6/2047 at 4.22%, 5s of 2048 at 4.25% and 5s of 2051 at 4.31%, callable 6/1/2033.

Citigroup Global Markets priced for the Washington State Housing Finance Commission (/BBB//) $328.165 million of social municipal certificates, Series 2023-1, Class A, saw 3.375s of 4/2037 at 5.067%.

Citigroup Global Markets also priced for the commission $328.165 million of partially tax-exempt social municipal certificates, Series 2023-1, Class X, with 1.447s of 4/2037 at 7.61%.

Siebert Williams Shank & Co. priced for the New Jersey Educational Facilities Authority (A2/A-/A/) $262.765 million of revenue bonds. The first tranche, $185.220 million of Higher Education Capital Improvement Fund issue, Series 2023A, saw 5s of 9/2024 at 3.55%, 5s of 2028 at 3.41%, 5s of 2033 at 3.64%, 5s of 2038 at 4.11%, 5s of 2043 at 4.43%, 4.625s of 2048 at 4.75% and 5.25s of 2053 at 4.56%, callable 2/1/2033.

The second tranche, $77.545 million of Higher Education Equipment Leasing Fund Program issue, Series 2023A, saw 5s of 9/2024 at 3.55%, 5s of 2028 at 3.41% and 5s of 2033 at 3.64%, noncall.

Ramirez & Co. priced for the Minneapolis-St. Paul Metropolitan Commission (/A+/A+/) $162.925 million of subordinate airport revenue refunding bonds. The first tranche, $154.630 million of governmental/non-AMT bonds, Series 2023A, saw 5s of 1/2025 at 3.36%, 5s of 2028 at 3.16%, 5s of 2033 at 3.32% and 5s of 2035 at 3.42%, callable 1/1/2033.

The second tranche, $8.295 million of private activity/AMT bonds, Series 2023B, saw 5s of 1/2025 at 3.91% and 5s of 2026 at 3.89%, noncall.

Secondary trading

Washington 5s of 2024 at 3.37%. California 5s of 2024 at 3.23% versus 3.22% Thursday. Minnesota 5s of 2025 at 3.23%.

Ohio 5s of 2027 at 3.08%. Michigan Trunk Line 5s of 2028 at 3.11%-3.09%. Massachusetts 5s of 2029 at 3.00%.

Ohio 5s of 2032 at 3.14% versus 3.10% original on Thursday. NYC 5s of 2033 at 3.31% versus 3.32% Thursday. California 5s of 2034 at 3.19% versus 3.15% on 9/13 and 3.15% on 9/11.

Metropolitan Water District of Southern California 5s of 2048 at 3.90% versus 3.92% Monday and 3.86% Thursday. NYC TFA 5s of 2048 at 4.36%-4.37% versus 4.33%-4.32% Thursday.

AAA scales

Refinitiv MMD's scale was cut three to seven basis points: The one-year was at 3.30% (+5) and 3.20% (+7) in two years. The five-year was at 2.98% (+5), the 10-year at 3.04% (+4) and the 30-year at 3.97% (+3) at 3 p.m.

The ICE AAA yield curve was cut up two to three basis points: 3.32% (+2) in 2024 and 3.23% (+3) in 2025. The five-year was at 2.98% (+3), the 10-year was at 3.01% (+2) and the 30-year was at 3.99% (+2) at 4 p.m.

The S&P Global Market Intelligence (formerly IHS Markit) municipal curve was cut four to six basis points: 3.31% (+5) in 2024 and 3.20% (+6) in 2025. The five-year was at 2.99% (+5), the 10-year was at 3.04% (+4) and the 30-year yield was at 3.97% (+4), according to a 3 p.m. read.

Bloomberg BVAL was cut two to five basis points: 3.29% (+3) in 2024 and 3.20% (+2) in 2025. The five-year at 2.94% (+3), the 10-year at 2.98% (+5) and the 30-year at 3.95% (+3) at 4 p.m.

Treasuries were weaker.

The two-year UST was yielding 5.104% (+4), the three-year was at 4.791% (+5), the five-year at 4.518% (+6), the 10-year at 4.364% (+5), the 20-year at 4.614% (+4) and the 30-year Treasury was yielding 4.428% (+4) near the close.

NYC Waters to sell $630M next week

The New York City Municipal Water Finance Authority said it will issue about $630 million of tax-exempt fixed-rate bonds next week.

Proceeds will be used to fund improvements to the city's water and sewer system and refund some outstanding water bonds.

An underwriting syndicate led by joint senior managers Raymond James and Blaylock Van are expected to price the bonds on Sept. 27, after a one-day retail order period.

Barclays, BofA Securities, Goldman Sachs, Loop Capital Markets, Siebert Williams Shank, and UBS are co-senior managers on the deal.

Primary market to come:

The San Diego Unified School District is set to price Wednesday $670 million of dedicated unlimited ad valorem property tax GOs, consisting of $23.655 million of taxable green Election of 2018 bonds (Aa2///), Series G-1, serial 2024; $51.345 million of green Election of 2018 bonds (Aa2//AAA/AAA/), Series G-2, serials 2024-2028; $275 million of green Election of 2018 bonds (Aa2//AAA/AAA/), Series G-3, serials 2024-2043, terms 2048 and 2053; $16.435 million of taxable sustainability Election of 2022 bonds (Aa2///), Series A-1, serial 2024; $8.565 million of sustainability Election of 2022 bonds (Aa2//AAA/AAA/), Series A-2, serials 2024-2028; and $295 million of sustainability Election of 2022 bonds (Aa2//AAA/AAA/), Series A-3, serial 2048, term 2053. Citigroup Global Markets.

The Patriots Energy Group Financing Agency (A1///) is set to price next week $578.720 million of gas supply revenue bonds, consisting of $567 million of tax-exempt bonds, Series 2023A-1, and $13 million of taxable bonds, Series 2023A-2. Goldman Sachs.

Competitive:

Cape May County, New Jersey (Aa1///), is set to sell $96 million of GOs at 11 a.m. eastern Wednesday.