After selling off late last week and at the start of the week, the municipal market continued to weaken but with smaller cuts to AAA scales amid an active primary market. U.S. Treasury yields rose, and equities ended mixed.

The two-year muni-to-Treasury ratio Wednesday was at 70%, the three-year was at 70%, the five-year at 70%, the 10-year at 72% and the 30-year at 90%, according to Refinitiv Municipal Market Data's 3 p.m., ET, read. ICE Data Services had the two-year at 70%, the three-year at 71%, the five-year at 70%, the 10-year at 73% and the 30-year at 91% at 4 p.m.

Muni yields rose one to five basis points, depending on the curve. UST yields rose one to seven basis points.

"The market has taken to heart the [Federal Open Market Committee] actions from last week," said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

The Fed opted to hold rates steady but indicated rates would be higher for longer and many market participants think the central bank has one remaining rate hike before year-end.

"The bigger issue, and what is serving to upset the market is this notion of there's not going to be any near-term pivot in policy," he said.

Possible rate cuts, which if they happen will occur in the back half of 2024, are driving the market right now.

"It's not so much that there may be another 25 basis point rate hike, but rather the idea that any pivot to an easing policy is not happening anytime soon," he said.

"It's been a 'shock and awe moment' in terms of rising rates, with the catalyst being the Fed, which continues to signal one more hike, compounding with the fact of quarter end and window dressing in terms of balance sheets, and the need for liquidity," said James Pruskowski, chief investment officer at 16Rock Asset Management.

New issues of "what's left to price have been done so at a concession," he said.

Munis are "rising to levels that now compete with other asset classes for the marginal dollar, even though that taxable equivalent yields are quite generous," Pruskowski said.

This, he said, has nothing to do with the fundamental backdrop even though "that is deteriorating, as most seen recently by the Philly Fed Coincident Index and various other measures."

It's a "big liquidity squeeze" and repricing at the term premium that has left the market a little on shaky grounds, Pruskowski noted.

Furthermore, with the market taking "this idea of 'higher for longer' to heart," Lipton said that is creating for munis "an even more discouraging environment for many traditional institutional buyers, such as banks and insurance companies."

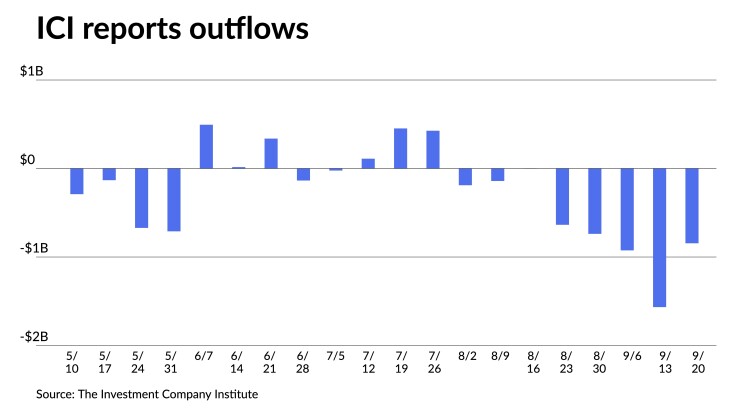

Meanwhile, fund flows continue to be "decidedly negative," according to Lipton.

The Investment Company Institute Wednesday reported investors pulled $845 million from municipal bond mutual funds in the week ending Sept. 20 after $1.566 billion of outflows the previous week. For the most recent reporting week, ETFs saw inflows of $462 million after $852 million of inflows the week prior, according to ICI.

Tax-exempt municipal money market funds also saw outflows for the second consecutive week as $589.4 million was pulled the week ending Monday, bringing the total assets to $114.94 billion, according to the Money Fund Report. The seven-day simple yield reset rose to 3.58%.

Market participants had initially hoped there would be evidence of emerging inflows into mutual funds by now. Still, investors keep pulling money from the funds, even if they are starting to stabilize, according to Pruskowski.

There is a substantial amount of redemptions, which is somewhat a surprise, but "given the current uncertainty over the rate environment, that is to be expected," Lipton said.

Taken together, this creates hesitation from the investor community, both retail and institutional investors.

"For relative value relationships, certainly out on the long end, we are seeing better value, and we are certainly a lot closer to fair value than we had been in the recent past," he said. "But, it doesn't seem to be enough to engage the investor community."

For investors to become more committed, and demonstrate more certainty, he said they need to see "clear evidence" that the economy is slowing down and inflation is under even "greater control."

Investors are looking for "signals that perhaps a Fed pivot to easing policy may come about sooner than currently anticipated," he said.

As long as rates "stay where they are, we don't exactly have the most favorable conditions for certain cohorts within institutional investor community to jump in with both with both feet," Lipton added.

In the primary market Wednesday, Wells Fargo Bank priced and repriced for the Texas Water Development Board (/AAA/AAA/) $1.016 billion of state water implementation revenue fund bonds, with yields falling up to 13 basis points. The first tranche, $1.011 billion of tax-exempts, Series 2023A, was repriced and saw 5s of 4/2024 at 3.72% (-5), 5s of 10/2024 at 3.72% (-5), 5s of 4/2028 at 3.48% (-4), 5s of 10/2028 at 3.46% (-6), 5s of 4/2033 at 3.63% (-2), 5s of 10/2033 at 3.63% (-3), 5s of 10/2038 at 4.09% (-8), 4.75s of 10/2043 at par, 4.875s of 10/2048 at par, 5.25s of 10/2051 at 4.62% (-5) and 5s of 10/2058 at 4.82% (-13), callable 10/15/2033.

The second tranche, $5.080 million of taxables, Series 2023B, was preliminarily priced and saw all bonds priced at par: 5.55s of 10/2024, 5.125s of 10/2028, 5.35s of 10/2033, 5.75s of 10/2038, 5.85s of 10/2043 and 5.95s of 10/2053, callable 10/15/2033.

Morgan Stanley priced for the Florida Development Finance Corp. $770 million of AMT Brightline Florida Passenger Rail Expansion Project revenue bonds, Series 2023C, with 8s of 7/2057 with a mandatory tender date of 4/1/2024 at 8.08%.

Raymond James & Associates priced and repriced for institutions $693.900 million of water and sewer system second general resolution revenue bonds, Fiscal 2024 Series AA from the New York City Municipal Water Finance Authority (Aa1/AA+/AA+/), which saw yields cut two to six basis points from Tuesday's retail offering. The first tranche, $262.145 million of Series AA-1, saw 5.25s of 6/2053 at 4.71% (+6) and 5s of 2053 at 4.76% (+6), callable 12/15/2033.

The second tranche, $164.380 million of Series AA-2, saw 5s of 6/2030 at 3.51% (+5), callable 12/15/2028, and 5s of 2035 at 3.74% (+5), callable 12/15/2033.

The third tranche, $214.960 million of Series AA-3, saw 5s of 6/2034 at 3.62% (+4), make whole call; 5s of 2043 at 4.48% (+2), callable 12/15/2033; and 5.25s of 2048 at 4.64% (+6), callable 12/15/2033.

Goldman Sachs preliminarily priced for the California State Public Works Board (Aa3/A+/AA-/) $634.095 million of various capital projects lease revenue refunding bonds, 2023 Series C, with 5s of 2024 at 3.62%, 5s of 2028 at 3.51%, 5s of 2033 at 3.61% and 5s of 2038 at 4.02%, callable 9/1/2033.

Siebert Williams Shank & Co. priced for the Wayne County Airport Authority (A1/AA/A/AA+/) on behalf of the Detroit Metropolitan Wayne County Airport $369.930 million of airport revenue bonds. The first tranche, $105.225 million of non-AMT bonds, Series 2023A, saw 5s of 12/2026 at 3.65%, 5s of 2028 at 3.61%, 5s of 2033 at 3.79%, 5.25s of 2038 at 4.26%, 5.25s of 2043 at 4.58% and 5.25s of 2048 at 4.78%, callable 12/1/2033.

The second tranche, $78.325 million of AMT bonds, Series 2023B, saw 5s of 12/2026 at 4.28%, 5s of 2028 at 4.25%, 5s of 2033 at 4.40%, 5.25s of 2038 at 4.75%, 5.5s of 2043 at 4.91% and 5.5s of 2048 at 5.05%, callable 12/1/2033.

The third tranche, $139.150 million of non-AMT refunding bonds, Series 2023C, saw 5s of 12/2024 at 3.81%, 5s of 2028 at 3.61%, 5s of 2033 at 3.79%, 5.25s of 2038 at 4.26% and 5.25s of 2042 at 4.55%, callable 12/1/2033.

The fourth tranche, $18.520 million of AMT refunding bonds, Series 2023D, saw 5s of 12/2024 at 4.40%, 5s of 2028 at 4.25%, 5s of 2033 at 4.40% and 5.25s of 2037 at 4.69%, callable 12/1/2033.

The fifth tranche, $28.710 million of AMT refunding bonds, Series 2023E, saw 5s of 12/2028 at 4.25%, noncall.

BofA Securities priced for the Pennsylvania Economic Development Financing Authority (/A-//) $150 million of solid waste disposal revenue bonds, with 4.6s of 12/2046 with a mandatory tender date of 10/1/2026 at par.

J.P. Morgan priced for the San Francisco Public Utilities Commission (/AA/AA-/) $121.600 million of power revenue bonds, 2023 Series A, with 5s of 11/2026 at 3.25%, 5s of 2028 at 3.15%, 5s of 2033 at 3.29%, 5s of 2038 at 3.83%, 5s of 2043 at 4.24%, 5s of 2048 at 4.44% and 5s of 2053 at 4.50%, callable 11/1/2032.

In the competitive market Wednesday, Rutherford County, Tennessee, (Aaa/AA+//) sold $171.240 million of GOs, to TD Securities, with 5s of 4/2024 at 3.67%, 5s of 2028 at 3.32%, 5s of 2033 at 3.41%, 5s of 2038 at 3.96% and 4.5s of 2043 at 4.52%, callable 4/1/2033.

Secondary market

NYC 5s of 2024 at 3.66%. Georgia 5s of 2024 at 3.76%. Maryland 5s of 2025 at 3.90%-3.75% versus 3.24% on 9/19 and 3.19% on 9/14.

California 5s of 2028 at 3.31%. Ohio Water Development Authority 5s of 2028 at 3.33%. Charlotte waters 5s of 2029 at 3.34%.

NY Dorm PIT 5s of 2034 at 3.74% versus 3.51% on 9/21 and 3.39%-3.38% on 9/20. California 5s of 2036 at 3.77%. Tennessee 5s of 2037 at 3.84%-3.83% versus 3.70%-3.69% on 9/22.

NYC TFA 5s of 2048 at 4.65%. Massachusetts 5s of 2048 at 4.53%-4.47% versus 4.35%-4.34% on 9/21 and 4.16%-4.15% on 9/12. San Jose Financing Authority 5s of 2052 at 4.21%-4.08% versus 4.24%-4.21% Tuesday.

AAA scales

Refinitiv MMD's scale was cut up four basis points: The one-year was at 3.62% (unch) and 3.58% (+4) in two years. The five-year was at 3.31% (+4), the 10-year at 3.35% (+4) and the 30-year at 4.26% (+4) at 3 p.m.

The ICE AAA yield curve was cut one to three basis points: 3.63% (+3) in 2024 and 3.56% (+2) in 2025. The five-year was at 3.27% (+1), the 10-year was at 3.29% (+2) and the 30-year was at 4.26% (+2) at 4 p.m.

The S&P Global Market Intelligence municipal curve was cut up to four basis points: The one-year was at 3.63% (unch) in 2024 and 3.58% (+4) in 2025. The five-year was at 3.33% (+4), the 10-year was at 3.35% (+4) and the 30-year yield was at 4.26% (+4), according to a 3 p.m. read.

Bloomberg BVAL was cut four to five basis points: 3.64% (+4) in 2024 and 3.56% (+4) in 2025. The five-year at 3.28% (+4), the 10-year at 3.35% (+4) and the 30-year at 4.32% (+5) at 4 p.m.

Treasuries were weaker.

The two-year UST was yielding 5.136% (+1), the three-year was at 4.898% (+7), the five-year at 4.693% (+8), the 10-year at 4.617% (+7), the 20-year at 4.928% (+7) and the 30-year Treasury was yielding 4.732% (+4).

Money market funds see outflows

Tax-exempt municipal money market funds saw a second consecutive week of outflows as $589.4 million was pulled the week ending September 25, bringing the total assets to $114.94 billion, according to the Money Fund Report, a weekly publication of EPFR.

The average seven-day simple yield for all tax-free and municipal money-market funds rose to 3.58%.

Taxable money-fund assets saw $42.06 billion added to end the reporting week.

The average seven-day simple yield for all taxable reporting funds rose to 5.04%.

Primary to come

New York State is set to price Thursday $542.865 of GOs, consisting of $213.135 million of tax-exempts, Series 2023A, serials 2025-2041; $236.135 of tax-exempts, Series 2023B, serials 2025-2041; $83.435 million of tax-exempt refunding bonds, Series 2023C, serials 2024-2042; and $10.160 million of taxables, Series 2023D, serial 2024. BofA Securities.

Durham, North Carolina, (Aa1/AA+/AA+/) is set to price Thursday $128.300 million of limited obligation bonds, Series 2023, serials 2024-2043. PNC Capital Markets.