Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

Interval funds include venture capital, real estate, insurance and credit have seen growth over the past several years.

February 1 -

Fed Chair Jerome Powell said cuts are likely this year but are not guaranteed. He added that the Fed is looking for more signs that inflation is moderating. "We are prepared to maintain the current target range for the federal funds rate for longer if appropriate."

January 31 -

Issuance for the month is slightly above the $27.666 billion 10-year average, according to LSEG Refinitiv data.

January 31 -

"Yields are attractive, and there's going to be a lot of demand and there's not going to be a lot of bonds," said Scott Diamond, co-head of the municipal fixed income team at Goldman Sachs.

January 30 -

"The market seems to be coalescing around the view that these historically rich ratios can be sustained through February, but that the market technical becomes far less favorable in March and April," said Birch Creek Capital strategists in a report.

January 29 -

The inflows into muni mutual funds mark a reversal from 2022 and 2023.

January 26 -

Despite fixed-income seeing losses this month, Jeff Lipton, managing director of credit research at Oppenheimer, believes "a performance sea change is nearing."

January 24 -

After the year-end rally, "2024 bond investors have been reluctant buyers, prices creeping lower perhaps until the data and the Fed's next steps are more clear," said Matt Fabian, partner at Municipal Market Analytics.

January 23 -

This week's heavy new-issue calendar of tax-exempt supply "could lead to a modest cheapening of ratios," said Vikram Rai, head of municipal markets strategy at Wells Fargo.

January 22 -

The top bond counsel in 2023 handled a combined $361.721 billion across 7,164 bond issues versus $359.189 billion in 7,882 transactions in 2022.

January 22 -

Growing new-issue supply is "adding to bidders' 'wait-and-see' mentality with a variety of credits coming to market at favorable spreads," said FHN Financial's Kim Olsan. Next week's calendar hits $8.4 billion.

January 19 -

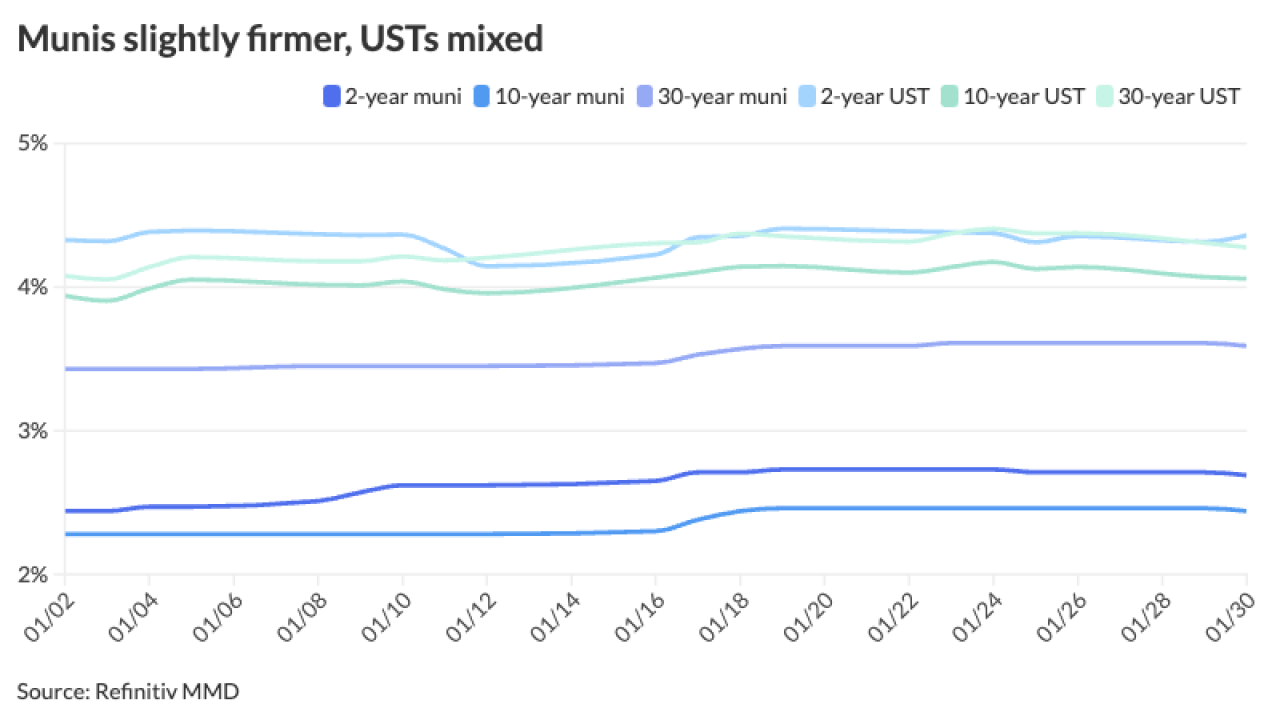

Muni yields rose up to eight basis points, depending on the scale, while UST yields rose up to six basis points at 30 years.

January 18 -

Jennifer Fredericks, a sales director at market data platform SOLVE, will lead Women in Public Finance's board of directors in 2024.

January 18 -

The Investment Company Institute Wednesday reported large inflows into municipal bond mutual funds, with investors adding $2.066 billion to funds, while exchange-traded funds saw $1.082 billion of outflows for the week ending Jan. 10.

January 17 -

Munis have "struggled to get out of starting gate" to start 2024 as munis are returning negative 0.24% so far this year, said Jason Wong, vice president of municipals at AmeriVet Securities.

January 16 -

The tax-exempt market could also see pressure due to "heavy issuance, anemic flows, and rate volatility," according to Barclays PLC.

January 12 -

The top two municipal bond insurers wrapped $31.845 billion in 2023, up 10.4% from the $28.847 billion of deals in 2022, according to Refinitiv data.

January 12 -

The December consumer price index came in slightly stronger than expected, perhaps eliminating the possibility of a rate cut in March, analysts said.

January 11 -

There were several ways Adaje could integrate ficc.ai's offerings into its system, the most impactful would be tender offering analyses, said Dan Silva, Adaje CEO.

January 11 -

The one-year was cut up to eight basis points, depending on the scale.

January 10