Municipals were weaker Thursday amid another busy new-issue day while municipal bond mutual funds reported inflows. U.S. Treasuries yields rose and equities were up near the close.

Muni yields rose up to eight basis points, depending on the scale, while UST yields rose up to six basis points at 30 years.

The two-year muni-to-Treasury ratio Thursday was at 62%, the three-year at 63%, the five-year at 60%, the 10-year at 59% and the 30-year at 82%, according to Refinitiv Municipal Market Data's 3 p.m. EST read. ICE Data Services had the two-year at 64%, the three-year at 63%, the five-year at 61%, the 10-year at 60% and the 30-year at 82% at 3:30 p.m.

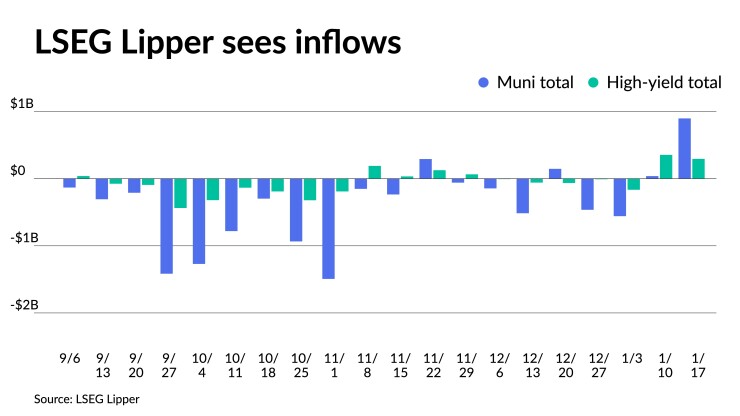

LSEG Lipper reported Thursday that investors added $898 million to muni mutual funds for the week ending Wednesday after inflows of $38.7 million the week prior.

High-yield saw inflows of $295.3 million after inflows of $355 million the week prior.

While returns so far in January are in the negative at 0.65%, per Bloomberg data, Jeff Timlin, a managing partner at Sage Advisory, said the month typically sees "minor" positive returns.

"As Treasury rates have sold off, munis have become richer, ratios have become more expensive. But that's because the lack of sensitivity to the Treasury market mostly due to technicals, i.e. supply and demand," he said.

January supply is typically outweighed by demand due to the January effect, he noted.

However, supply has been picking up during the back half of the month.

In the primary market Thursday, Morgan Stanley priced for the California Health Facilities Financing Authority (/AA-/AA/) $540.680 million of Scripps Health revenue bonds, Series 2024A, with 5s of 11/2026 at 2.67%, 5s of 2029 at 2.47%, 5s of 2034 at 2.60%, 5s of 2039 at 3.23% and 5s of 2044 at 3.61%, callable 11/15/2033.

Morgan Stanley also priced for the authority is also set to price Thursday $267.335 million of Scripps Health revenue bonds, Series 2024B. The first tranche, $133.675 million of Series 2024B-1, saw 5s of 11/2061 with a mandatory put date of 2/1/2029 at 2.72%, callable 2/1/2028.

The second tranche, $133.660 million of Series 2024B-2, saw 5s of 11/2061 with a mandatory put date of 2/4/2031 at 2.90%, callable 2/4/2030.

Wells Fargo priced for the Los Angeles Department of Water and Power (Aa2/AA+//AA+/) $255.230 million of water system revenue bonds, 2024 Series A, with 5s of 7/2029 at 2.10%, 5s of 2034 at 2.19%, 5s of 2039 at 2.74%, 5s of 2044 at 3.27%, 5s of 2050 at 3.57% and 5s of 2054 at 3.70%, callable 1/1/2034.

Goldman Sachs priced for the Pennsylvania Turnpike Commission (Aa3/AA-/AA-/AA/) a downsized $205.835 million of turnpike revenue bonds, Series A of 2024, with 5s of 12/2027 at 2.66%, 5s of 2029 at 2.57%, 5s of 2034 at 2.80%, 5s of 2039 at 3.28% and 5s of 2044 at 3.66%, callable 12/1/2033.

In the competitive market, The Triborough Bridge and Tunnel Authority (/AA+/AA+/AA+/) sold $296.340 million of MTA bridges and tunnels climate bond certified payroll mobility tax senior lien green bonds, Series 2024A, to Jefferies, with 5s of 5/2034 at 2.52%, 5s of 2039 at 3.20%, 5s of 2044 at 3.50%, 5s of 2049 at 3.78% and 5s of 2054 at 3.88%, callable 5/15/2034.

The South Washington County Independent School District No. 833, Minnesota, sold $133.015 million of GO school building, facilities maintenance and refunding bonds, Series 2024A, to BofA Securities, with 5s of 2/2025 at 3.20%, 5s of 2029 at 2.53%, 5s of 2034 at 2.64%, 5s of 2039 at 3.27% and 4s of 2044 at 4.01%, callable 2/1/2032.

Market participants, Timlin said, waited for issuance to return to the market to see "what the general tone is or interest is in those deals."

And with the uptick in supply, he said "that's where we'll see how well the market digests the supply because there's been a buildup of demand," he said, noting issuance "basically shut down" in mid-December.

Timlin believes market participants will be selective regarding where they will put money to work.

However, he noted the catalyst over whether there will be more or less issuance moving forward will be rates, which is "the most uncertain thing in the market right now."

Secondary trading

Maryland 5s of 2025 at 2.90% versus 2.82% on 1/11. Massachusetts 5s of 2025 at 2.89% versus 2.58% on 1/3. Washington 5s of 2026 at 2.83%.

California 5s of 2029 at 2.50% versus 2.31% on 1/9. Maryland 5s of 2029 at 2.47%. DC 5s of 2030 at 2.43%-2.42% versus 2.37% on 1/11.

Tennessee 5s of 2033 at 2.60% versus 2.30% on 1/12. NYC Municipal Water Finance Authority 5s of 2034 at 2.44%-2.43%. NYC 5s of 2035 at 2.74%-2.70%.

Massachusetts 5s of 2049 at 3.83%-3.84% versus 3.84%-3.83% Wednesday and 3.69%-3.71% on 1/12. NYC TFA 5s of 2053 at 3.89%.

AAA scales

Refinitiv MMD's scale was cut up to eight basis points: The one-year was at 2.99% (unch) and 2.71% (unch) in two years. The five-year was at 2.43% (+8), the 10-year at 2.44% (+6) and the 30-year at 3.57% (+4) at 3 p.m.

The ICE AAA yield curve was cut two to six basis points: 2.99% (+2) in 2025 and 2.78% (+3) in 2026. The five-year was at 2.48% (+5), the 10-year was at 2.44% (+5) and the 30-year was at 3.54% (+4) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was cut up to six basis points: The one-year was at 2.98% (unch) in 2025 and 2.74% (unch) in 2026. The five-year was at 2.42% (+6), the 10-year was at 2.44% (+6) and the 30-year yield was at 3.56% (+5), according to a 3 p.m. read.

Bloomberg BVAL was cut three to five basis points: 2.92% (+4) in 2025 and 2.78% (+4) in 2026. The five-year at 2.43% (+5), the 10-year at 2.47% (+5) and the 30-year at 3.54% (+3) at 3:30 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.351% (flat), the three-year was at 4.139% (+1), the five-year at 4.041% (+2), the 10-year at 4.137% (+3), the 20-year at 4.489% (+5) and the 30-year Treasury was yielding 4.369% (+6) near the close.