Municipals continued to experience a short-end correction Wednesday amid a busy day in the primary market which saw Jefferson County, Alabama's, mega sewer refunding deal price along with a billion-plus of Massachusetts GOs offered to retail. U.S. Treasuries were slightly weaker out long and equities were in the black near the close.

The municipal AAA one-year was cut up to eight basis points, depending on the scale, while UST yields rose up to three basis points.

The Investment Company Institute Wednesday reported small outflows from municipal bond mutual funds for the week ending Jan. 3, with investors pulling $7 million out of the funds following $571 million of outflows the week prior. Exchange-traded funds saw outflows of $307 million following $341 million of inflows the week prior.

Last year was a "wild ride" for munis, as "returns dropped by more than 2% in late October, but by yearend, the Bloomberg Municipal Bond Index posted the best annual total return since 2019," noted Cooper Howard, a fixed income strategist at Charles Schwab. Munis returned 6.4% last year.

Howard expects positive total returns this year from the broad market despite munis currently returning negative 0.24%.

But due to overly rich valuations, muni returns "may struggle in the near term," he said.

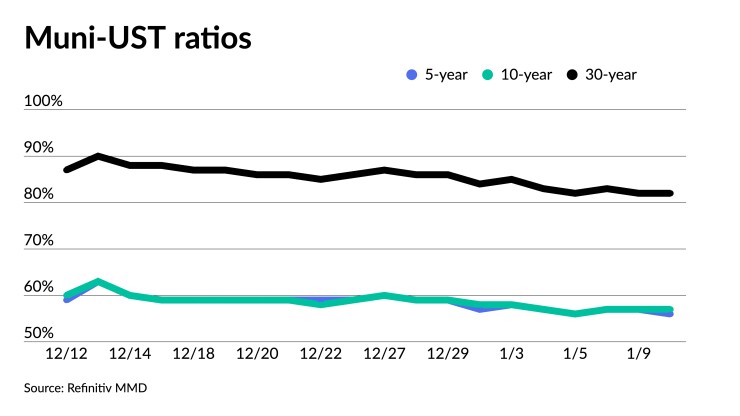

At only 57.8% of USTs, the 10-year muni-to-Treasury is near the lowest level in more than two decades, he said.

The two-year muni-to-Treasury ratio Wednesday was at 60%, the three-year at 60%, the five-year at 56%, the 10-year at 57% and the 30-year at 82%, according to Refinitiv Municipal Market Data's 3 p.m. EST read. ICE Data Services had the two-year at 61%, the three-year at 60%, the five-year at 59%, the 10-year at 58% and the 30-year at 82% at 3 p.m.

Historically, Howard said "munis have struggled to outperform Treasuries when relative yields are low."

A mitigating factor, he noted, is that due to low issuance, January has "historically been the best month for total returns."

Issuance, though, is robust this week at an estimated $9.1 billion, and several large deals priced Wednesday.

In the primary market Wednesday, Raymond James & Associates priced and repriced for Jefferson County, Alabama, (Baa1/BBB+/BBB/)

BofA Securities held a one-day retail order for

The second tranche, $543.725 million of refunding bonds, Series 2024 A, saw 5s of 3/2027 at 2.50%, 5s of 2029 at 2.38%, 5s of 2034 at 2.51%, 5s of 2039 at 3.13% and 5s of 2044 at 3.48%, callable 1/1/2034.

Raymond James & Associates priced and repriced for the Conroe Independent School District, Texas, (Aaa/AAA//) $550.895 million of PSF-insured unlimited tax school building bonds, Series 2024, with yields lowed up to four basis points from the preliminary pricing: 5s of 2/2025 at 2.91% (unch), 5s of 2029 at 2.40% (unch), 5s of 2034 at 2.45% (-2), 5s of 2039 at 3.04% (-1), 5s of 2044 at 3.46% (unch), 4s of 2049 at 4.14% (-1) and 5s of 2049 at 3.75%, callable 2/15/2034.

Piper Sandler priced for the Minnesota Agricultural and Economic Development Board (A2/A//) $500 million of HealthPartners Obligated Group healthcare facilities revenue bonds, Series 2024, with 5s of 1/2035 at 2.99%, 5s of 2039 at 3.46%, 5s of 2044 at 3.79%, 4s of 2049 at 4.25% and 5.25s of 2054 at 4.17%, callable 1/1/2034.

In the competitive market, The Florida Board of Education (Aaa/AAA/AAA/) sold $234.010 million of Public Education Capital Outlay refunding bonds, 2024 Series A, to BofA Securities, with 5s of 6/2025 at 2.84%, 5s of 2029 at 2.33%, 5s of 2034 at 2.44% and 5s of 2035 at 2.55%, noncall.

Beyond this week, the New York State Thruway Authority (A1/A+//) has added a $1.030 billion of general revenue bonds, Series P, deal, to be priced at the end of the month.

Despite this heavy new-issue week and another billion-dollar deal on the horizon, Howard said low issuance in 2024 should be a good thing for total returns in 2024.

"High absolute yields and generally strong financial positions have resulted in municipalities issuing less debt over the past two years," he said.

While many muni shops

Furthermore, as 2024 starts, there are a few crosswinds in the muni market, said Anders S. Persson, Nuveen's chief investment officer for global fixed income, and Daniel J. Close, Nuveen's head of municipals.

For one, volatility will continue this year, according to Howard.

Last year saw yields move substantially higher or lower for more weeks than compared to prior years, he said.

"Volatility will likely remain high in 2024 as the Fed is expected to shift to cutting rates in 2024," Howard said.

There is good news, though: $33 billion of Jan. 1 money, which needs to be reinvested, should stabilize the market, Persson and Close said.

While muni yields are rich to UST, muni yields themselves "are much cheaper than they were a couple of years ago," they said.

"Munis will likely remain range bound, and current yields should keep investors focused on the asset class," they said. "However, we would see any declines as potential buying opportunities."

Secondary market

Wisconsin 5s of 2025 at 2.90%. Virginia 5s of 2026 at 2.58% versus 2.57% Tuesday. North Carolina 5s of 2027 at 2.51%.

Wisconsin 5s of 2028 at 2.44% versus 2.41% Tuesday. California 5s of 2029 at 2.35%. Washington 5s of 2031 at 2.35% versus 2.35% Tuesday.

Connecticut 5s of 2034 at 2.39% versus 2.41% Tuesday and 2.42%-2.41% on 1/3. Ohio Water Development Authority 5s of 2034 at 2.35%. DC 5s of 2035 at 2.43%-2.42% versus 2.38% Monday.

San Diego USD 5s of 2053 at 3.39%-3.38% versus 3.40% Friday. NY State Urban Development Corp. 5s of 2055 at 3.84%-3.85%.

AAA scales

Refinitiv MMD's scale saw cuts four years and in: The one-year was at 2.90% (+7) and 2.62% (+5) in two years. The five-year was at 2.25% (unch), the 10-year at 2.28% (unch) and the 30-year at 3.45% (+2) at 3 p.m.

The ICE AAA yield curve was cut one to six basis points: 2.89% (+6) in 2025 and 2.66% (+6) in 2026. The five-year was at 2.35% (+5), the 10-year was at 2.31% (+1) and the 30-year was at 3.43% (+1) at 4 p.m.

The S&P Global Market Intelligence municipal curve saw large cuts at one-year: The one-year was at 2.89% (+8) in 2025 and 2.66% (+1) in 2026. The five-year was at 2.29% (unch), the 10-year was at 2.32% (unch) and the 30-year yield was at 3.41% (unch), according to a 3 p.m. read.

Bloomberg BVAL was cut up to three basis points: 2.77% (+3) in 2025 and 2.63% (+3) in 2026. The five-year at 2.29% (+1), the 10-year at 2.33% (unch) and the 30-year at 3.43% (unch) at 4 p.m.

Treasuries were slightly weaker.

The two-year UST was yielding 4.365% (flat), the three-year was at 4.113% (-1), the five-year at 3.981% (+1), the 10-year at 4.039% (+3), the 20-year at 4.352% (+3) and the 30-year Treasury was yielding 4.213% (+3) near the close.

Primary to come

The Lewisville Independent School District, Texas, is set to price Thursday $462.655 million of unlimited tax school building bonds, Series 2024. Piper Sandler.

New Braunfels, Texas, (Aa1///) is set to price Thursday $148.970 million of utility system revenue and refunding bonds, Series 2024, serials 2024-2055. HilltopSecurities.

Competitive

Dallas is set to sell $223.620 million of combination tax and revenue certificates of obligation, Series 2024A, at 11 a.m. Thursday.